The market does not wait for you! But how to start investing? There are 3 ways to start doing so: Do-It-Yourself (DIY), Advisory & Portfolio Review, or a Discretionary Managed Account.

DIY: Do-It-Yourself

The first option is the Do-It-Yourself method. There are many resources online available to teach you how to start investing, but do note that the DIY method still requires a lot of personal commitment and time.

Personal Commitment required –

- Knowledge

- Skillset

- Experience

- Time to do research

- Time to monitor the market

- Time to register and sign up various accounts

- Guts to pull the trigger

Here are some tips that may help you start investing, should you decide to Do-It-Yourself:

Attend Courses

If you would like to invest in REITs, do attend courses.

See courses as an investment! They can help you save potentially thousands of hours of frustration and hard work failing, when you can learn the ways from the people in the industry.

Interested in Investing in Singapore REITs? Do take a look at the Investing in Singapore REITs for Passive Income and Capital Gain course by Kenny Loh, an Investment Coach for AKLTG (Adam Khoo Learning Technologies Group). Click the link for more info.

Take a look at the individual stocks you would like to invest

One quick way to get an overview of stocks is by using a Stock Screener.

By investing in Stock Screeners, you get to get an overview of a particular stock/REIT in an instant. For example, the above-mentioned REIT screener gives you information such as leverage ratio, property overview, and debt information, all-in-one page.

If you want to invest in Singapore REITs, do take a look at the StocksCafe Singapore REITs Screener for Singapore REITs. Click the link for more info.

Private Tuition Classes

Prefer to learn investing in private? Or have a busy schedule?

Do take a look at Kenny’s Private Tuition Classes, and learn from a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor! His Private Tuition Classes, similar to courses, is a great way to jump into the world of investing. These one-on-one classes are fully customizable depending on individual requirements. Choose from any/all of the following topics, or ask him if you would like to learn something else related to investing:

- Investing in Singapore REITs

- Short Selling Singapore Stocks

- Technical Analysis

- Fundamental Analysis

- How to trade the US Stock Market

Do click here for more information, or contact me at kennyloh@fapl.sg.

Advisory, Portfolio Review & Discretionary Managed Account

Get an Investing Headstart by constructing a well-balanced, fully customizable diversified portfolio! I provide the following services:

Construct a Diversified Portfolio

Don’t know what to invest in? Or to start investing? Don’t worry! Let Kenny Loh, an Independent Financial Advisor, do the work for you, and construct a diversified portfolio for you. Do visit this page to view the in-depth approach of his portfolio advisory service.

If you do not want to go through the hassle of managing your investment accounts, and would like a certified financial advisor like Kenny to manage your investment accounts for you, do contact me at kennyloh@fapl.sg to enquire more.

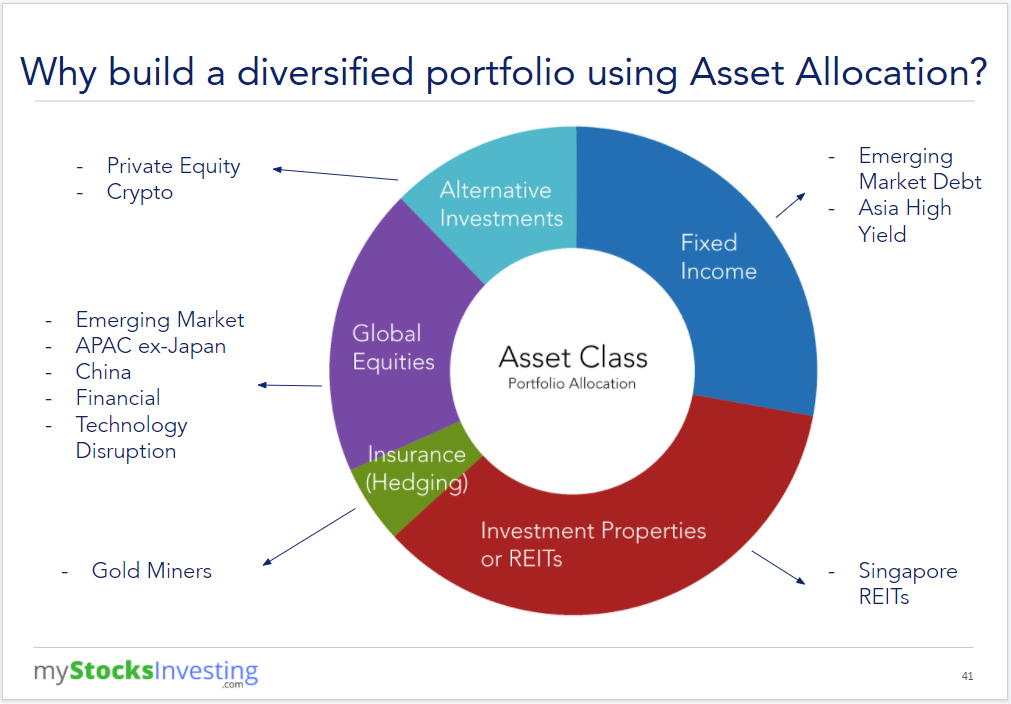

Why build a diversified portfolio?

- Reduced volatility from market forces and global events

For example, due to the Covid-19 pandemic, for Singapore REITs, the hospitality sector is hit hard, but the industrial sector isn’t. A well-diversified portfolio can help soften the impact. It should include multiple asset classes, including unit trusts, global equities, alternative investments e.g. cryptocurrency, fixed-income investments and investment properties e.g. REITs.

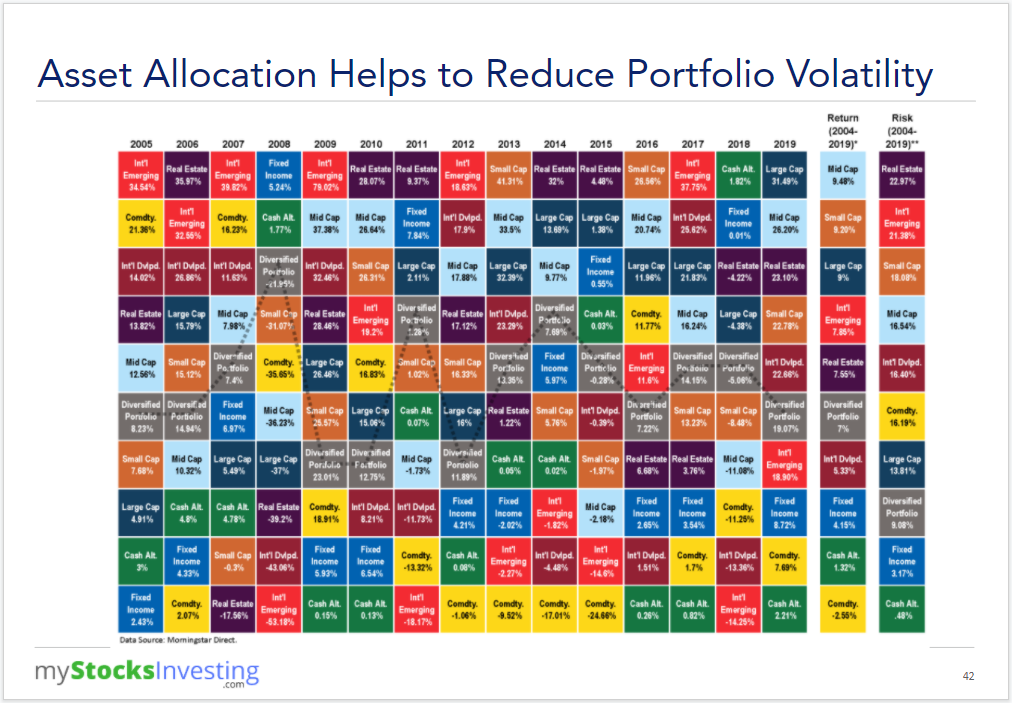

This applies to the various asset classes as well. A diversified portfolio is less volatile, ranging between -21.95% and +19.07% growth rate from 2004-2019, averaging 7% per year. Compared to Real Estate for example, with growth rates ranging anywhere from -39.2% to +35.7% in a year.

As you can see, some asset classes and investments have lower risk but lower yield, while some have much higher yields but much higher risks. For example, REITs are much less volatile compared to cryptocurrency assets which can more than double or halve its value in less than a day.

Construct your very own, fully customisable investment portfolio, tailored to your risk profile and investment needs today. Interested? Find out more on this page or contact me at kennyloh@fapl.sg.

Portfolio Repair

Unhappy with your investment portfolio? Not getting the returns you desire? It’s time to renovate your investment portfolio.

Do contact me at kennyloh@fapl.sg and I can take a look into your portfolio and make recommendations, and create your investment portfolio you’ll be proud of.

Discretionary Managed Account

By engaging this service, Kenny can help you invest in various asset classes, including unit trusts, global equities, alternative investments e.g. cryptocurrency, fixed-income investments and investment properties e.g. REITs. Simply contact me at kennyloh@fapl.sg and discuss your investment objectives, and let him do the work for you.

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also an invited speaker of REITs Symposium and Invest Fair. Kenny Loh also offers REIT Portfolio Advisory for a fee. Do contact him at kennyloh@fapl.sg