Two of the most common questions from retail investors when I conduct investment classes or private investment portfolio review are:

- How to get started to invest?

- What is safe to invest?

I hope this post can help all retail investors (especially beginners) to get started safely and easily before moving into more complex asset classes like shares, bonds, ETF (Exchange Traded Fund), ILP (Investment Linked Policies sold by insurance companies), Endowment Policies, REIT (Real Estate Investment Trust), unit trust, commodities, structured products, alternative investment, private equity, etc.

As a Licensed Financial Advisor who specializes in Investment Portfolio Advisory, I would recommend to start with Singapore Saving Bonds (SSB) as this asset class is virtually NO RISK, NO PRICE VOLATILITY and GOOD LIQUIDITY (with one month redemption notice). Some people would argue that that is not true that SSB has no risk. However, I am not going to debate it because there are much bigger problems to deal with if Singapore government goes bankrupt, due to the reasons that all government linked companies and our saving / investments in various Singapore banks, SRS and CPF all will be affected.

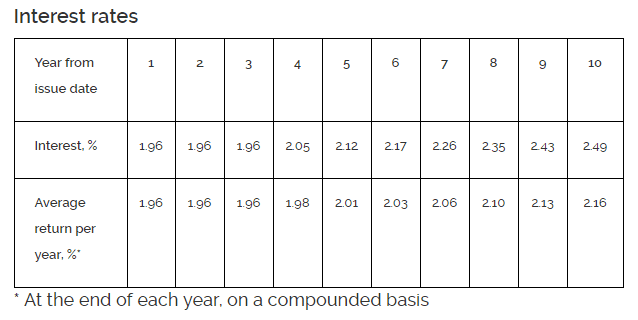

This month SSB gives investors a 10-year average risk free interest rate of 2.16%. This return is definitely higher than the bank saving interest rate of 0.05%. This is a very straight forward comparison and no-brainer decision to make. Investors may use SSB as a parking facility of your emergency fund (recommended 6 months of indispensable monthly expense). You may engage a Certified Financial Planner if you need help to find out your indispensable monthly expense and conduct a Personal Financial Health Screening to calculate your own financial ratio, by setting up personal income statement and net worth statement to keep track of your financial health annually.

2 Simple Steps to subscribe to Singapore Saving Bonds (Get it Started!)

- Open a CDP Account with SGX. https://dollarsandsense.sg/step-step-guide-opening-cdp-account-singapore/

- Subscribe to Singapore Saving Bond. http://www.sgs.gov.sg/savingsbonds/Your-SSB/How-to-buy.aspx

For investment who would like to have an independent and unbiased investment advice to the current investment portfolio with the following objectives, you may engage Kenny Loh (kennyloh@fapl.sg)

- Risk Assessment of Current Portfolio

- Optimise the Risk Adjusted Return of the Portfolio

- Construct a Diversified Portfolio for Retirement Needs (Capital Growth Strategy or Passive Income Generation)

- Safe Guard and Ring Fence Current Investment Assets from Creditors, Inheritance Tax, Estate Duty or Mental Incapacity.

- Review Pro/Cons and suitability of the investment options recommended by Banks (unit trust, bonds, structured products), Insurance companies (ILP, Endowment, Whole Life Plan) or Property Agents (is physical property the only investment options?) before officially signing the contract and committing huge amount of money.

Kenny Loh is an award winning Financial Consultant from an Independent Financial Advisory firm. He won Top 5 Investment AUA Award for 2018 with million dollars of investment under his advisory comprises Unit Trust, Shares, Bonds, REITs, ETF, Alternative Investment, Structured Products, Commodities, Property Funds, M&A Private Equity fund, Angel Investment fund, etc.

He does not believe “One Size Fit All” Investment strategy because different investors have different needs, different investment objectives at different life stages. He personalises and customises every individual portfolio to meet the financial needs with the appropriate asset classes with pre-assessed client’s risk profile.