FTSE ST Real Estate Investment Trust Index has formed a Head and Shoulder and broke the neckline and 200D SMA support! This is a strong warning sign that the trend of Singapore REITs will reverse to down trend. Suggest retail investors to pull out the charts of your current REIT portfolio to decide the next steps.

There are a few things retail investors can do.

- Do nothing. – If you bought the stocks at high, be prepared to suffer capital loss for a period of time. If you bought at low, be prepared to watch your capital gain erodes.

- Sell – If you bought at high, you may decide to cut loss. Do take note that the stock price can go even lower when the down trend starts and you will suffer more capital loss than the dividend gain. If you bought at low, you may consider to take profit.

- Hedge by Short Selling – If you bought the stocks at low and enjoying good dividend payout but you don’t want to sell, you can hedge your current REIT portfolio by short selling.

- Prepare to buy – If you have done your homework identifying fundamental strong Singapore REIT, this is a good buying opportunity but make sure you don’t buy when the stock price is on the down trend. Wait for the stocks to bottom up and show reversal trend. Make sure you know how to identify the trend reversal using Technical Analysis.

- Use HOPE Analysis – This is a NO-NO. If you use HOPE in your stock investing, that means you do not know what is investing is all about. Suggest you equip yourself with sufficient financial knowledge before throwing your hard earned money into stock market.

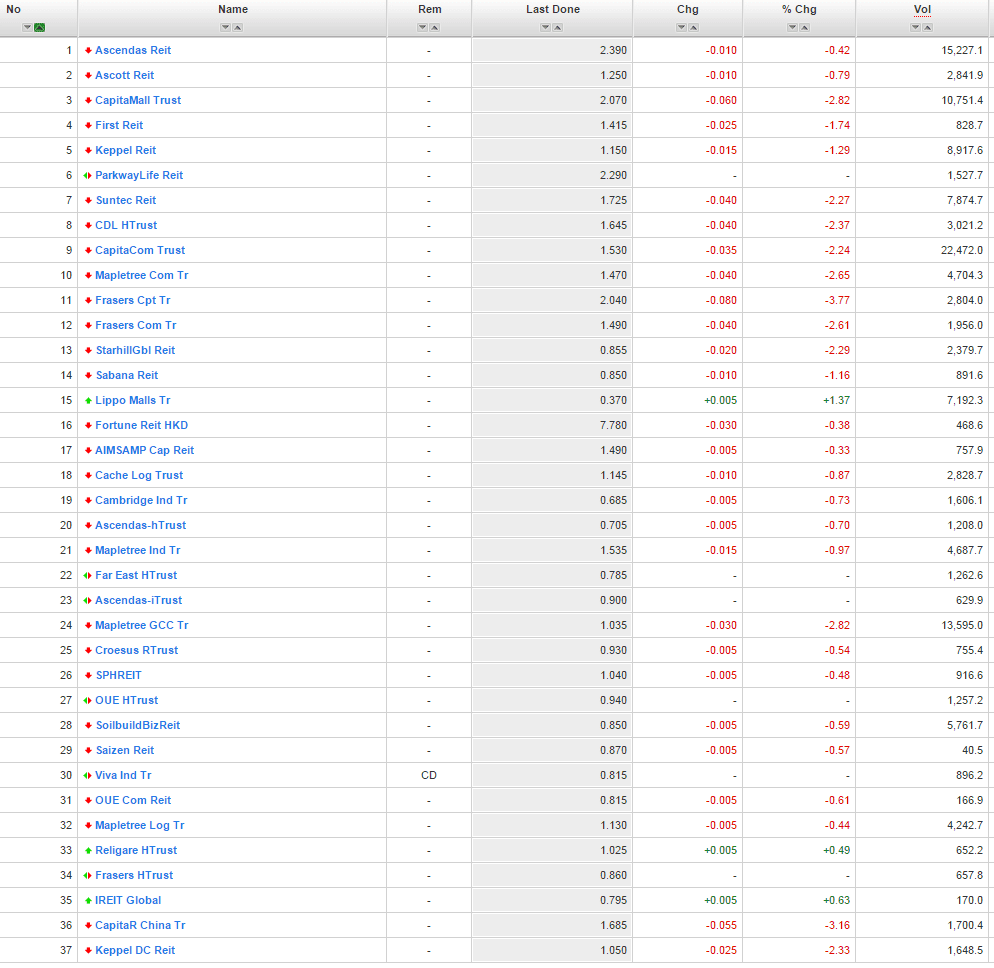

For record purpose, it was a fierce sell off today in Singapore REIT especially with the big market capitalization.

See other relevant posts here: