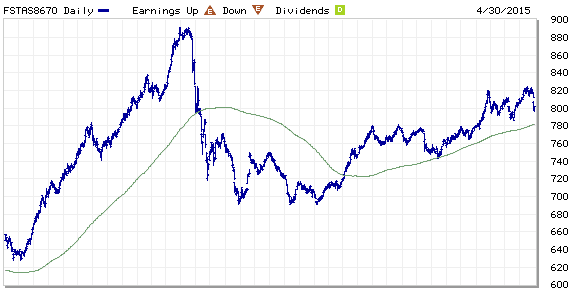

FTSE ST Real Estate Investment Trusts (FTSE ST REIT) Index decreases from 812.05 to 802.45 compare to last post on Singapore REIT Fundamental Comparison Table on April 3, 2015. The index is continuing the uptrend and supported by the 200D SMA. However do take note that the index is trading below 20D and 50D SMA at the moment. Immediate resistance at about 825. Double Tops chart pattern in formation which is a trend reversal pattern.

- Price/NAV decreases from 1.07 to 1.056. (Singapore REIT in general slightly overvalue)

- Distribution Yield decreases from 6.49% to 6.46%.

- Gearing Ratio reduces from 33.82% to 33.71%

- Most overvalue REIT is Parkway Life (Price/NAV = 1.458), followed by FIRST REIT (Price/NAV = 1.422). Both Healthcare REIT, Defensive in nature.

- Most undervalue REIT is Fortune REIT (Price/NAV = 0.663), followed by Saizen REIT (Price/NAV = 0.791). Both are having overseas properties and exposed to currency exchange risk.

- Higher Distribution Yield is VIVA Industrial Trust (9.14%) followed by Croesus Retail Trust (8.78%). Note: High Distribution Yield does not mean it is safe REIT for investment. Don’t invest purely base on the Yield % because it is wrong thing to do without knowing the reasons.

- Highest Gearing Ratio is Croesus Retail Trust (50.9%) followed by VIVI Industrial Trust (43.4%)

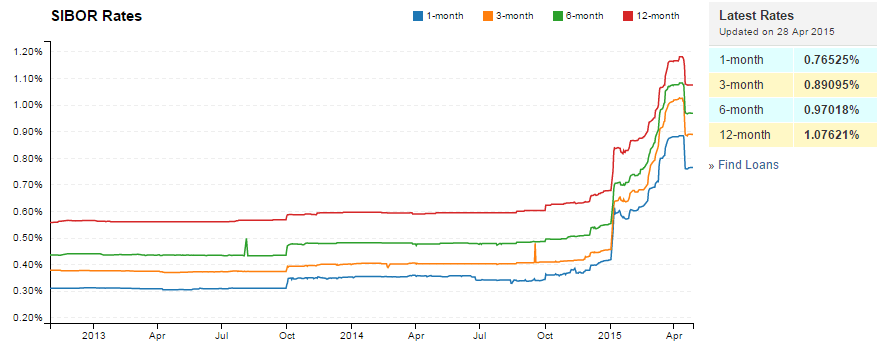

- Singapore Interest Rate no change at 0.34%.

- 1 month decreases from 0.88116% to 0.76525%

- 3 month decreases from 1.01959% to 0.89095%

- 6 month decreases from 1.07680% to 0.97018%

- 12 month decreases from 1.16689% to 1.07621%

Singapore Interest Rate and SIBOR continue to rise and on uptrend (forming a Higher High, Higher Low pattern). Not a good sign for REIT which have high gearing ratio because there may be increase in borrowing cost depends on the debt expiry profile. Besides REIT, It is also time to seriously evaluate your current mortgage loan and work on Refinance Plan before the mortgage loan interest shot up even further.

Grab an insight of the REIT class here 3 Tips To Increasing Returns On REITs Investments

Check out the very pragmatic and educational public seminar here “Investing in Singapore REIT“.