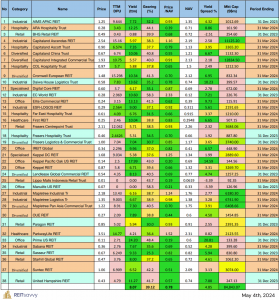

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increases from 692.19 to 722.93 (+4.4%) compare to last post on Singapore REIT Fundamental Comparison Table on Oct 3, 2015. The index rebounded from recent low of 650 to 740. The long term trend remains down as the index is trading below 200D SMA. Current rebound is not supported by the volume. It remains to be seen whether this rebound is only a Dead Cat Bounce.

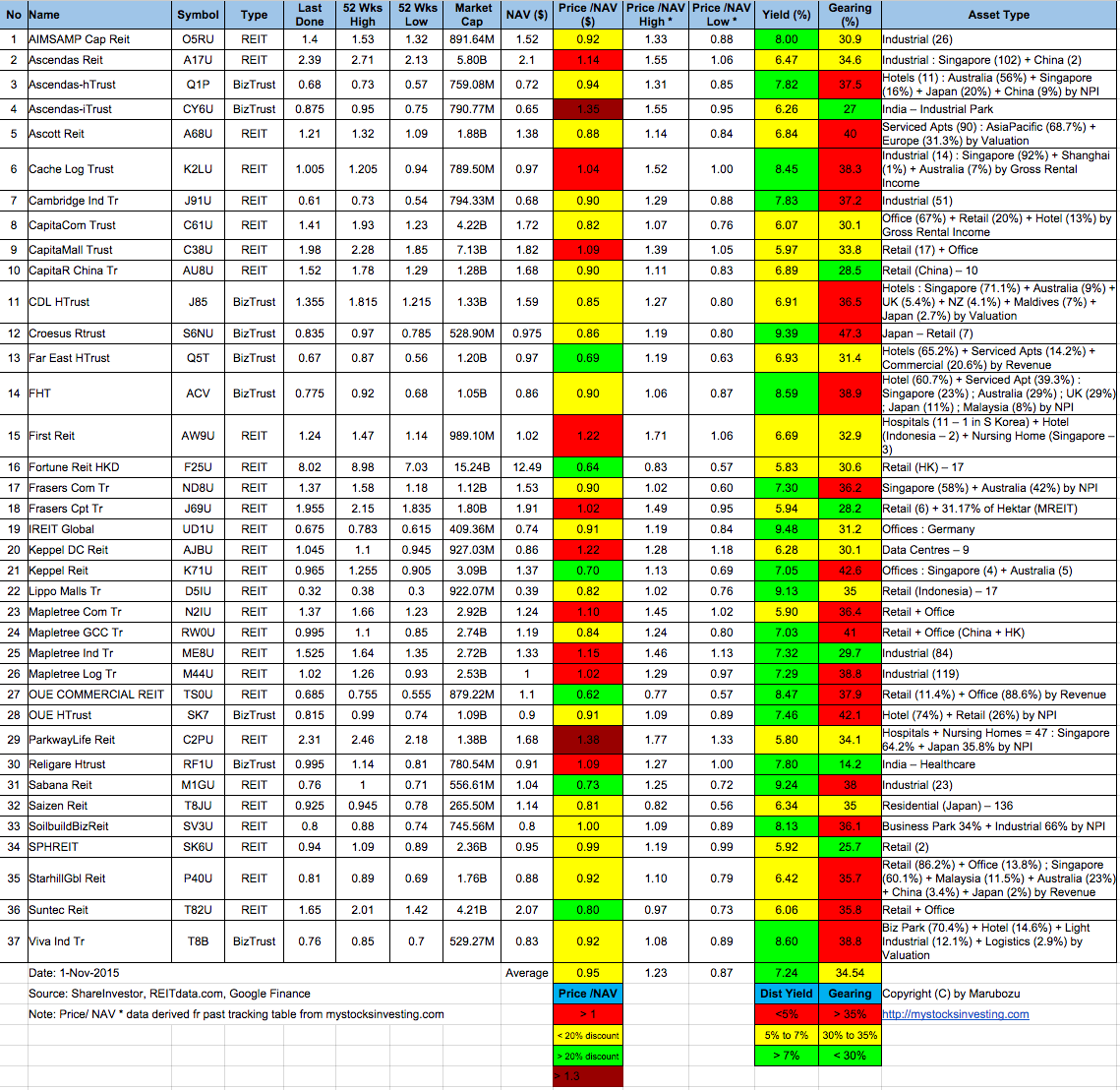

- Price/NAV increases from 0.91 to 0.95. (Singapore Overall REIT sector is slightly under value now)

- Distribution Yield decreases from 7.51% to 7.24% (take note that this is lagging number). More than half of Singapore REITs (20 out of 37) have Distribution Yield > 7%. Current yield is attractive but dangerous to make investing decision purely base on the yield. Past performance does NOT equal to future performance.

- Gearing Ratio increases from 34.09% to 34.54%. 19 out of 37 have Gearing Ratio more than 35%.

- Most overvalue is Parkway Life (Price/NAV = 1.38), followed by Ascendas iTrust (Price/NAV = 1.35).

- Most undervalue (base on NAV) is OUE Commercial REIT (Price/NAV = 0.62), followed by Fortune REIT (Price/NAV = 0.64).

- Higher Distribution Yield is iREIT Global (9.48%), followed by Croesus RTrust (9.39%) .

- Highest Gearing Ratio is Croesus Retail Trust (47.3%) followed by Keppel REIT (42.6%)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

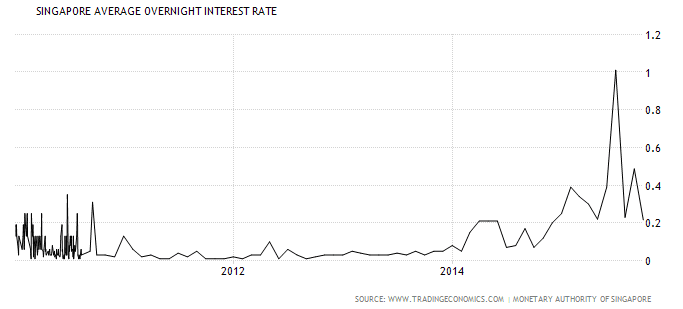

- Singapore Interest Rate decreases from 0.49% to 0.21%

- 1 month decreases from 1.01741% to 0.88800%

- 3 month decreases from 1.13933% to 1.01050%

- 6 month decreases from 1.19083% to 1.06846%

- 12 month decreases from 1.31225% to 1.19551%

Currently most REITs in Singapore are still trading below 200D SMA which is technically bearish. Although the distribution yield are very attractive but do take note that this is a lagging number. As REIT is very much depends on the economic cycle, it is important to keep a close eye on economic data (i.e. GDP, consumer spending, PMI) as economic condition will affect the future NPI. NPI will affect Distribution and share price. However, some REITs are more defensive in nature and less sensitive to economy slow down. If you want to find out those REITs which have very high distribution yield but not affected much by Interest Rate Hike & Economy slow down, check out the How to Invest in Singapore REIT to generate Passive Income here.