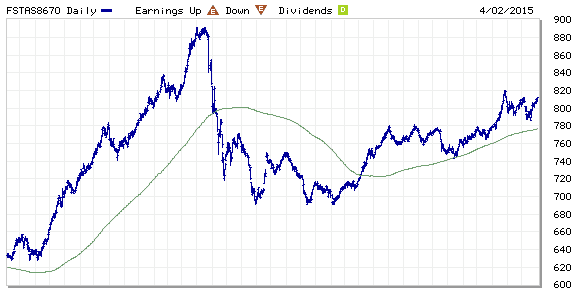

FTSE ST Real Estate Investment Trusts (FTSE ST REIT) Index increases from 805.26 to 812.05 compare to last post on Singapore REIT Fundamental Comparison Table on Mar 1, 2015. The index is continuing the uptrend after retraced to test 790-795 as support. Long term trend for Singapore REIT is bullish base on the chart pattern of this ST REIT index as the 200D SMA is trending up. Immediate resistance at about 820.

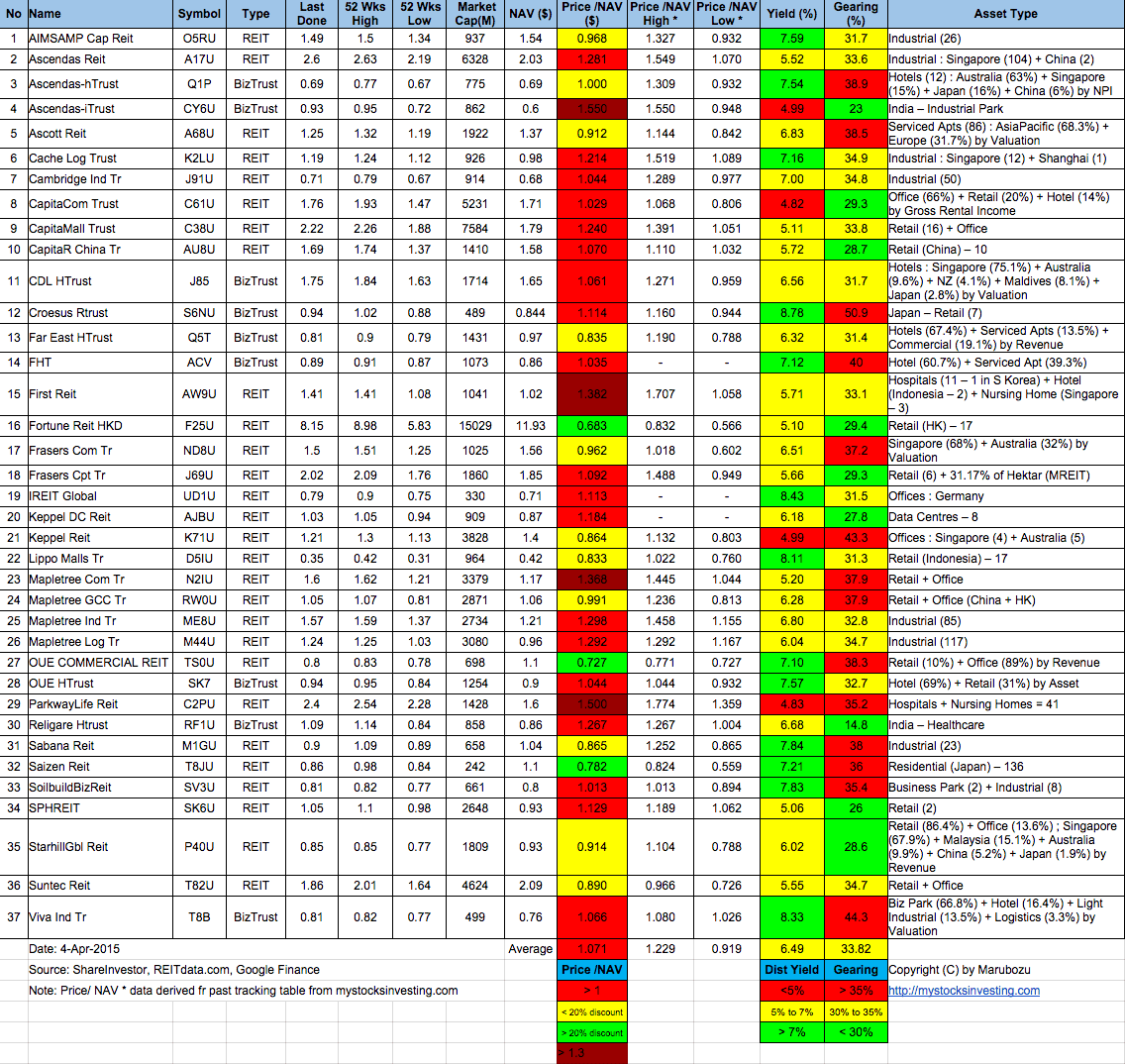

- Price/NAV no change at 1.07 (Singapore REIT in general slightly overvalue)

- Distribution Yield increases from 6.48% to 6.49%.

- Gearing Ratio no change at 33.82%.

Singapore REIT Bubble Charts – Value Selection and Risk Prevention.

- Singapore Interest Rate spikes to 0.39% and retrace back to 0.34%.

- 1 month increases from 0.61669% to 0.88116% (42% increase!)

- 3 month increases from 0.68138% to 1.01959% (49% increase!)

- 6 month increases from 0.74182% to 1.07680% (45% increase!)

- 12 month increases from 0.87509% to 1.16689% (33% increase!)

Singapore Interest Rate and SIBOR continue to rise. Not a good sign for REIT which have high gearing ratio because there may be increase in borrowing cost depends on the debt expiry profile. Besides REIT, It is also time to seriously evaluate your current mortgage loan and work on Refinance Plan before the mortgage loan interest shot up even further.

Grab an insight of the REIT class here 3 Tips To Increasing Returns On REITs Investments

Check out the very pragmatic and educational public seminar here “Investing in Singapore REIT“.