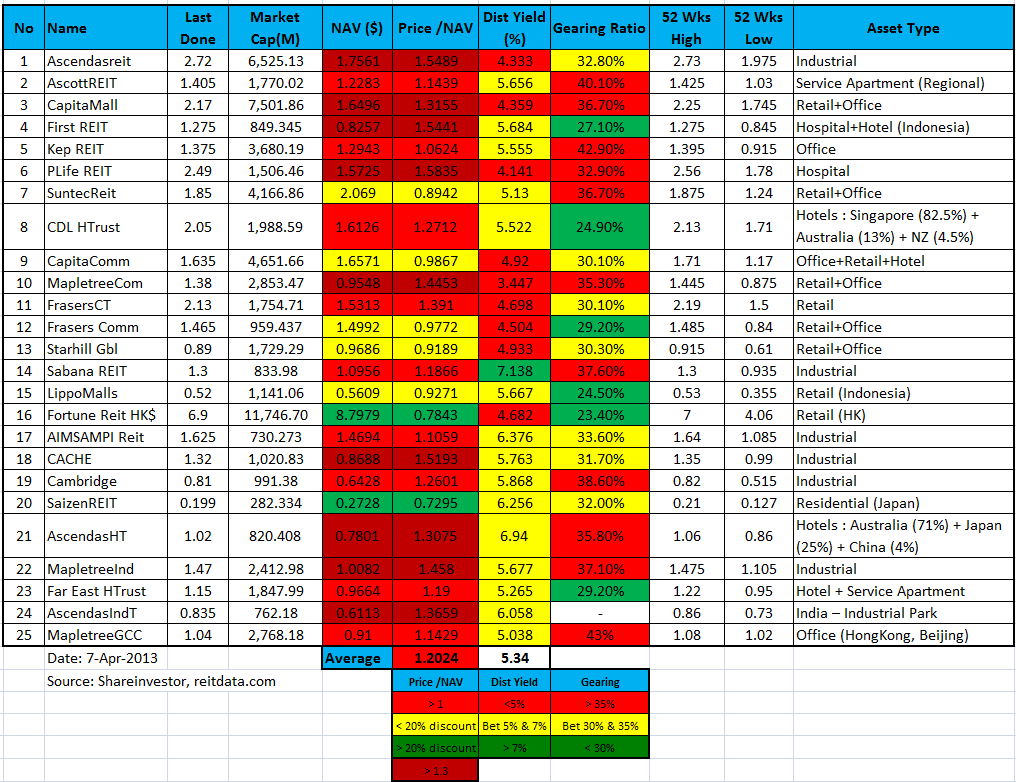

Added Average Price / NAV and Distribution Yield so that I can monitor these two numbers every month. In average, Singapore REIT is 20% over value base on NAV with Dividend Yield of 5.34% base on my comparison table below. Some of the REITs are extremely overvalue with high gearing ratio. Be extremely cautious if the stock market reverse to the down trend and the banks start to raise interest rate. Those REIT will be badly hit as they have to pay more interest for their debt. Alternatively, these REITs may issue rights to repay the debt. The share price will plunge when the REIT managers issue right at huge discount.

Last comparison table of Singapore REITs.

Check out here if you want to know what are the important financial ratio to analyse REIT in Singapore.

Dear Sir,

I am a retiree in Singapore who invests with the objective of getting a stable dividend income to offset the high inflation rate.

Can I please seek your thoughts of First REIT? It’s not that highly geared (27.1%) but the price is way above the NAV (over 1.5%). Its dividend yield is still amongst the highest.

Should a retiree invest in this? Appreciate your thoughts.

First of all you have to determine your holding time frame and your risk tolerance. It is nothing wrong to invest in First REIT because fundamentally the REIT is sound with stable distribution income. The question is whether you can sleep well if you buy at current level (buy at high) but later the market starts the correction or crash.

Personally I will not buy at this price for the 5.X% dividend. I would prefer to keep cash and pick up this REIT when it is under value. I am following strictly my investing rule of “Buy Low Sell High” to minimize my investment risk.

BTW, First REIT is under my watchlist to invest when there is Great Singapore sale.

I second what Marubozu said, FirstREIT has great fundamentals and is relatively stable. However for a “retiree”, buying an overvalued stock and holding is quite irresponsible. (something my own father has done in the past, I feel obliged to warn you)

1. Wait for it to come down, below $1.00 which i am sure will inevitably happen.

2. If you cannot wait, divide your investments into 4 equal portions. Buy 1 portion now then equal portions for every 20% drop.

First REIT is extremely over value now. Price / NAV = 1.70.

See latest comparison table here.

https://mystocksinvesting.com/singapore-reits/singapore-reits-comparison-table-for-dividend-investment-may-2013/

Hi,

May I ask whether does it mean that if the REIT is under NAV, we can still buy it as it has not risen much compared to the peers?

Thanks.

Hi Jeremiah,

I am not certified to make any buy or sell recommendation. You have to make your own investing decision by interpreting those numbers and assess the risks.

regards

Marubozu