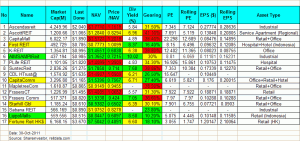

Have been doing analysis on Singapore REITs to build up my Dividend Stocks portfolio. Below is a snapshot of the REIT comparison table.

My criteria in selecting REIT:

-

Last Done Price < NAV –> indicates undervalue

-

Dividend Yield > 6% –> Beat Singapore Inflation

-

Gearing < 30% –> Reduce the risk of Right placement (dilution of share price) and net profit margin when interest rate increases (lower DPU, Distribution Per Unit).

Cautious: DO NOT evaluate REITs purely from the financial numbers only. There are two undervalue REITs in my list which may cause us LOSE more than the dividends in future.

-

The manager sold their units to raise $$ for the dividend! Use critical thinking: if the REIT is performing well and generating positive cash flow, why The Manager need to sell the units to raise cash to payout dividends?

-

The manager issued Right at a discount to acquire additional properties. BUT, NAV, Dividend Yield, DPU, TERP all drop after ex-Right date….

If you have time to do analysis, post your answers for these 2 REITs ….

Anyway, some REITs are quite attractive at the current valuation. Happy shopping but read those management reports properly.

Disclaimer: I am not certified to make any recommendation on buy or sell on any REITs. Do not ask me which REITs to buy or sell. The above information is my personal analysis for sharing. I am not providing any financial advice or recommendation.

The selling of units for funding refers to AIMs right?

Could you let us know which is the other one?

You got it!

The other one is LippoMalls. Share price drops close to 20% on ex-Right date and now this REIT is no longer undervalue.

No wonder my alert rang on Lippo..

Sigh.. I was considering to get suntec when it fell to 1.06 recently. But with situation in Europe so uncertain.. I didn’t do anything.

Some analysts were calling for a financial system collapse at that time. Though I did not think it will happen, still felt current environment contains quite a bit of risk 🙁

Just be extremely cautious on the REITs with high gearing ratio.