Fortune REIT Fundamental Analysis

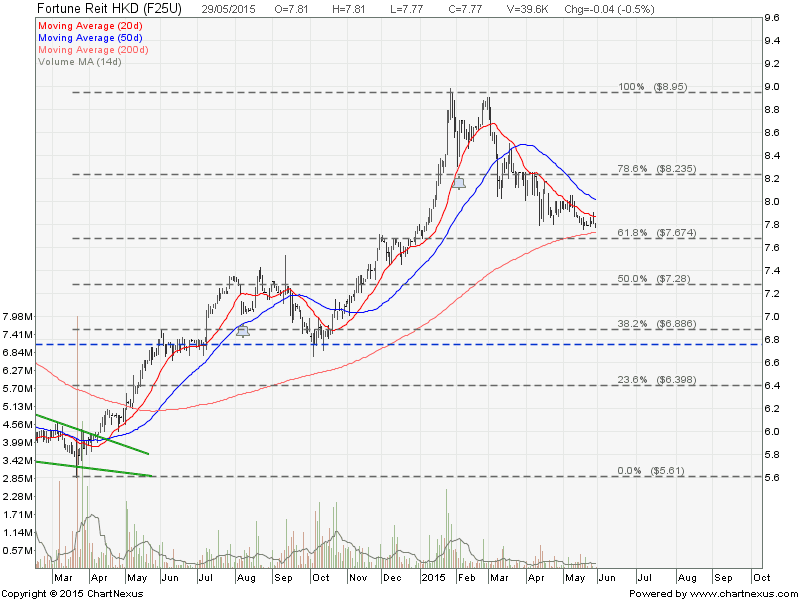

- Last Done Price = HK$7.77

- NAV = HK$11.87

- Price / NAV = 0.654 (35.6% Discount to NAV)

- Price / NAV (High) = 0.832

- Price / NAV (Low) = 0.566

- Distribution Yield = 5.8%

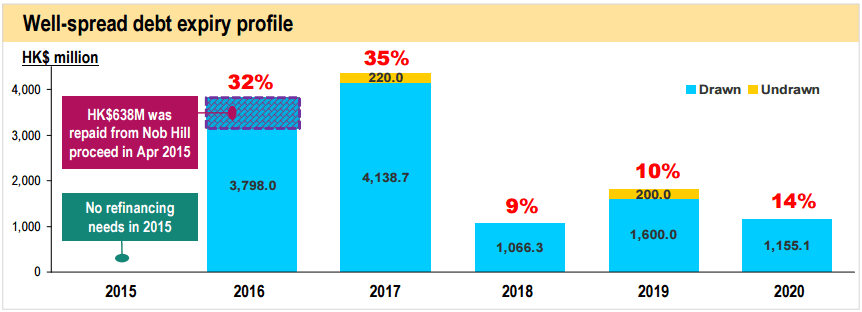

- Gearing Ratio = 33.2%

- Occupancy Rate = 98.1%

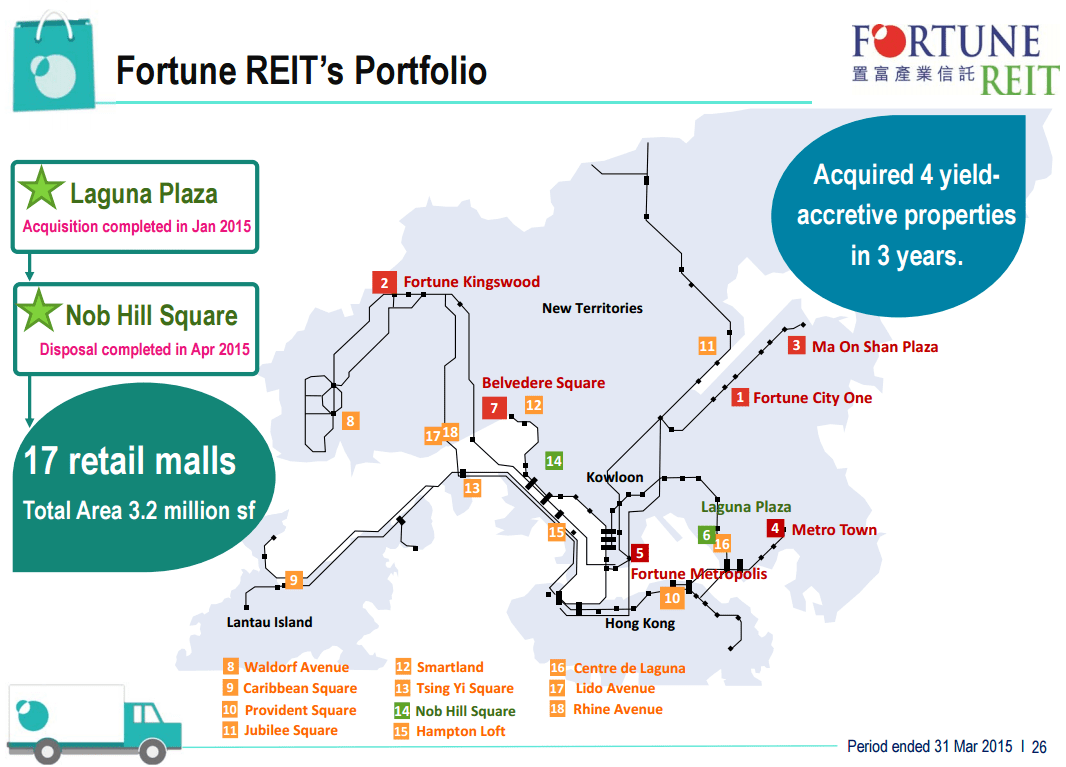

Last Fundamental Analysis for Fortune REIT.

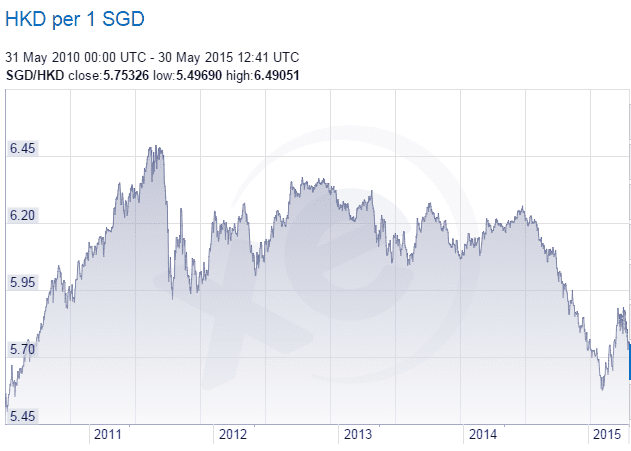

Currency Risk

Fortune REIT Technical Analysis

Fortune REIT has dropped about 13% from the high of about HK$9.00 and currently just sitting on the 200D SMA support. Coincidentally this 200D SMA is also the 61.8% Fibonacci Retracement Support. Watch closely whether this support level holds. If yes, it may be a good entry level to those who are interest to invest in Fortune REIT for the 6% Dividend Yield.

Check out the hands on REIT Investing class here to learn how to conduct Fundamental Analysis and Technical Analysis on Singapore REIT. Equip yourself the financial knowledge on how to select a Fundamental strong REIT to generate consistent passive income.

Timing is very important in stock investing because you will still lose money when you invest in the market down trend. You can use Technical Analysis to identify the trend to maximize your profit and protect yourself from losing money.