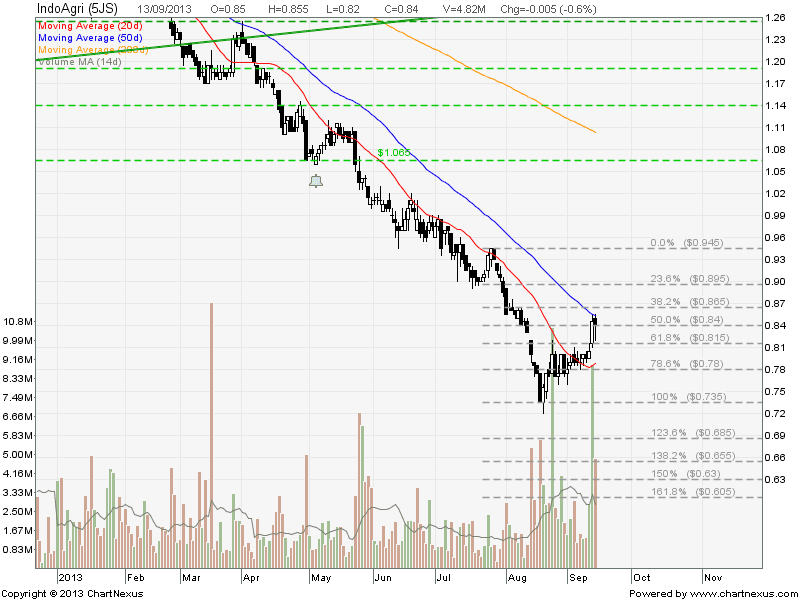

Hanging Man at 50D SMA resistance. Potential reversal for recent rebound! Wait for confirmation!

The trend remains down!

Original post by Marubozu from My Stocks Investing Journey.

Key Statistics for IFAR

| Current P/E Ratio (ttm) | 17.9524 |

|---|---|

| Estimated P/E(12/2013) | 19.1573 |

| Relative P/E vs. FSSTI | 1.4049 |

| Earnings Per Share (IDR) (ttm) | 412.0000 |

| Est. EPS (IDR) (12/2013) | 385.8120 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 1,196.40 |

| Shares Outstanding (M) | 1,424.28 |

| 30 Day Average Volume | 2,909,467 |

| Price/Book (mrq) | 0.7658 |

| Price/Sale (ttm) | 0.7959 |

| Dividend Indicated Gross Yield | 1.01% |

| Cash Dividend (SGD) | 0.0085 |

| Last Dividend | 05/06/2013 |

| 5 Year Dividend Growth | – |

| Next Earnings Announcement | 10/31/2013 |