Lippo Malls Indonesia Retail Trust (LMIR) Fundamental Analysis

- Last Done Price = $0.365

- NAV = $0.42

- Price / NAV = 0.869 (13.1% Discount)

- Price / NAV (High) = 1.022

- Price / NAV (Low) = 0.76

- Distribution Yield = 7.86% (base on DPU TTM)

- Distribution Yield = 8.65% (assume 0.79 cents for next 4 Quarters)

- Gearing Ratio = 31.6%

- WALE = 4.90 Years

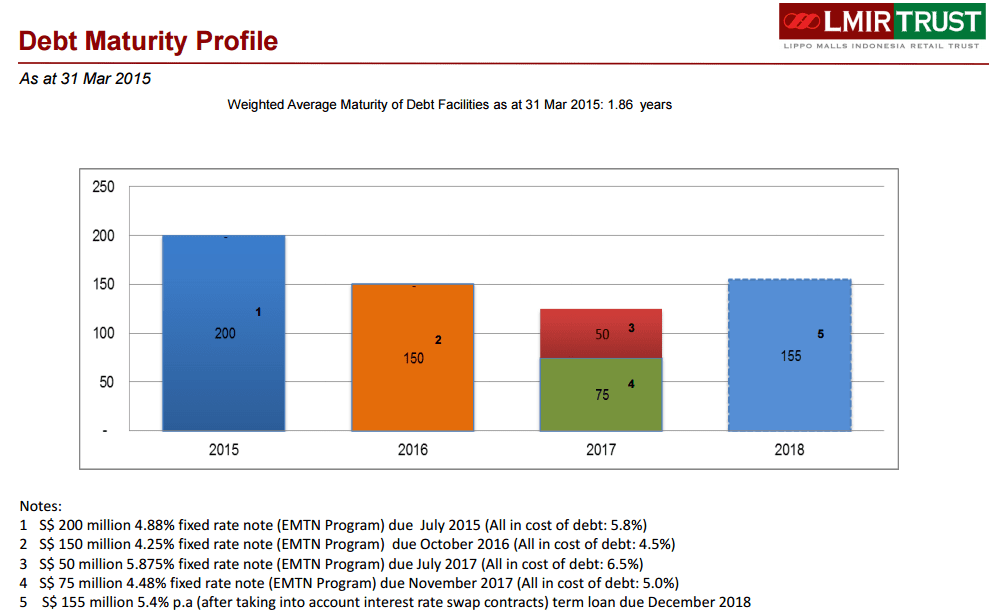

- WADB = 1.86 Years

Last Fundamental Analysis for Lippo Malls Indonesia Retail Trust (LMIR)

Currency Risk

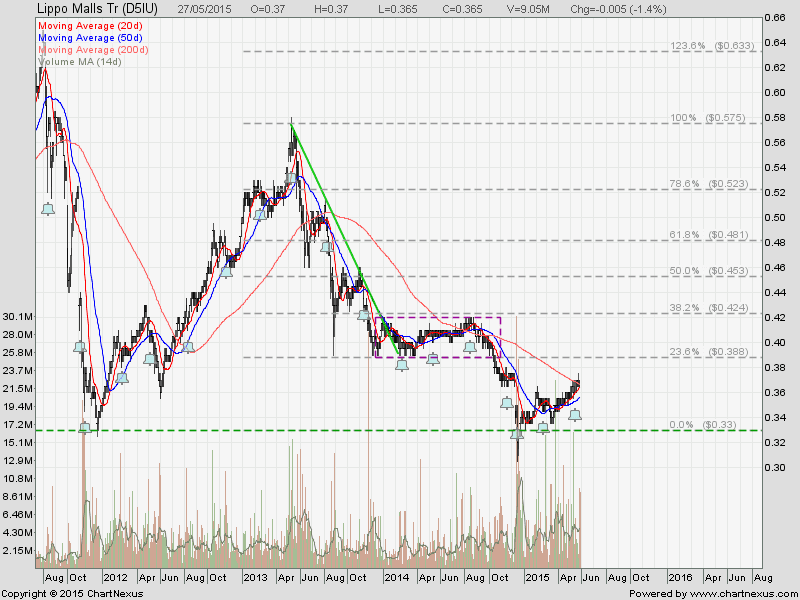

Lippo Malls Indonesia Retail Trust (LMIR) Technical Analysis

LMIR is on short term up trend (20 and 50D SMA trending up) and currently testing the 200D SMA resistance.

LMIR is on short term up trend (20 and 50D SMA trending up) and currently testing the 200D SMA resistance.

Summary

Fundamentally valuation and yield looks attractive and down side risk is limited to my own risk appetite. Technically LMIR has found the bottom at $0.30 and the trend is reversing. Current level looks like attractive entry level to me personally for long term investing.