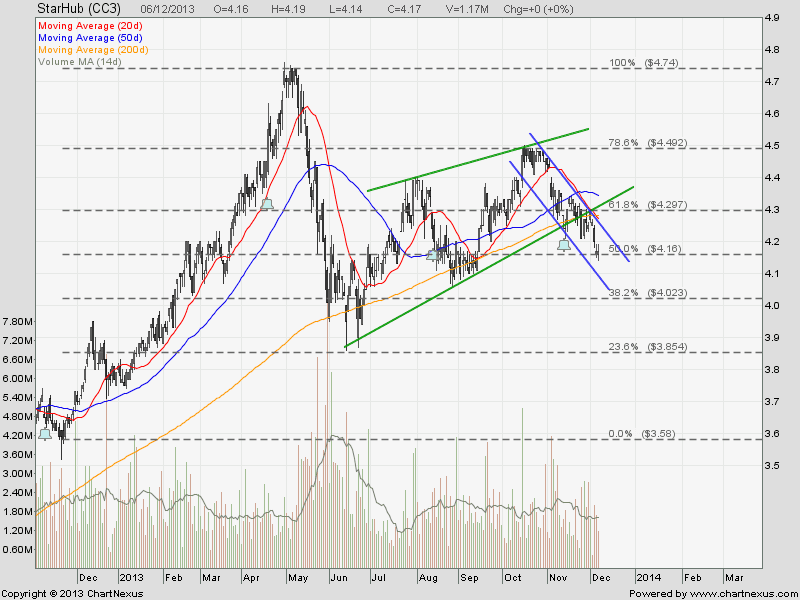

Starhub looks like breaking out from a Rising Wedge and start trading in a down trend channel. Starhub recently retested 200D SMA resistance but failed. Price target is $3.90 if this breakout is successful. The chart is bearish as Starhub is trading below all 3 moving averages.

See previous analysis for Starhub.

Key Statistics for STH

| Current P/E Ratio (ttm) | 19.1548 |

|---|---|

| Estimated P/E(12/2013) | 19.2166 |

| Relative P/E vs. FSSTI | 1.4391 |

| Earnings Per Share (SGD) (ttm) | 0.2177 |

| Est. EPS (SGD) (12/2013) | 0.2170 |

| Est. PEG Ratio | 3.5652 |

| Market Cap (M SGD) | 7,170.46 |

| Shares Outstanding (M) | 1,719.53 |

| 30 Day Average Volume | 1,807,833 |

| Price/Book (mrq) | 86.4763 |

| Price/Sale (ttm) | 2.9880 |

| Dividend Indicated Gross Yield | 4.80% |

| Cash Dividend (SGD) | 0.0500 |

| Dividend Ex-Date | 11/13/2013 |

| 5 Year Dividend Growth | 2.13% |

| Next Earnings Announcement | 02/07/2014 |