Original post from https://mystocksinvesting.com

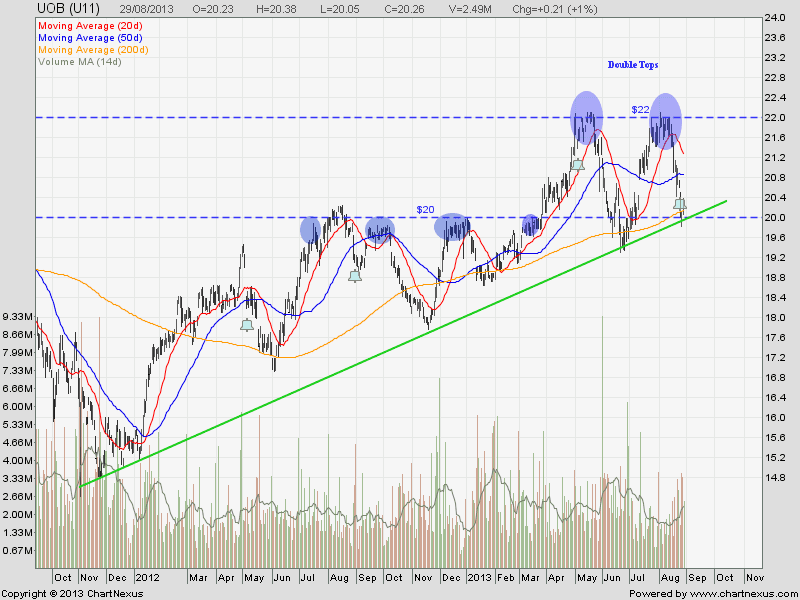

I love UOB chart because I can trade either direction!

Currently UOB has just rebounded from the uptrend support with next significant resistance at $22. Alternatively, UOB can go as low as $18 if the uptrend support (also the neckline of the Double Tops & 200D SMA support) is broken at about $20.

Simply love it!

Key Statistics for UOB

| Current P/E Ratio (ttm) | 11.3501 |

|---|---|

| Estimated P/E(12/2013) | 11.4918 |

| Relative P/E vs. FSSTI | 0.9236 |

| Earnings Per Share (SGD) (ttm) | 1.7850 |

| Est. EPS (SGD) (12/2013) | 1.7630 |

| Est. PEG Ratio | 1.6034 |

| Market Cap (M SGD) | 31,914.11 |

| Shares Outstanding (M) | 1,575.23 |

| 30 Day Average Volume | 1,910,367 |

| Price/Book (mrq) | 1.3496 |

| Price/Sale (ttm) | 3.7070 |

| Dividend Indicated Gross Yield | 2.96% |

| Cash Dividend (SGD) | 0.2000 |

| Last Dividend | 08/26/2013 |

| 5 Year Dividend Growth | 1.49% |

| Next Earnings Announcement | 11/05/2013 |