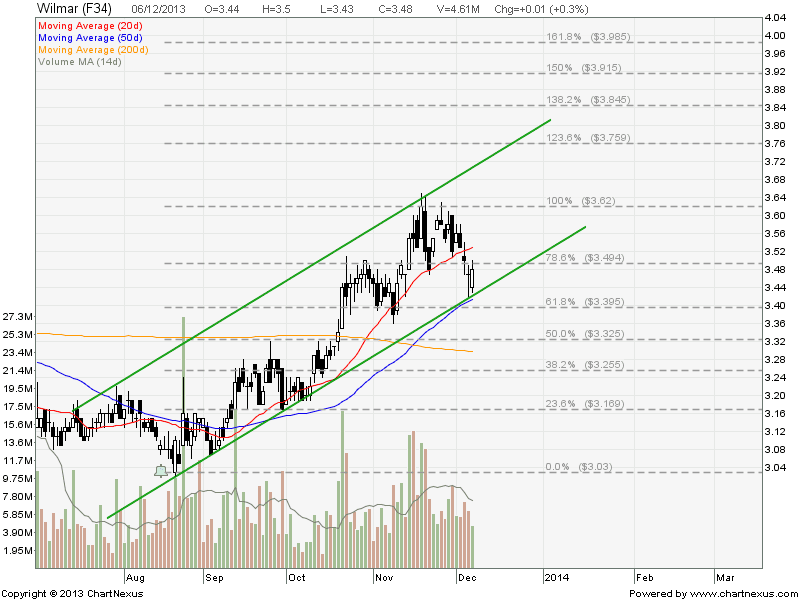

Wilmar looks like rebounding after retracing back to uptrend channel support. $3.40 is also the 50D SMA support and also the 61.8% Fibonacci Retracement level. Expect rebound from here with medium term price target of about $4.00 (161.8% FR) as long as Wilmar continues to stay within this up trend channel.

See previous analysis on Wilmar.

Key Statistics for WIL

| Current P/E Ratio (ttm) | 12.4893 |

|---|---|

| Estimated P/E(12/2013) | 13.5783 |

| Relative P/E vs. FSSTI | 0.9383 |

| Earnings Per Share (USD) (ttm) | 0.2230 |

| Est. EPS (USD) (12/2013) | 0.2050 |

| Est. PEG Ratio | 1.3312 |

| Market Cap (M SGD) | 22,268.79 |

| Shares Outstanding (M) | 6,399.08 |

| 30 Day Average Volume | 7,207,967 |

| Price/Book (mrq) | 1.2120 |

| Price/Sale (ttm) | 0.4041 |

| Dividend Indicated Gross Yield | 1.58% |

| Cash Dividend (SGD) | 0.0250 |

| Dividend Ex-Date | 08/16/2013 |

| 5 Year Dividend Growth | 0.37% |

| Next Earnings Announcement | 02/21/2014 |