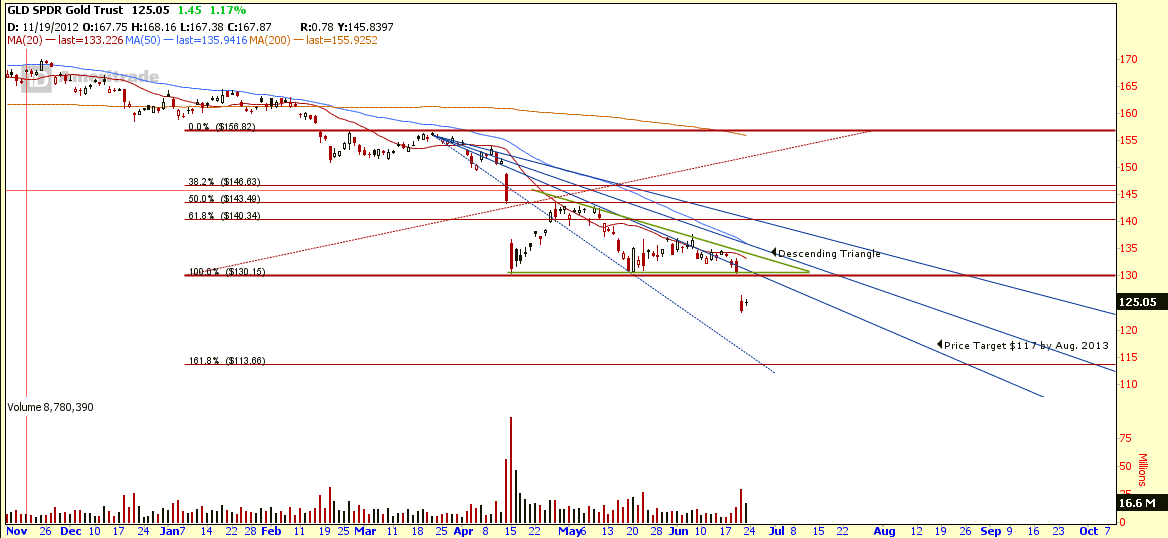

SPDR Gold (GLD): Break DescendingTriangle Support!

Expect another round of selling of GLD after this Gold ETF broke the $130 support. Price target for this Descending Triangle breakdown is minimum $117. With the help of Fibonacci Fan, GLD may reach this target by Aug 14, 2013.

Current trade setup to short GLD using Vertical Spread.

- Strategy: Long Vertical Put Spread

- STO GLD Aug13 120 Put

- BTO GLD Aug13 125 Put

- Breakeven @ Expiry date on Aug16, 2013 = $123.22

- Maximum Profit = $323

- Maximum Loss = $177

- Reward / Risk = 1.82

- Cut Loss = GLD goes above $130

Previous Analysis on SPDR GOLD ETF (GLD).