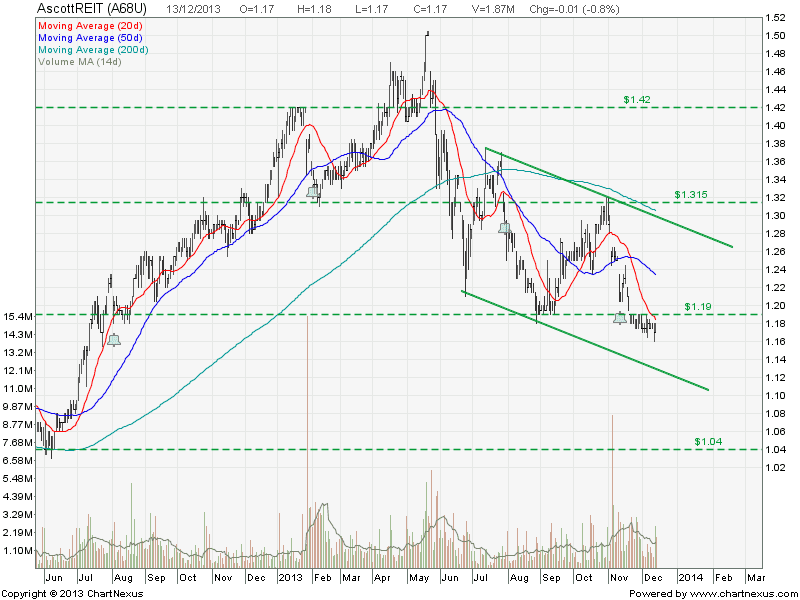

ASCOTT REIT: High Gearing & Down Trend

ASCOTT REIT has just broken the support at $1.19 and continue the down trend in a down trend channel. ASCOTT REIT is over value base on NAV and has high gearing ratio of 41.1%.

Be extremely careful of the interest rate hike and right issue.

See other Singapore REIT comparison table here.

Personally I see totally NO reasons to invest in this ASCOTT REIT base on Fundamental Analysis, Technical Analysis and Monetary Policy. I would like to hear from you if anyone see things different in this REIT.