Suntec REIT Fundamental & Technical Analysis

Suntec REIT April 2017

Suntec REIT Fundamental Analysis

- Last Done Price = $1.85

- Market Cap = $4.7 B

- NAV = $2.12

- Price / NAV = 0.87 (13% Discount)

- Price / NAV (High)= 0.97

- Price / NAV (Low) = 0.73

- Distribution Yield (TTM) = 5.44%

- Gearing Ratio = 37.7%

- WALE (Retail) = 2.27 Years

- WALE (Office) = 4.02 Years

- WADM = 2.56 Years

- Occupancy Rate (Retail) = 98.0%

- Occupancy Rate (Office) = 98.9%

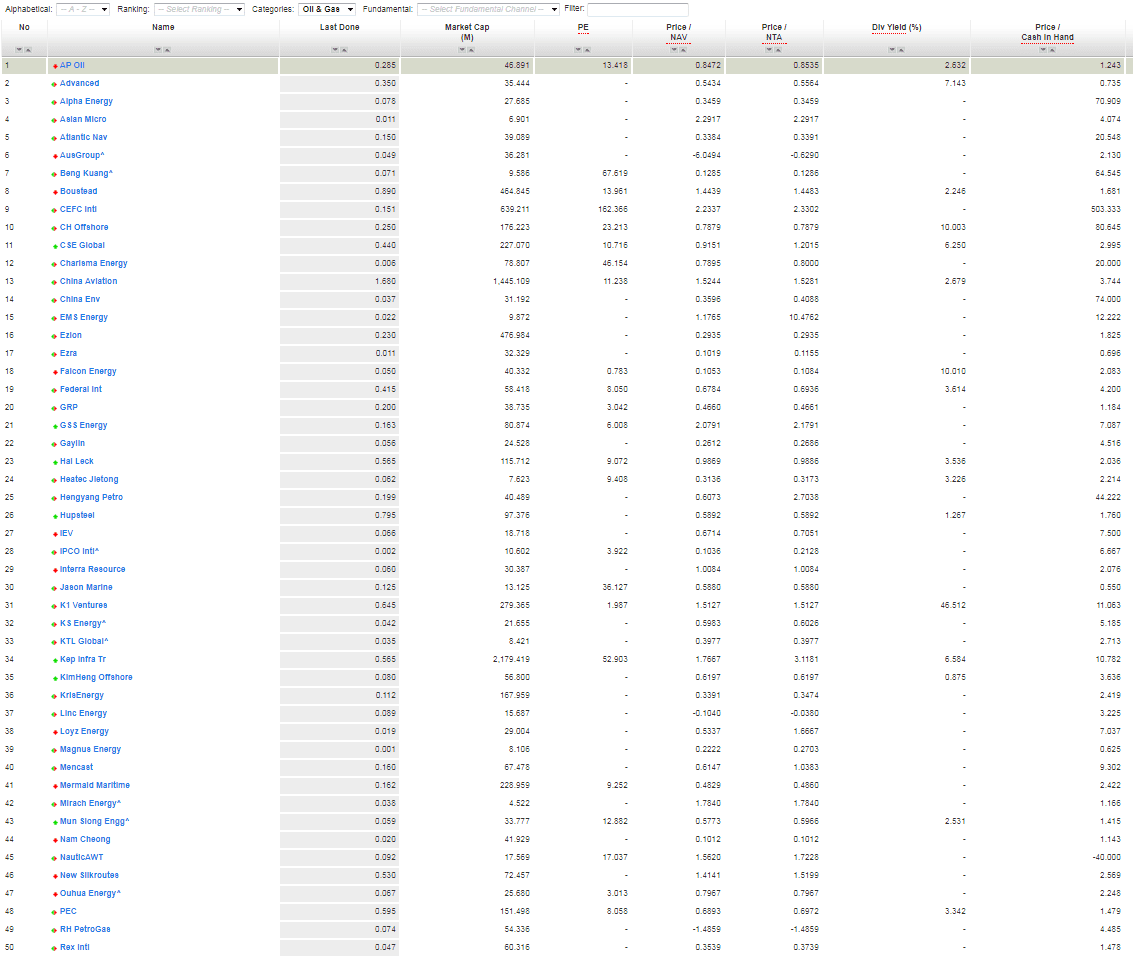

Other Singapore REITs Comparison Table

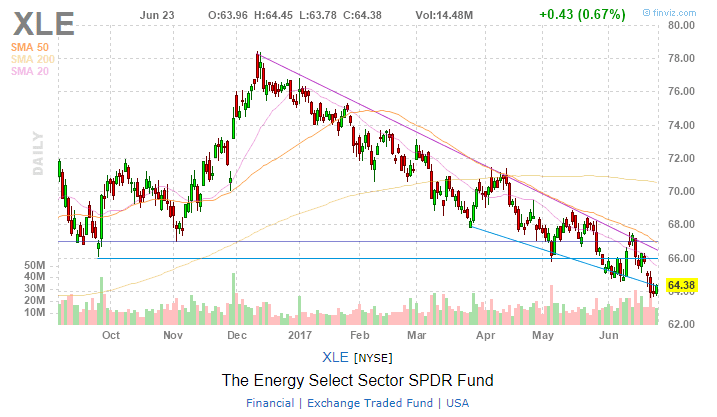

Suntec REIT Stock Chart & Technical Analysis

Suntec REIT is s currently trading in an uptrend channel but will be reaching the previous high of $2.00 soon.

Singapore REITs Office Sector Comparison

Check out longest running Singapore REITs Hands on Course & Training here.

Click here to find out Singapore REITs Portfolio Advisory