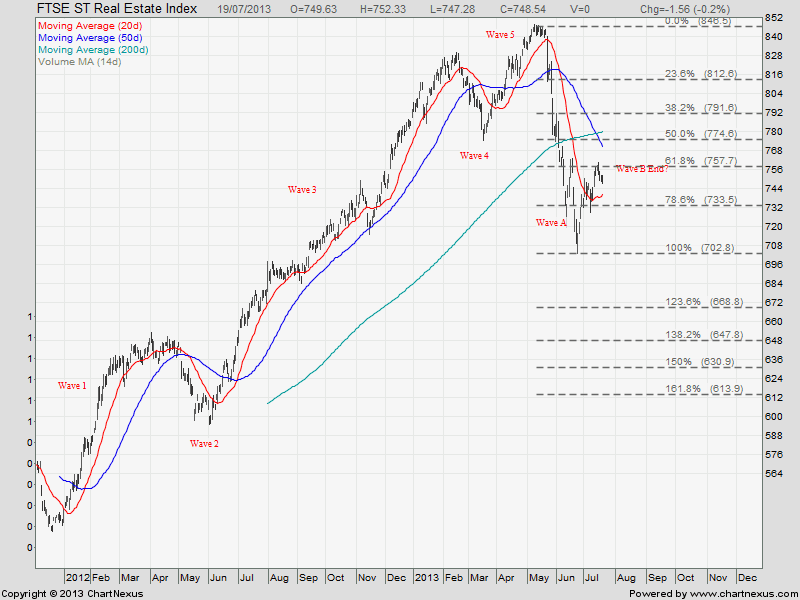

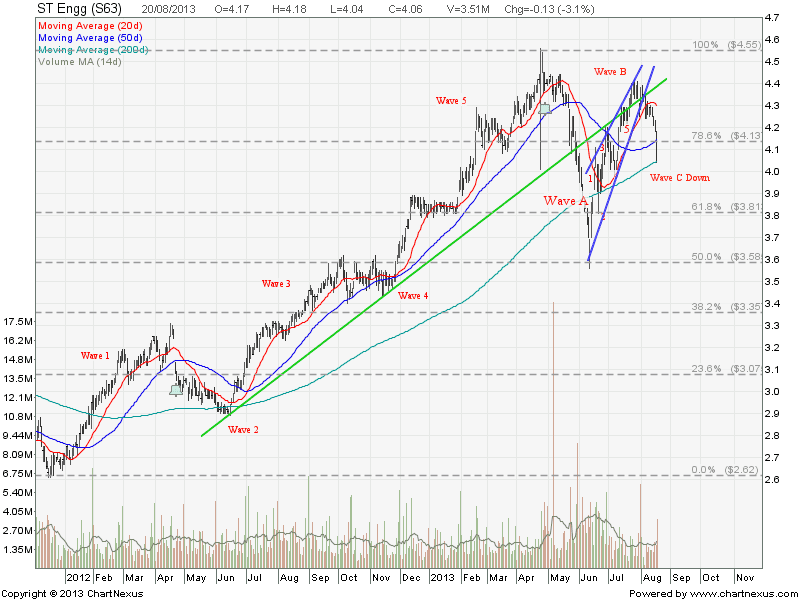

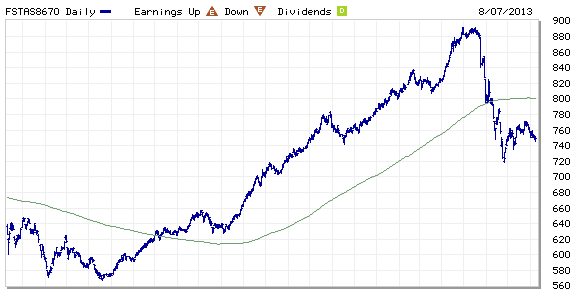

ST Engineering: Elliott Wave C Down!

ST Engineering broke down from the Rising Wedge and is currently testing 200D SMA. If this 200D SMA support is broken, there will be a huge down side to go base on Elliott Wave pattern (Wave C Down). Sit tight!

See last analysis on ST Engineering.

Key Statistics for STE

| Current P/E Ratio (ttm) | 21.5728 |

|---|---|

| Estimated P/E(12/2013) | 20.1990 |

| Relative P/E vs. FSSTI | 1.6640 |

| Earnings Per Share (SGD) (ttm) | 0.1882 |

| Est. EPS (SGD) (12/2013) | 0.2010 |

| Est. PEG Ratio | 2.4336 |

| Market Cap (M SGD) | 12,606.04 |

| Shares Outstanding (M) | 3,104.94 |

| 30 Day Average Volume | 1,646,100 |

| Price/Book (mrq) | 6.8085 |

| Price/Sale (ttm) | 1.9539 |

| Dividend Indicated Gross Yield | 1.72% |

| Cash Dividend (SGD) | 0.0300 |

| Last Dividend | 08/21/2013 |

| 5 Year Dividend Growth | -0.09% |

| Next Earnings Announcement | 11/07/2013 |

Compare to last

Compare to last