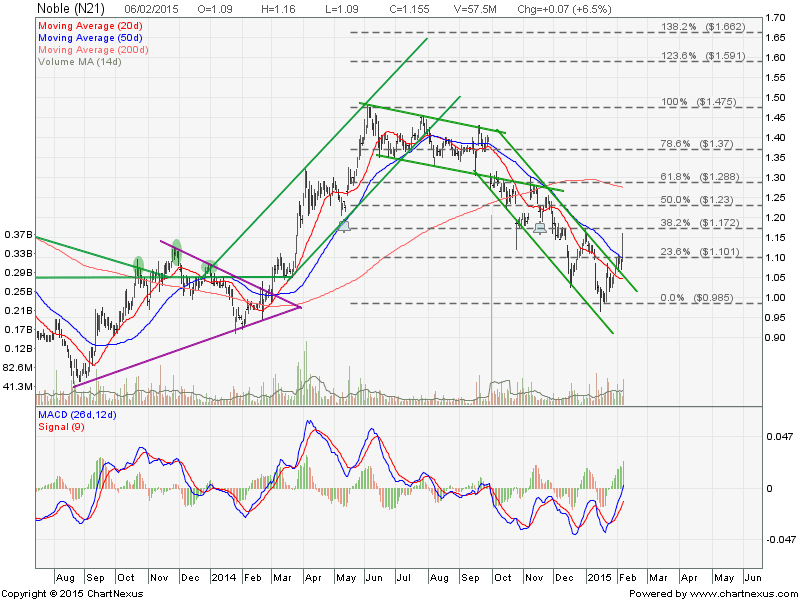

Noble Group: Down Trend Ended?

Noble Group has broken out from the Down Trend Channel resistance. This is the 1st sign of potential reversal pattern. Things to watch for the reversal confirmation:

- 20D & 50D starts to trend up.

- A Higher High, Higher Low chart pattern formation.

- Noble has to clear $1.17 resistance (38.2% Fibonacci Retracement Level)

- Potential formation of Inverted Head and Shoulders with neckline at $1.17.

Potential Entry Point (Long position):

- Noble pull back to form the Right Shoulder (Inverted Head and Shoulders)

- Breakout at $1.17 and turned this resistance to support level.

Original post by Marubozu from My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 9.8036 |

|---|---|

| Estimated P/E(12/2014) | 11.6948 |

| Relative P/E vs. FSSTI | 0.6525 |

| Earnings Per Share (USD) (ttm) | 0.0871 |

| Est. EPS (USD) (12/2014) | 0.0730 |

| Est. PEG Ratio | 0.1893 |

| Market Cap (M SGD) | 7,784.08 |

| Shares Outstanding (M) | 6,739.47 |

| 30 Day Average Volume | 26,969,120 |

| Price/Book (mrq) | 1.1027 |

| Price/Sale (ttm) | 0.0605 |

| Dividend Indicated Gross Yield | 0.99% |

| Cash Dividend (USD) | 0.0300 |

| Dividend Ex-Date | 11/18/2014 |

| 5 Year Dividend Growth | 3.75% |

| Next Earnings Announcement | 02/18/2015 |