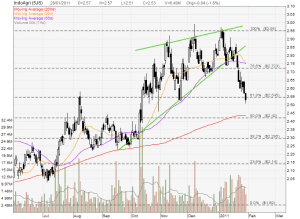

IndoAgriculture: Breaking Out Soon?

IndoAgri has formed an Inverted Head and Shoulders and currently testing the neckline resistance at about $2.30. Previously IndoAgri had a very nice breakout from a Rising Wedge and reached the minimum breakout target price. Can IndoAgriculture have a nice breakout from this Inverted Head and Shoulders pattern and reach the minimum target price of $2.54? If yes, this IndoAgri chart pattern can be a very good teaching material of chart patterns for a Technical Analysis class!