Intuitive Surgical Inc (ISRG) Option Trading Strategy: Butterfly

Trading Plan

- Ticker: Intuitive Surgical Inc (ISRG)

- Direction: Bullish

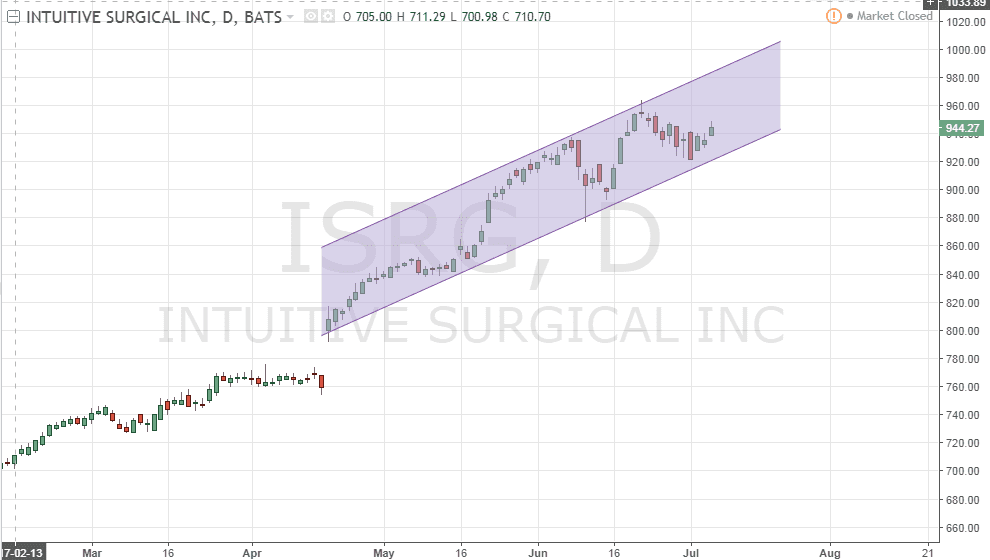

- Chart Pattern: Trading within an up trend channel

- Price Target: 955

- Duration: Out by July 20 (Earning July 20 AMC)

- Option Strategy: Butterfly

Chart

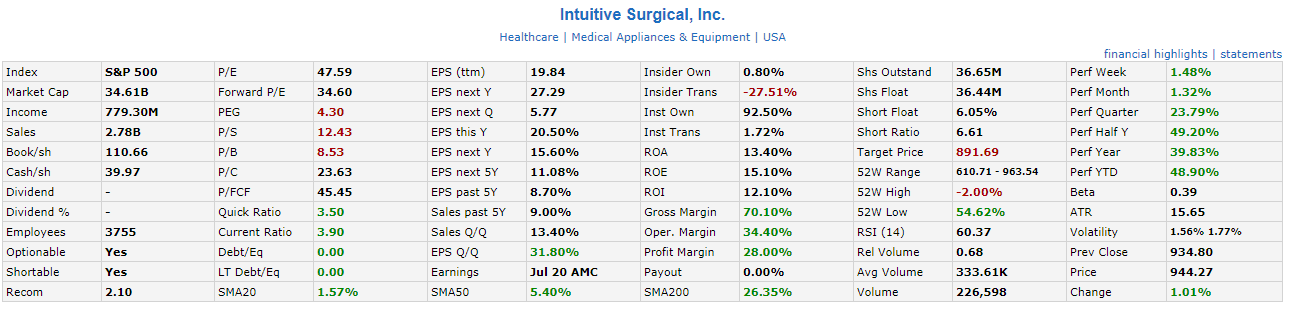

ISRG Fundamental Data

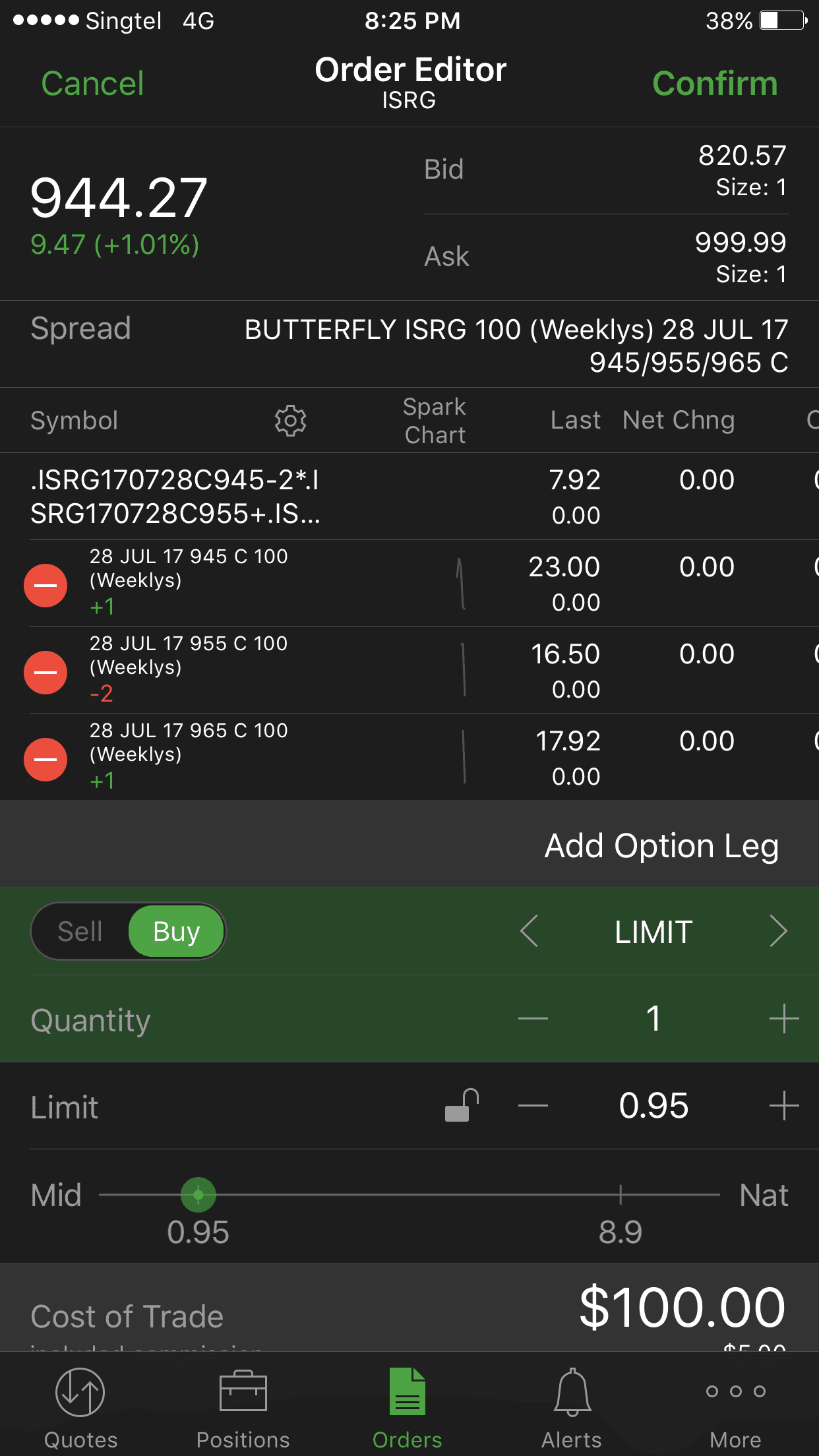

Strike Price Setup

- +1 July 28 945 Call

- -2 July 28 955 Call

- +1 July 28 965 Call

Risk Profile

- Maximum Gain = $863

- Maximum Loss = $95

- Reward / Risk = 9.08

Original post from https://mystocksinvesting.com

Disclaimer: This is my own trade planning for own use. This is NOT a recommendation to buy or sell and I will NOT be responsible if anyone copy the trades without understanding the risks.