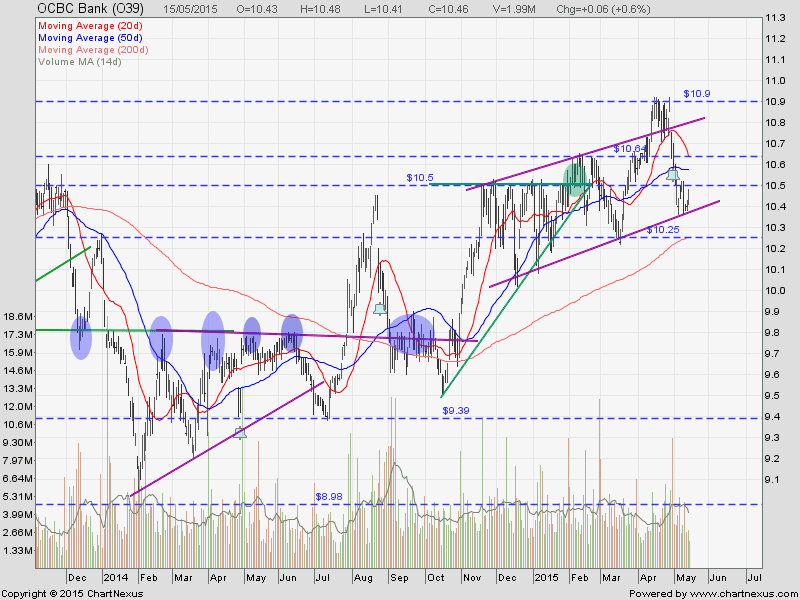

OCBC Bank: Rebounding in a Channel

OCBC Bank looks like rebounding from a up trend channel support but immediately facing resistance at $10.50.

Original post by Marubozu My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 10.0990 |

|---|---|

| Estimated P/E(12/2015) | 10.9874 |

| Relative P/E vs. FSSTI | 0.6462 |

| Earnings Per Share (SGD) (ttm) | 1.0357 |

| Est. EPS (SGD) (12/2015) | 0.9520 |

| Est. PEG Ratio | 1.1730 |

| Market Cap (M SGD) | 41,690.96 |

| Shares Outstanding (M) | 3,985.75 |

| 30 Day Average Volume | 3,709,383 |

| Price/Book (mrq) | 1.2841 |

| Price/Sale (ttm) | 3.4120 |

| Dividend Indicated Gross Yield | 3.39% |

| Cash Dividend (SGD) | 0.1800 |

| Dividend Ex-Date | 04/30/2015 |

| 5 Year Dividend Growth | 5.46% |

| Next Earnings Announcement | 08/05/2015 |