ST Engineering Rebound! Is It Time To Buy?

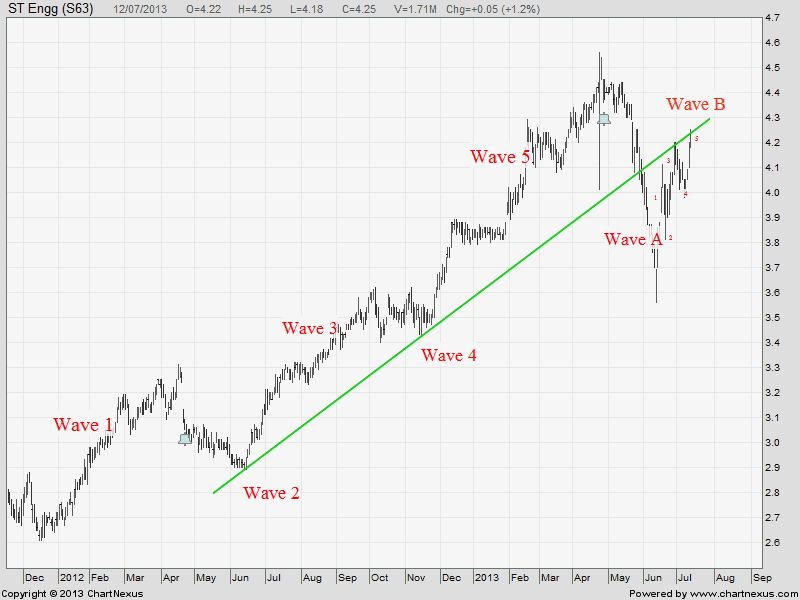

I have to re-draw the Elliott Wave count for ST Engineering because the recent rebound is still the Wave B. There is also a Mini Elliott Wave in Wave B (1-2-3-4-5) and currently hitting the uptrend support turned resistance level (green line).

For those who know Elliott Wave pattern and know how to count the Wave (1-2-3-4-5-A-B-C), you should be able to identify what is the next move! It is Wave C of the Big One and Wave A for the Small One! The Big and The Small are in the same direction! Now we just need to wait for the certain candlestick pattern to form! Happy Trading!