See previous week Weekly Inter Market Analysis.

Original post from https://mystocksinvesting.com

SPY (SPDR S&P500 ETF)

SPY is trading within a very tight range between the all time high resistance of 227.75 resistance and immediate support at 223. Probably will see the breakout this week after Donald Trump inauguration as US President.

- Immediate resistance at 227.75

- Immediate support: about 223

- Previous resistance turned support zone: about 219-220.

- 200D SMA support (trending up): about 214

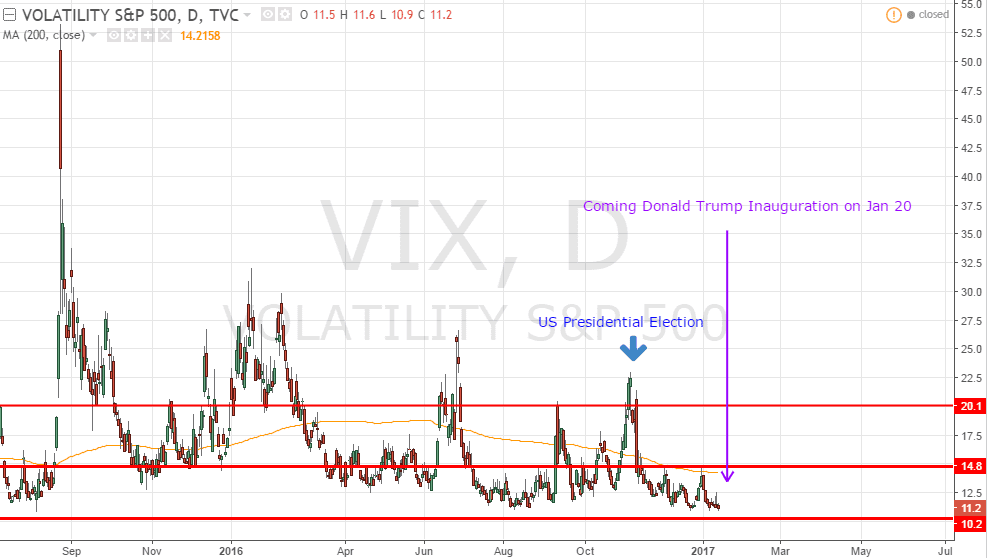

VIX

VIX continues to stay within the complacent zone at 14.0. No fear entering into 2017. The inauguration of Donald Trump as the 45th President of the United States will be held on Friday, January 20, 2017. Let’s see whether the market is worried about what he is going to say, and prepared for the shock!

Sector Performance (SPDR Sector ETF)

- Best Sectors: Consumer Discretionary (XLY) +0.77%

- Worst Sector: Real Estate (XLRE) -2.26%

SUDX (S&P US Dollar Futures Index)

SUDX retraced from resistance at about 138 and currently testing the uptrend support (in green). Let see whether SUDX will rebound from this level or continue to move down. The trend remains up for US Dollar.

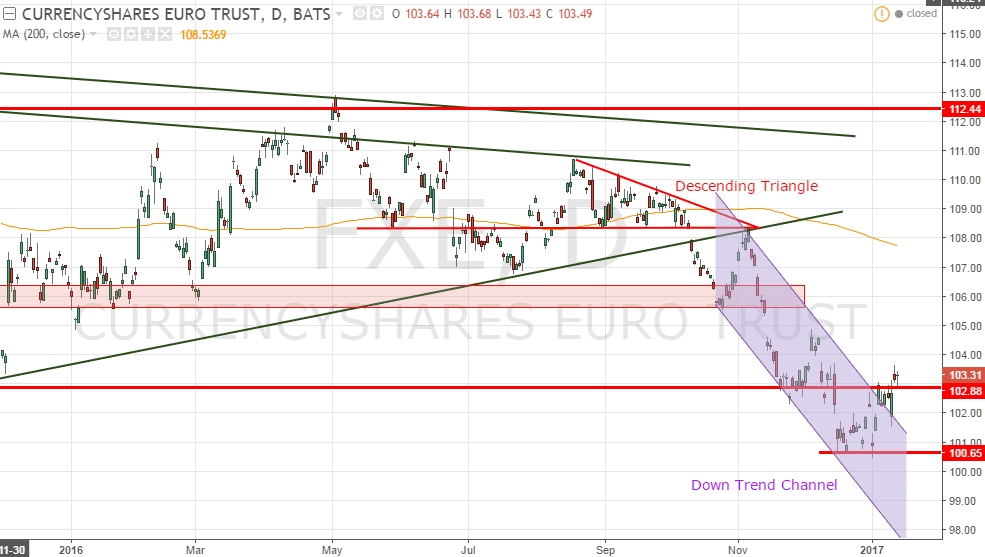

FXE (Currency Shares Euro ETF)

FXE is still testing the channel resistance and also the support turned resistance level (horizontal red line) at about 102.88. Expect more down ward pressure for FXE if rejected at this resistance.

XLE (SPDR Energy Sector ETF)

XLE is currently retracing to test the support at 74.87. Breaking this support will probably send XLE to the next support level of 71.84.

USO (United States Oil Fund)

USO is currently facing the rectangle resistance zone. USO is still trading side way until a more convincing breakout. Opportunity for bullish trade when USO breaks out upward from this consolidation range.

TLT (iShares 20+ Years Treasury Bond ETF)

TLT is finding support at 117-118 and is current rebounding. Next resistance zone about 127-128 at 38.2% Fibonacci Retracement level and also the previous support turned resistance. The trend remains down for TLT.

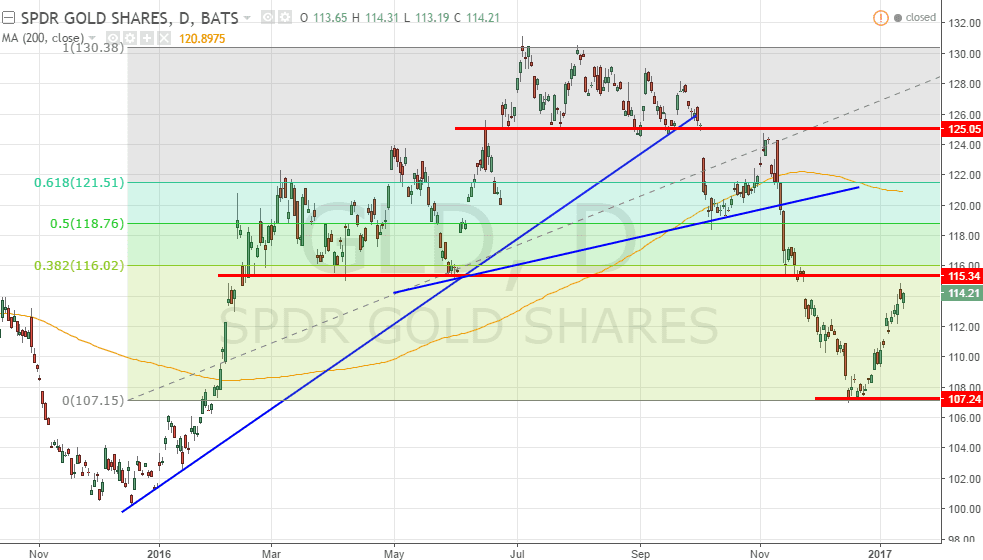

GLD (SPDR Gold Shares)

GLD is getting near to the next resistance zone about 115-116 at 38.2% Fibonacci Retracement level and also the previous support turned resistance. Watch out for the reversal patterns. The trend remains down for GLD.

Next Week Economic Calendar

Key events:

- ECB Press Conference on Jan 19 (Thursday)

- Janet Yellen speaks on Jan 19 (Thursday) and Jan 20 (Friday)

- Crude Oil Inventories on Jan 20 (Friday)

See upcoming Events here. https://mystocksinvesting.com/events/