Great Financial Crisis? What Great Financial Crisis?

That seems to be the attitude in 2011. Which worries us at EconomyWatch.com, because we do not believe that the underlying problems have been solved. If anything, they have been exacerbated.

But first, the numbers, taken as ever from our Economic Statistics Database.

World Economic Statistics at a Glance – 2011 Forecast

- World GDP (PPP): $78.092 trillion

- GDP Growth Rate: 3.3%

- GDP Per Capita (PPP): $11,100

- GDP By Sector: Services 63.4%, Industry 30.8%, Agriculture 5.8%

- Growth In Trade Volume: 6.953%

- Industrial Production Growth Rate: 4.6%

- Population: 6.768 billion

- Population Growth Rate: 1.133%

- Urban Population: 50.5%

- Urbanization Rate: 1.85% (125 million people move to cities every year)

- The Poor (Income below $2 per day): Approx 3.25 billion (~ 50%)

- Millionaires: Approx 10 million (~ 0.15%)

- Labor Force: 3.232 billion

- Inflation Rate – Developed Countries: 2.5%

- Inflation Rate – Developing Countries: 5.6%

- Unemployment Rate: 8.8%

- Investment: 23.4% of GDP

- Public Debt: 58.3% of GDP

- Market Value of Publicly Traded Companies: $48.85 trillion, or 62.6% of World GDP

Sources: EconomyWatch.com Economic Statistics Database, CIA World Factbook, IMF, World Bank

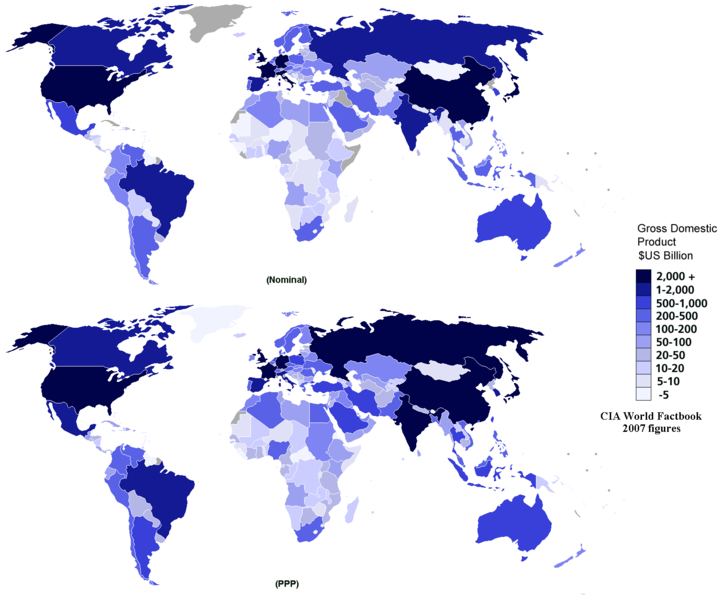

The World Economy in 2010 was worth $74.007 trillion in GDP terms, using the Purchasing Price Parity (PPP) method of valuation. This is expected to grow to $78.092 trillion in 2011.

The overall global economy averaged a 3.2 per cent growth rate between 2000 and 2007, suffering a slight dip in 2001 – 2002 thanks to the Dot Com Crash, but continuing to grow throughout that period. In fact 2004 – 2007 were boom years. The Emerging Markets, led by the giants of China, India, Russia and Brazil (the BRIC countries) had been posting 7 per cent – 10 per cent growth rates for years. Property and stock market booms had brought consistent growth in North America and Europe. Investment was bringing economic development to much of the Middle East and Africa, and even Japan was recovering from its deflationary ‘Lost Years’.

Economic conditions within these countries play a major role in setting the economic atmosphere of less well-to-do nations and their economies. In many aspects, developing and less developed economies depend on the developed countries for their economic wellbeing.

Theories were even circulating that thanks to the growth of the developing world, we might enjoy years of unfettered growth, as new markets would go through successive growth spurts and counter the effects of slowing growth elsewhere. It was suggested that Asia was ‘decoupling’ from the US and able to grow under its own steam thanks to its two ‘Awakening Giants’.

Sadly, that turned out to be hogwash, as deregulation allowed western banks to build up unsustainable levels of debt that brought the global economy to the brink of depression.

As the ‘Sub-Prime’ Crisis morphed into a fully fledged crash then global Financial Crisis, 2008 started to bomb and 2009 became the first year that the world recorded a loss in GDP since World War II. 2.031% was wiped out of the global economy – or $3.3 trillion of value.

We are now in what the IMF calls a ‘Two Speed Recovery Process‘.

Advanced economies have now shrunk as much as feared, but they are either growing slowly or stagnating, with unsustainable debt levels and persistently high unemployment. The US is continuing to stimulate its economy – although it seems more like giving free money to banks who then horde it – which continues to raise debt levels, while the Europeans, thanks to the Eurozone Crisis of 2010, are more focused on budget cuts, helping to reduce debts but keeping unemployment high with a chance of a second recession hitting (the so-called W-shaped recovery). Japan continues to struggle with high debt, a strong currency and deflation.

There are exceptions, of course. Australia and Canada have both done well from rising commodity prices and well-managed banks, while the amazing German high-end export machine goes from strength to strength – putting further pressure on its Eurozone partners in the process.

Developing economies, on the other hand, are experiencing strong growth, as they continue to invest in their own infrastruccture, grow overall exports, and start to see increased levels of consumption from the hundreds of millions that they pull out of poverty every year, the tens of millions that join the middle class, and the millions that join the ranks of the rich.

This emerging market growth process is also leading to an urbanized planet. For the first time in 2010, the majority of the world’s population lived in cities (50.5% or 3.417 billion people), and that number is growing by over 125 million people a year.

This two-speed process has led to a rapid change of the politcal and economic power structure that has existed since the end of World War II.

During this period, we have seen China Overtake Japan as the world’s second largest economy, and the replacement of the old G7/ G8 structure with the G20, bringing together the twenty most important economies from both the advanced and developing worlds.

But let us get back to why we now find ourselves in a world where the ‘advanced’ economies are in such a sluggish mood.

Yes, There Was a Great Financial Crisis. No, it Wasn’t a ‘Freak’ Accident that No One Could Have Predicted. No, it Hasn’t Been Solved.

De-regulation allowed banks to grow bigger and bigger by taking on ever greater leverage – i.e. betting with borrowed or engineered money – against ever smaller capital reserves.

When valuations were going up, leverage helped to fatten profits. Bankers and their shareholders didn’t need to laugh all the way to the bank, since they already owned it.

But when markets turned (despite models that assumed that housing markets only ever went up) that leverage amplified losses. Vague concepts of ‘moral hazard’ quickly turned to a Too Big To Fail policy. The fear was that if one bank failed, the domino effect could take the whole system down.

And rather than set about cleaning up the system, western governments proceeded to save those banks with taxpayer money, while the commercial paper markets froze, the Baltic Dry Index went effectively to zero, and real unemployment started climbing to depression-era levels.

Bankers have since gone back to paying themselves billions in bonuses while their debts have effectively been nationlized and transferred to government debt. Meanwhile unemployment remains stubbornly high.

National Debt marked the second phase of the Great Financial Crisis, that started in 2009 with Dubai’s defaults. While Dubai was saved by the oil wealth of Abu Dhabi, Europe in 2010 was a different story. The structural problem of the European Union, in which Monetary Policy has been centralized while Fiscal Policy remains national, was fully exposed by the soaring bond costs for the PIIGS countries. The Eurozone Crisis started in Greece, quickly spread through Portugal and Ireland, and even threatend the UK.

The response involves loans that (surprise surprise) lets European banks keep their money, while austrity measures throw yet more people on the breadline. At the start of 2011, one in eight working age Spaniards is out of a job, while cuts to government services budgets are reaching 40 per cent in instances.

With the exception of the incredible German export machine, powered by the mittelstand, Europe is lowing at a prolonged period of low growth and civil unrest.

That on its own would be bad enough, but combined with the next problem, it could be truly disasterous.

Inflation is Back – and Stagflation is Coming

Just before the dawn of the 21st century, oil averaged $16 a barrel. By July 2008, less than 10 years later, oil hit a high of $146 a barrel – a stunning rise of more than 800%. From early 2007 to mid 2008 alone the price has risen more than threefold from the mid $40s.

During the Oil Crisis of the 1970s, oil spiked at a nominal peak of $38. In today’s prices (adjusted for inflation), that is $106, a figure that we blew past in early 2008.

At the start of 2011 oil prices were hovering around the $85 price. It seems unlikely they will stay here, despite the growth of natural gas supplies. As emerging markets drive ever greater resource demands, a set of Wikileaks documents confirm what many have suspected; that the Saudis have exaggerated their reserves and Peak Oil has already been reached.

In fact there is a growing school of thought known as ‘Peak Oil’ that believes we have – or will soon – reach peak oil production capabilities. In the 1950s Dr M. King Hubbert correctly predicted peak oil and decline rates for the mainland US oil industry. His model came to be known as The Hubbert Peak Theory. It predicts that world peak oil production will be reached sometime between 2000 and 2010, and will decline thereafter.

The costs of commodities across the board are being driven up by the 3 billion inhabitants of the BRIC nations, whose wealth is growing at 8 per cent to 10 per cent a year, not to mention a further 2 billion or so in the other emerging markets.

As long as supply can’t keep up with demand, and with all the cheap money that is flowing into markets from western central banks, inflation growth is likely.

This could challenge social stability in poorer countries – and could signal stagflation for the advanced economies.

Conversely, it has been powering a period of strong economic growth in Africa, with countries like Ghana now leading global growth figures.

Although it should be fuelling similar growth stories in the Middle East, something else has been growing – descent.

A younger generation of well-educated but un- or under-employed youth are no longer ready to accept autocratic rule, corruption and a lack of civil society.

If they manage to bring real change to their countries, in the form of plural democracies and greater accountability, the world’s political economy could be re-configured in unexpected ways.

Bro so what is e conclusion?

Hello just thought I would tell you something.. This is twice now I’ve came to your blog in the last 2 weeks hunting for stock trading information. Love what your website has to offer!