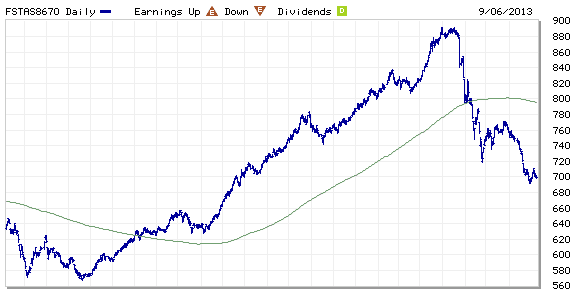

FTSE ST Real Estate Investment Trusts (FTSE ST REIT) Index changes from 749.17 to 699.17 compare to last post on Singapore REIT Fundamental Comparison Table on Aug 9, 2013. The index is trading below 200D SMA and technically bearish. Currently the index is trading in Elliott Wave C (down) and no sign of reversal yet.

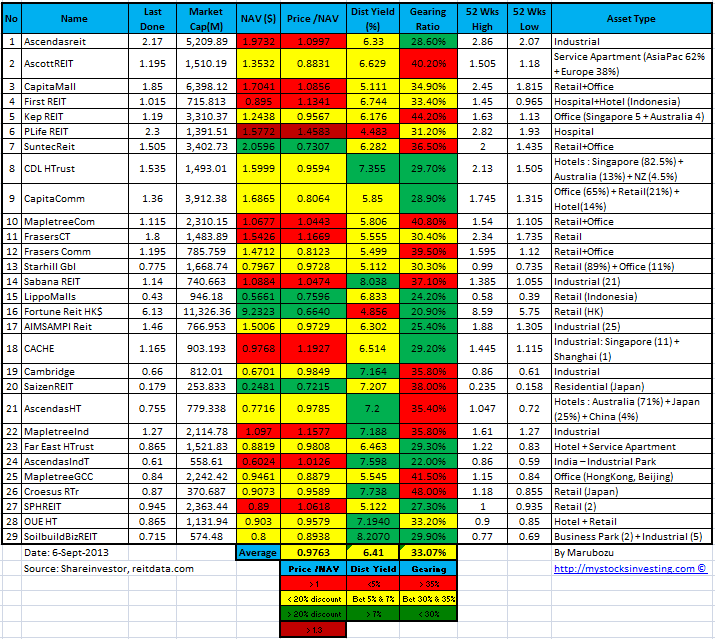

Compare to last Singapore REIT comparison table:

Added Soilbuild Business REIT.

- Price/NAV decreases from 1.0568 to 0.9763.

- Dividend Yield increases from 5.91% to 6.41%.

- Gearing Ratio remains the more or less the same at 33.07%.

- In Short, Singapore REIT become attractive in terms of valuation and distribution yield again. However technically Singapore REIT is still on down trend and the price can go even lower although fundamental looks attractive.

Find out how I do research on Singapore REIT, how to interpret those financial ratio in the comparison table, when is the best time to buy using simple Trend Analysis. Check out my next public tutorial on “How to pick Singapore REIT for Dividend Investing” .