Singapore REIT sold off on May 23, 2013 after Ben Bernanke’s speech on QE exit plan and shock contraction of China PMI. This caused Japan Nikkei plunged 7.3% in one day. Interestingly Singapore REITs also faced a wide sell off between 3-5% and this is very unusual because REITs are defensive in nature. It is time to really take a look at chart pattern and use technical analysis to exit the current portfolio. No if, No but, No need to hope and SAFETY first. Also bear in mind that the month of May is still not finished yet…. “Sell in May and Go Away?”

Note: Singapore REIT is over value at the moment.

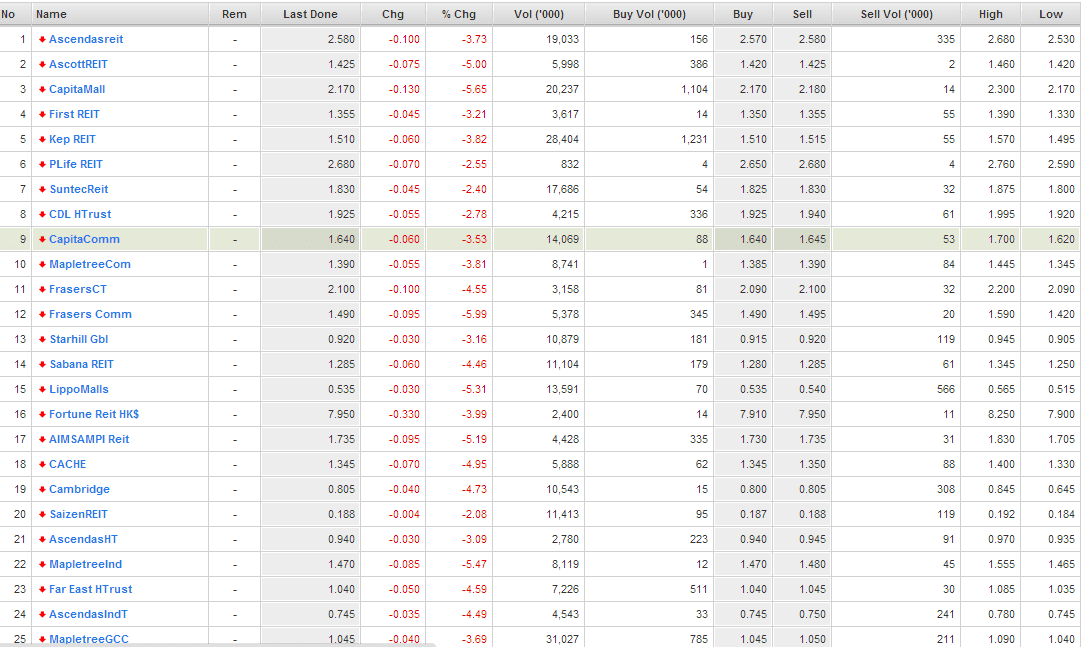

See Singapore REIT Comparison table here.

Interest rates increase if QE exit.. affect funding cost of REIT… decrease DPU..

Hi, I would like to get some advice from you on AscendaH Reits? What does it mean for me as a shareholder with the staple securities announcement?

Hi K, I suggest you check with your broker. I am not certified to give you any financial advice.