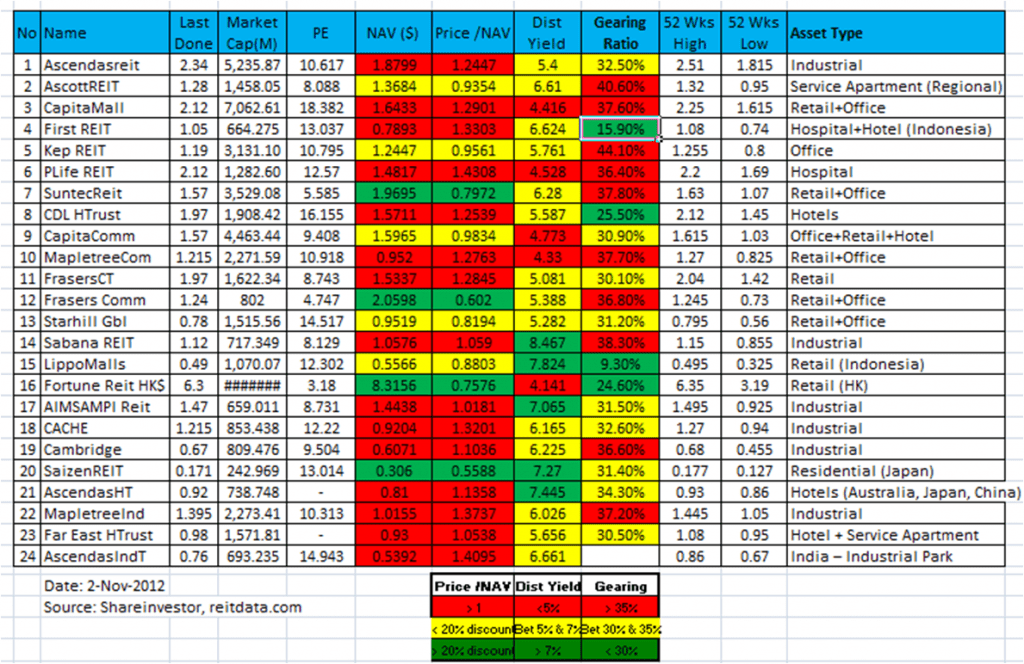

Latest Comparison table for Singapore REIT in terms of Market Cap, PE ratio, NAV, Gearing Ratio, Distribution Yield and Asset Type.

Added Ascendas India Trust

Last comparison table of Singapore REITs.

Some readers requested me to conduct class to teach how to select a right REIT for dividend investing and explain the terminology of financial ratio of the above table. Please check out the class detail on REIT investing by clicking HERE (REIT Investing Class).

Fantastic

Hi … I am a newbie here. I would like ask if you can share what the steps you will do to choose a REITS ? Will you see the PE first, or Price/NAV, or Yield first, and what next after that ?

Tommy,

It is very much depends on your investing objective, investing strategy, your holding period and your risk appetite before deciding what numbers you need to look at. I can’t tell you exactly what are the steps because I combine all the analysis (Financial Ratio, Risk Assessment, WALE, Debt Profile, sustainabilty of DPU, Tenant Mix, Growth Strategy, Type of property, economic condition, currency risk, policy risk, chart pattern, stock price trend, etc) before I make any investment decision.

Marubozu

Hi Marubozu,

How do you compute/arrive at the distribution yield numbers on the table? The numbers seem higher if compared against those published on trading platform (e.g. DBS Vickers). Thank you in advance!

Regards

Hi Alex,

I got those numbers from shareinvestor. There are a few possibilities of the difference:

(1) Distribution yield is computed base on rolling 4 quarters or financial year.

(2) The time difference. You can getting the live data but my comparison table is dated.

regards

Marubozu

Hi, I too invest in reits for passive income. Your table of reits comparison is indeed very useful. You are right, never before have so many singapore reits been traded above their NAV.

I notice that the NAV for Fraser Comm is stated at S$2.06. Is there a typo error?

Regards,

CS

CS,

Thanks for pointing out. The NAV given in Shareinvestor is $2.06. I did a check on Bloomberg, Reuters and reitdata.com and the NAV is $1.50. So, just use the more conservative number for calculation and Price / NAV is 0.81.

regards

Marubozu