With Markets Falling, It Pays To Stay In Singapore

Sophie Davidson

Last year, financial markets around the globe witnessed a number of setbacks. China devalued its currency, the S&P 500 suffered its first correction in 4 years, the price of oil kept dropping, and the Dow plunged more than 1,000 points in just one day. However, it wasn’t all bad news in 2015.

Investors that favoured leveraged products such as CFD (what is CFD trading explained) could make their capital go a lot further. What’s more, ongoing speculation about US and UK interest rates coupled with Eurozone uncertainty meant forex was another attraction option.

But for citizens of Singapore, there was no need to seek out lucrative investment opportunities or gamble on future possibilities, as our own mandatory retirement savings plan continued to deliver commendable returns.

The strength of the CPF

Although a lot depended on the nature of members’ balances, Singapore’s Central Provident Fund (CPF) delivered its usual 2.5 to 5 per cent payouts in 2015. This was despite the poor performance of other indexes and markets.

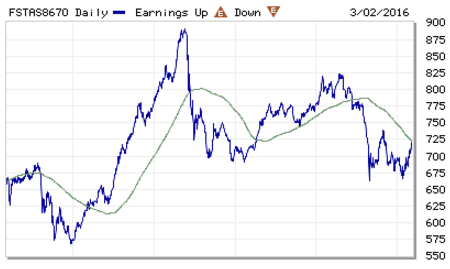

Within the space of 12 months, the Singapore Straits Times Index was subject to a near 15 per cent drop, while the country’s private resident property prices fell 0.9 per cent in Q2 and a further 1.3 per cent in Q3.

When compared with the S&P 500, the last time the CPF did so well was during the European debt crisis of 2011. At that time, payouts were pegged to one percentage point above Singapore government securities.

Reasons for the CPF’s perennial performance

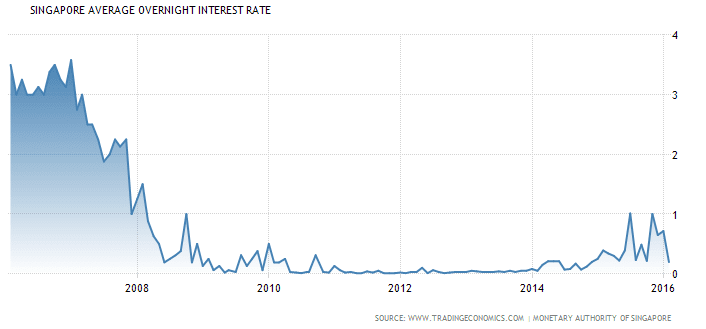

The CPF payout rate is set at the higher of the 2.5 per cent minimum or is based on the 12-month savings deposit rate at local banks. Consider years of low yields globally and this minimum rate looks very generous indeed.

Tony Nash, chief economist at Complete Intelligence and CPF account holder blamed the “cat-and-mouse game that the Fed has played with market investors” for poor global returns in 2015. He also added “expectations around higher interest rates (created) muted expectations for equity returns.”

But as with all financial investments, there is a potential downside to the CPF’s unwavering payout percentage.

The contentiousness of the CPF

The fact most workers aged 50 and below must pay in about 20 per cent of their wages to the CPF remains a spiky political issue. The government’s moves to increase the minimum age for collecting funds has also proved unpopular, while calls from the opposition to increase the interest on payouts were quite controversial too.

Compared to the US Social Security program, which is a defined-benefit plan with typically larger payouts, the CPF doesn’t always come out on top either. Even so, the program continues to deliver consistent returns amid a backdrop of economic uncertainty elsewhere.

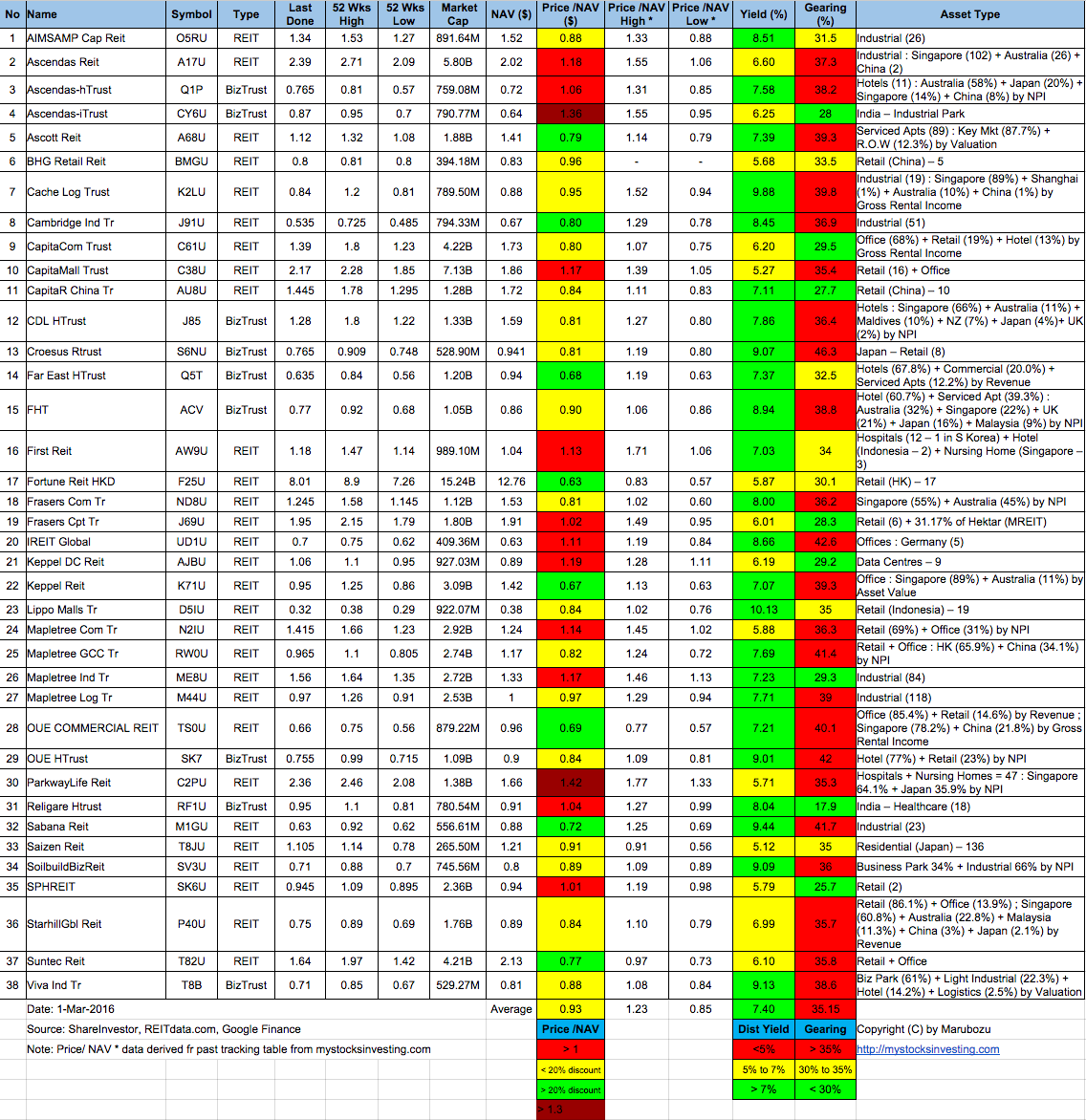

On top of that, members that took up the option to invest some of their funds in approved securities haven’t exactly fared too well. Around 45 per cent of participants posted profits equal to or less than 2.5 per cent, while around 40 per cent posted losses. Therefore, with markets falling, it pays to stay in Singapore.