S-REITs Prospects and Opportunities in 2024 (with TFC)

As interest rates rise and costs increase, Singapore REIT managers are navigating tough waters. We had the opportunity to host a panel of top industry leaders shed light on how they’re adapting – and what savvy investors need to know.

The conversation revolved around the impact of interest rates on Singapore Real Estate Investment Trusts (REITs).

SPECIAL GUEST:

Emelia Tan, Director of Research at the Singapore Exchange (SGX);

Nupur Joshi, CEO of the REIT Association of Singapore (REITAS); and

Kenny Loh, Wealth Advisory Director and REIT Specialist at REITSavvy.

With over 40 years of combined experience between them, the guests were well-positioned to offer valuable perspectives on the issues at hand. Here are some of their biggest takeaways for understanding Singapore REIT performance in the year ahead.

PANELISTS AND THEIR EXPERTISE:

Emelia Tan, known for her extensive research and market analysis at SGX Group, brought her expertise in understanding market updates and data points. Nupur Joshi, as the CEO of REITAS, provided insights from the corporate side and highlighted the association’s role in representing Singapore-listed REITs. Kenny Loh, an experienced REIT investor and advisor, offered a unique perspective as an active participant in the market.

THE IMPACT OF INTEREST RATES ON REITS:

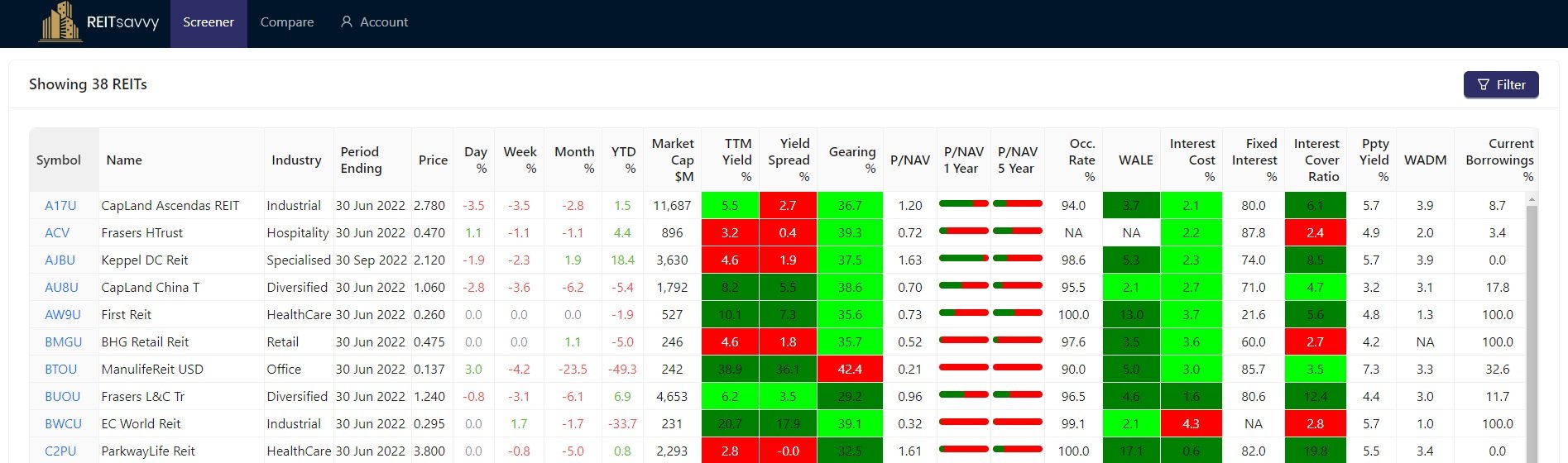

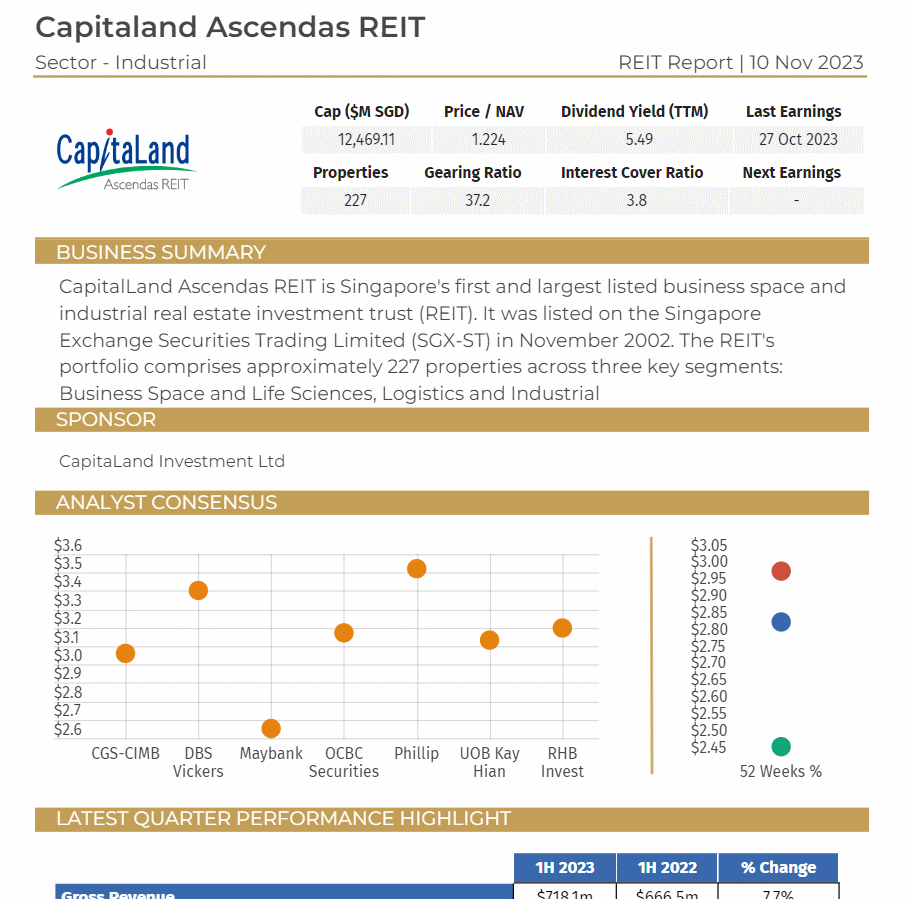

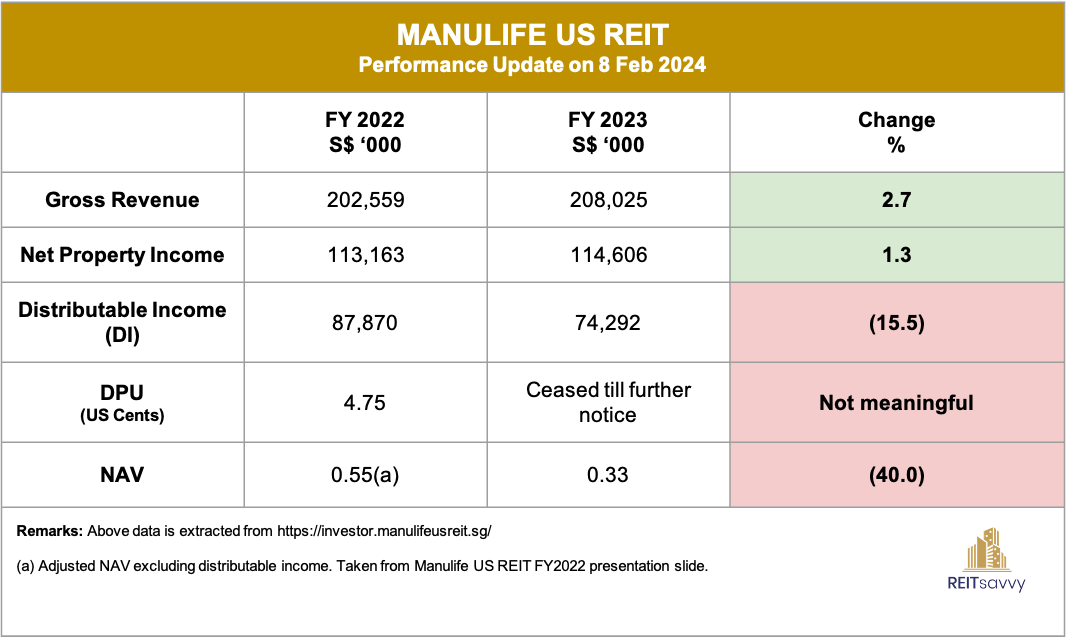

The conversation started with a focus on how interest rates affect the REIT sector. Kenny noted that the market has already absorbed the impact of interest rates, with traders closely monitoring data and correlations between US government bond yields and the REIT sector. He emphasised that the REIT sector is currently in a sideways movement, waiting for earning results and potential market triggers before a potential bull run.

MANAGING THROUGH INTEREST RATE FLUCTUATIONS:

The panel then explored how REIT managers navigate the challenges posed by interest rate fluctuations. Emelia Tan pointed out that REIT managers have to adapt to the current market environment, considering interest rates that are higher than pre-pandemic levels but expected to decline in the future. REIT managers need to reevaluate their portfolios, focusing on divestments and capital allocation strategies to fund acquisitions and asset enhancements.

As interest rates rose sharply last year, Nupur noted “the worst is behind us.” Most panelists agreed rates have likely peaked for now and may start declining. But Emelia cautioned “we are living in a higher for longer environment…capital is still expensive.”

So how are REIT managers coping? Kenny listed popular strategies: “reconstituting portfolios, redevelopment, asset enhancements.” Emelia added some are “releasing more, more, more distribution” or using rights issues to pay down debt. With rising costs in mind, Kenny said ESG initiatives around energy efficiency can help cut utilities and maintenance expenses.

Nupur emphasised the lag some may face, as many interest costs remain locked in at higher rates. But savvy investors can position themselves ahead of the anticipated rate declines. And rates aren’t the only factor – “earnings results will be a kickstart” if no surprises emerge, noted Kenny.

EXPERT OPINIONS AND STRATEGIES:

Throughout the discussion, each panellist shared valuable insights and strategies. Nupur emphasised the importance of collaboration within the REIT ecosystem, highlighting the collective voice of investors and the need for REIT managers to address issues such as corporate actions. Kenny stressed the significance of data from SGX and MLIR (Market Leasehold Interest Rate) in his analysis and portfolio building process.

OVERSEAS EXPANSION AND COMPLEX STRUCTURES

Many Singapore REITs now derive much of their income overseas. But as Reggie asked, does this increased complexity worry investors? Nupur reassured that diversification is part of maturing REIT growth plans.

Kenny weighed in on evaluative factors like targeted regions or property segments, the sponsor’s involvement, and on-the-ground management. And while debt structures can perplex, he highlighted Maple Tree Logistic Trust’s global reach as an example of necessary hedging.

The panel concurred that retail investors need not scrutinise every move. “Trust the manager – how do you trust? Track record,” advised Kenny . As long as core business fundamentals remain sound, overseas diversification should provide growth opportunities.

THE RISING IMPACT OF ESG

When Reggie playfully questioned if retail investors truly cared about ESG, the panel leapt to clarify growing alignment. Emelia noted institutional interest is rising, which will impact returns. Nupur added sustainability efforts now factor into competitive financing alternatives.

But Kenny acknowledged ESG is still nascent for many Asian investors. REIT managers, he acknowledged, must proactively showcase sustainability actions and reporting. Only then can transparency build understanding and trust over time.

For those still skeptical, get ahead of the trends or risk lagging as ESG increasingly influences flows and valuations. Progress today readies REITs and portfolios for the demanding standards of tomorrow.

In summarising the insights, Reggie brought listeners up to speed on the issues constantly evaluated by top REIT managers and experts. Whether navigating volatility, diversifying offerings, or futureproofing through sustainability, their multifaceted perspectives offer invaluable guidance for 2023.

KEY TAKEAWAYS AND MARKET OUTLOOK:

As the conversation drew to a close, the panelists discussed the market sentiment and the varying perspectives of investors. They highlighted the different groups of investors: those who act early, those who wait for news announcements, and those who follow the crowd. The panelists expressed optimism that a positive market catalyst, such as an interest rate cut or better-than-expected earnings results, could potentially trigger a bullish trend in the REIT sector.

You can check their full interview on Chills with TFC, Episode 158 on Spotify, YouTube, Google podcast or Apple podcast for a comprehensive understanding of the impact of interest rates on Singapore REITs. The insights shared by industry experts shed light on how REIT managers manage through interest rate fluctuations and adapt their strategies accordingly. As investors eagerly await market triggers, such as earning results and potential interest rate changes, the future of the Singapore REIT market holds promise.

KEY POINTS DISCUSSED:

- Interest rates and their correlation with the REIT sector.

- The market’s absorption of interest rate data and its impact on REITs.

- Strategies employed by REIT managers to navigate interest rate fluctuations.

- The importance of collaboration within the REIT ecosystem.

- The role of data in REIT analysis and portfolio building.

- Varying investor perspectives and their potential impact on the market.

- The possibility of a bullish trend in the REIT sector based on market catalysts.

If you’re still trying to make sense of REIT in a volatile market, check the pro REIT outlook with forecasts and strategies for 2024.

This post first appeared on The Financial Coconut here.

Financial Ratio Analysis for Singapore REITS (2nd March 2024, 9am to 1pm)

- Learn how to assess the financial health of Singapore REITs by analyzing key ratios

- Identifying financial strengths and weaknesses, enabling them to make informed investment decisions

- Interpret ratios and understand what are the operation factors which can affect the ratio in future

- Learn how to use valuation ratios to determine the fair value of Singapore REITs and assess their sustainability.

- Identify undervalued or overvalued REITs, aiding them in making sound investment choices.

Cost: $467 –> $373 (20% discount if you use this link!)

Venue: SGX Academy Room. 2 Shenton way

SGX Centre 1. Level 2, S068804

Laptop is required. Please bring your own laptop for the training.

For more information, check out the link below to sign up for the course.

https://www.sgxacademy.com/event/financial-ratio-analysis-for-singapore-reits/

Technical Analysis for Singapore REITS (9th March 2024, 9am to 1pm)

- Learn how to effectively use chart patterns, identify support and resistance to analyze Singapore REITs’ price movements

- Identify trends and make informed investment decisions

- Gain insights into market psychology and sentiment analysis

- Gauge the overall market sentiment and make better predictions about future price movements of Singapore REITs

- Learn how to develop and implement trading strategies based on technical analysis

Cost: $467 –> $373 (20% discount if you use this link!)

Venue: SGX Academy Room. 2 Shenton way

SGX Centre 1. Level 2, S068804

Laptop is required. Please bring your own laptop for the training

For more information, check out the link below to sign up for the course.

https://www.sgxacademy.com/event/technical-analysis-for-singapore-reits/

Kenny Loh is a Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement

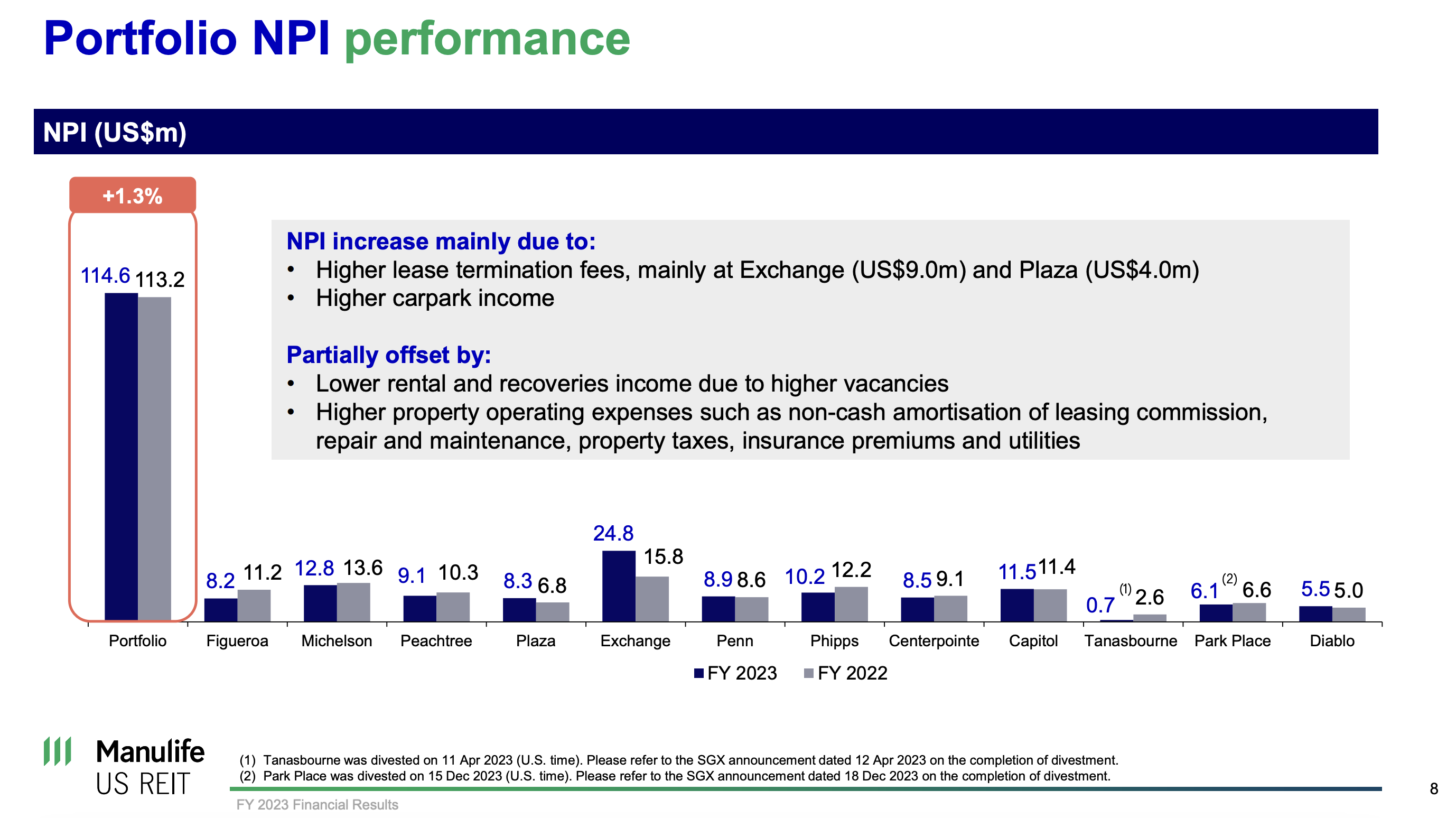

*Image from MUST REIT presentation slide

*Image from MUST REIT presentation slide

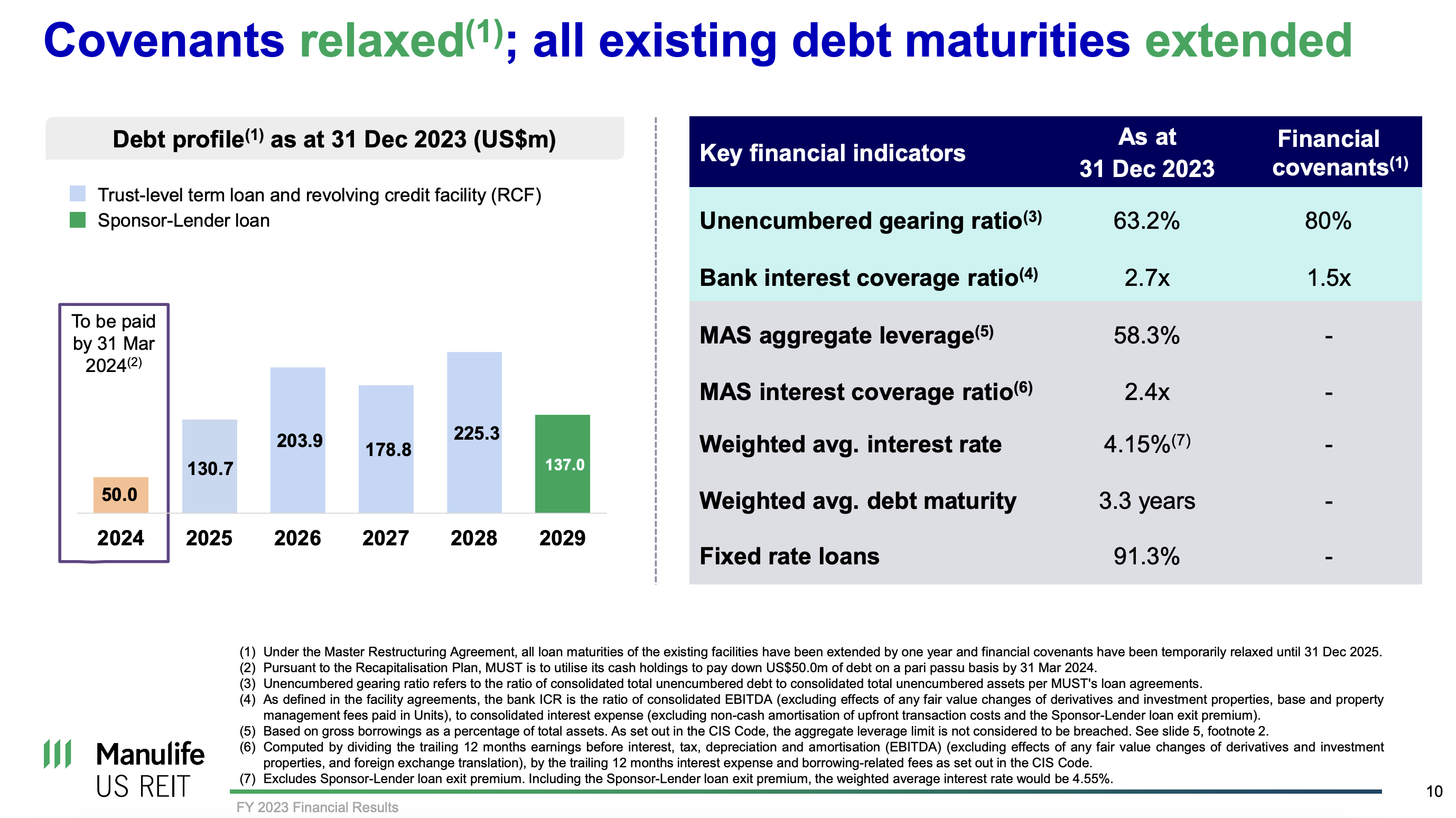

*Image from MUST presentation slide

*Image from MUST presentation slide *Image from MUST IR

*Image from MUST IR