Navigating U.S. Estate Tax on U.S. Stock Holdings: A Guide for Singapore Investors

Introduction

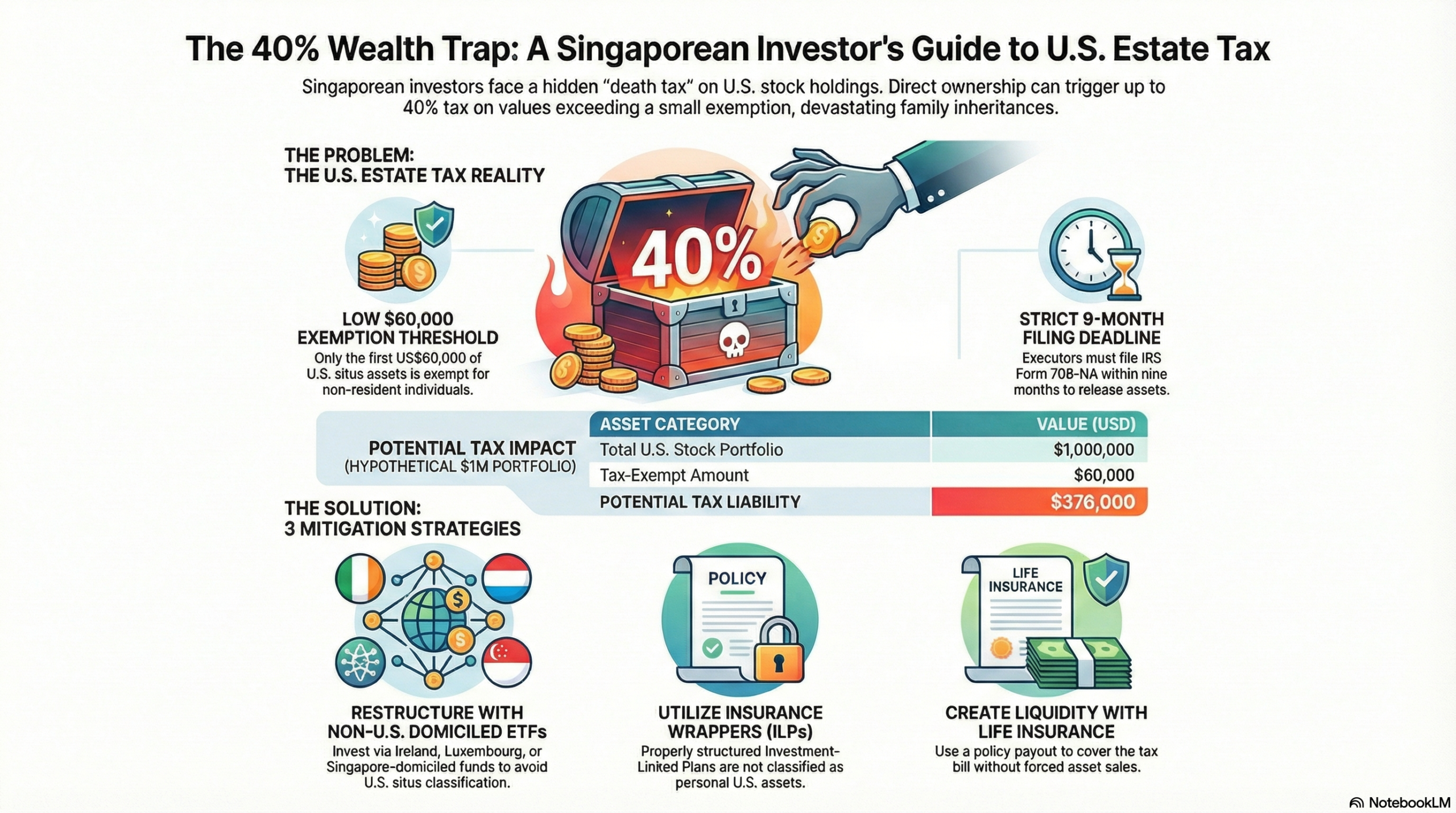

Apple, Nvidia, Tesla, Microsoft, Amazon…… many of us, especially younger investors, are drawn to these US Stocks, known for their stellar performance over the years. The S&P 500 has delivered an average annual return of 10.33% since 1957 (Investopedia). However, did you know that owning these stocks directly as a non-U.S. person (like us) can trigger a significant tax burden upon death? This tax, the U.S. estate tax, can claim up to 40% of the value of your US assets, drastically reducing the wealth passed on to your beneficiaries.

Understanding the US Estate Tax

The US estate tax applies to “US situs” assets owned by non-resident, non-citizen individuals at the time of their death. These assets include shares in companies incorporated in the US, US real estate, certain US-based bonds and mutual funds, and even cash deposits held with US brokers.

Unfortunately, the threshold for exemption is extremely low for non-US persons. Only the first US$60,000 of US situs assets is exempt from tax. Any value above that amount may be subject to estate tax, at rates that can go as high as 40%.

For example, a Singaporean investor with a portfolio of US stocks valued at US$1 million would only receive an exemption of US$60,000. The remaining US$940,000 would be subject to estate tax, potentially resulting in a tax bill of up to US$376,000!

Furthermore, the executor of the estate must file IRS Form 706-NA within nine months of the investor’s death and settle the tax liability to obtain a Federal Transfer Certificate. Without this certificate, US custodians may refuse to release or transfer the deceased’s assets to their beneficiaries.

Estate Planning Strategies to Reduce Exposure

So how can we mitigate this devastating tax burden? Here are 5 strategies that you can possibly execute to do so.

Restructuring your Portfolio

- Keep direct U.S. stock holdings below US$60,000

- Increase exposure via non-US ETFs or mutual funds that invest in U.S. markets but are domiciled in Ireland, Luxembourg, or Singapore

These instruments (unit trusts, ETFs, mutual funds etc.), despite investing in US equities, won’t be subjected to the US estate tax as they are not domiciled in the US. For Singaporeans, this could be investing in unit trusts through brokers like Phillip Securities, or ETFs listed on the Singapore Exchange (SGX).

Use an Insurance Wrapper

- Purchase investment-linked insurance plans (ILPs) that invest in US equities

- Death benefit proceeds are not classified as US situs assets if structured properly

You can involve an insurance-based investment product, such as investment-linked insurance policies (ILPs). They typically combine investment in global markets with life insurance coverage. So even if there is US stock exposure within the ILP, it should not be subject to US Estate Tax as the asset is not held by the investor personally.

However, you have to ensure that the policyholder and beneficiary structures are clear.

Set Up a Holding Company

- Hold US stocks via a non-US corporation (e.g. setting a company in Singapore)

- The company, not the individual, owns the US assets, potentially removing them from the personal estate

But! It may give rise to other tax considerations, such as capital gains tax upon sale of the company’s shares. In addition, it gives rise to additional tax complications depending on jurisdiction. Proper legal and tax advice is essential before implementing this structure.

Create a Trust Structure

- Transfer U.S. stocks into a foreign irrevocable trust

Trusts can be especially useful to pass down your wealth to future generations. However, trust creation and maintenance involve higher costs and usually require professional management, and the structure must be carefully designed to avoid triggering adverse tax consequences in other jurisdictions.

Cash Creation via Life Insurance

- Purchase a life insurance policy whose death payout covers the expected U.S. estate tax

- This ensures liquidity for your estate without forced asset sales

Lastly, you can purchase a life insurance policy with a death benefit sufficient to cover the anticipated estate tax. This ensures that the estate has enough liquidity to settle any tax due without having to sell US investments under pressure or delay asset distribution to beneficiaries.

This may be a good strategy if you already have a large US asset portfolio. However, you need to forecast accurately your estate value and tax liability. Also, unlike some of the other solutions, this still requires you to file tax with the IRS, which is not an easy procedure.

Conclusion

Many of us are either unaware or are indifferent of the complications arising from this US Estate Tax. But it can take away a significant portion of your wealth (up to 40%!) that you can transfer to your future generations. Therefore, it is crucial to mitigate these effects in order to preserve your wealth for your future generations. Failing to plan is planning to fail! Also, to quote:

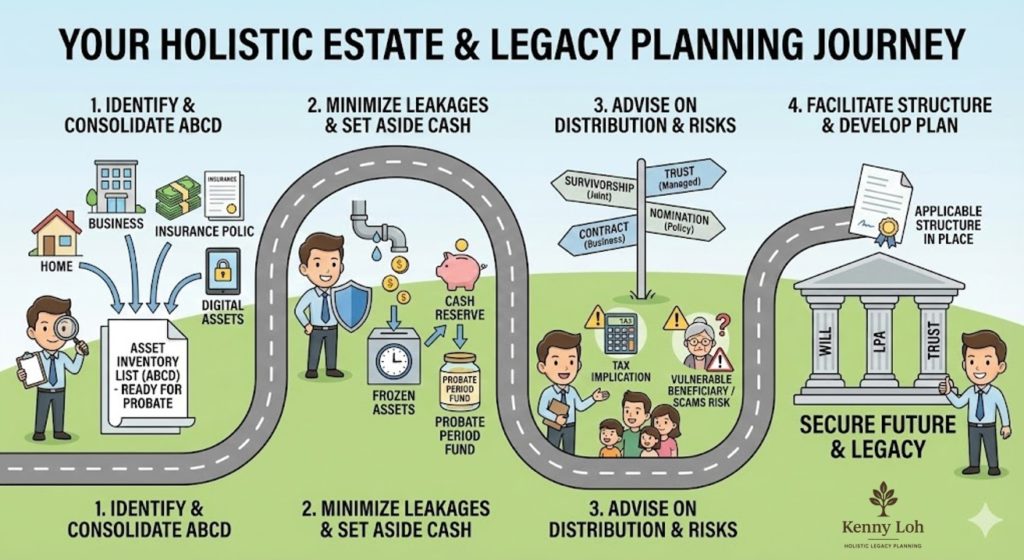

Kenny Loh is a seasoned Wealth Advisory Director with deep expertise in comprehensive investment planning and estate management. He is dedicated to helping clients strategically grow their investment capital, generate sustainable passive income for retirement, and seamlessly transition wealth to future generations. Through meticulous asset structuring, he ensures tax-efficient portfolio transfers, allowing beneficiaries to benefit from tax-free capital appreciation while optimizing long-term financial security. With a professional approach and a wealth of experience, Kenny empowers clients to preserve and enhance their legacies with confidence.

Arrange for a non-obligatory one-to-one free consultation here!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.