The Current State of Manulife US REIT: FY 2023 Report Update

- Post author:Marubozu

- Post published:February 17, 2024

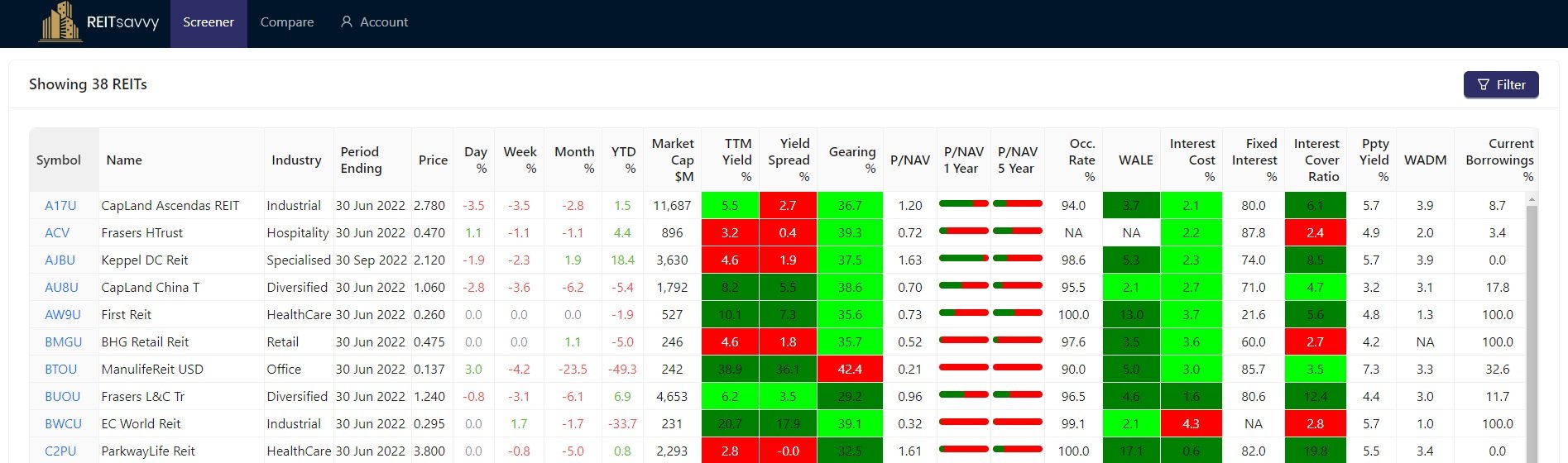

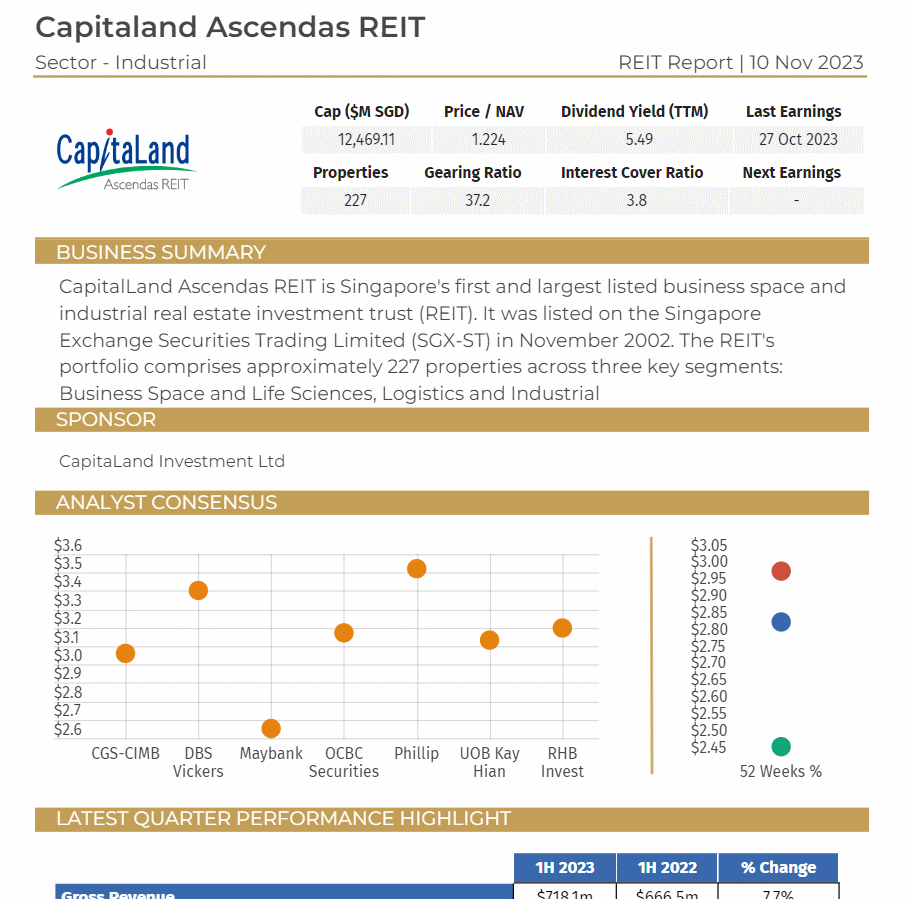

This article first appeared on REITsavvy, my new website featuring my own REITs screener.

MANULIFE US REIT unveiled its FY2023 financial results on February 8, 2024. The REITsavvy team made a visit to MUST to attend the live briefing session and met with the management team. Here are key highlights that investors should know of.

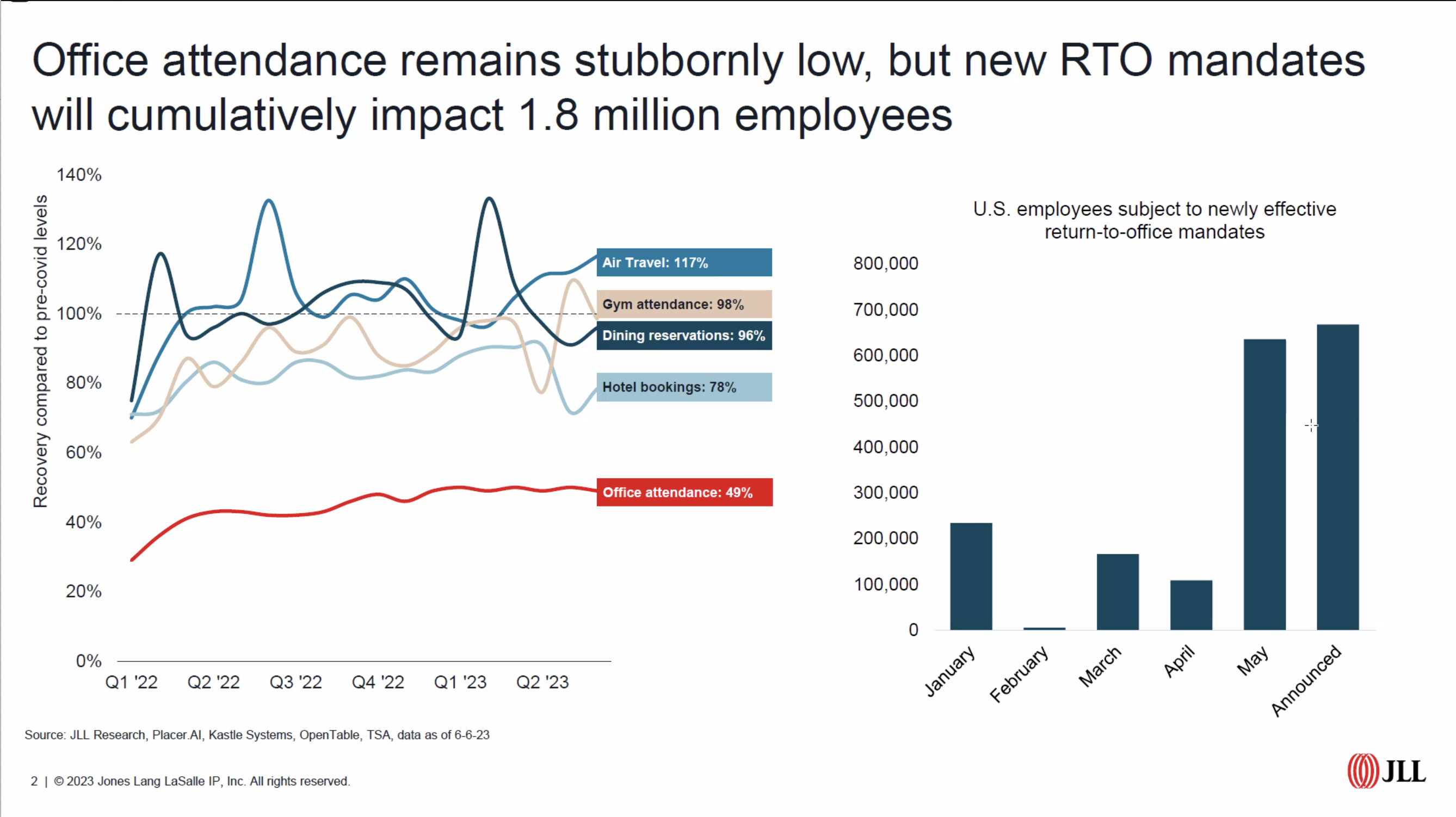

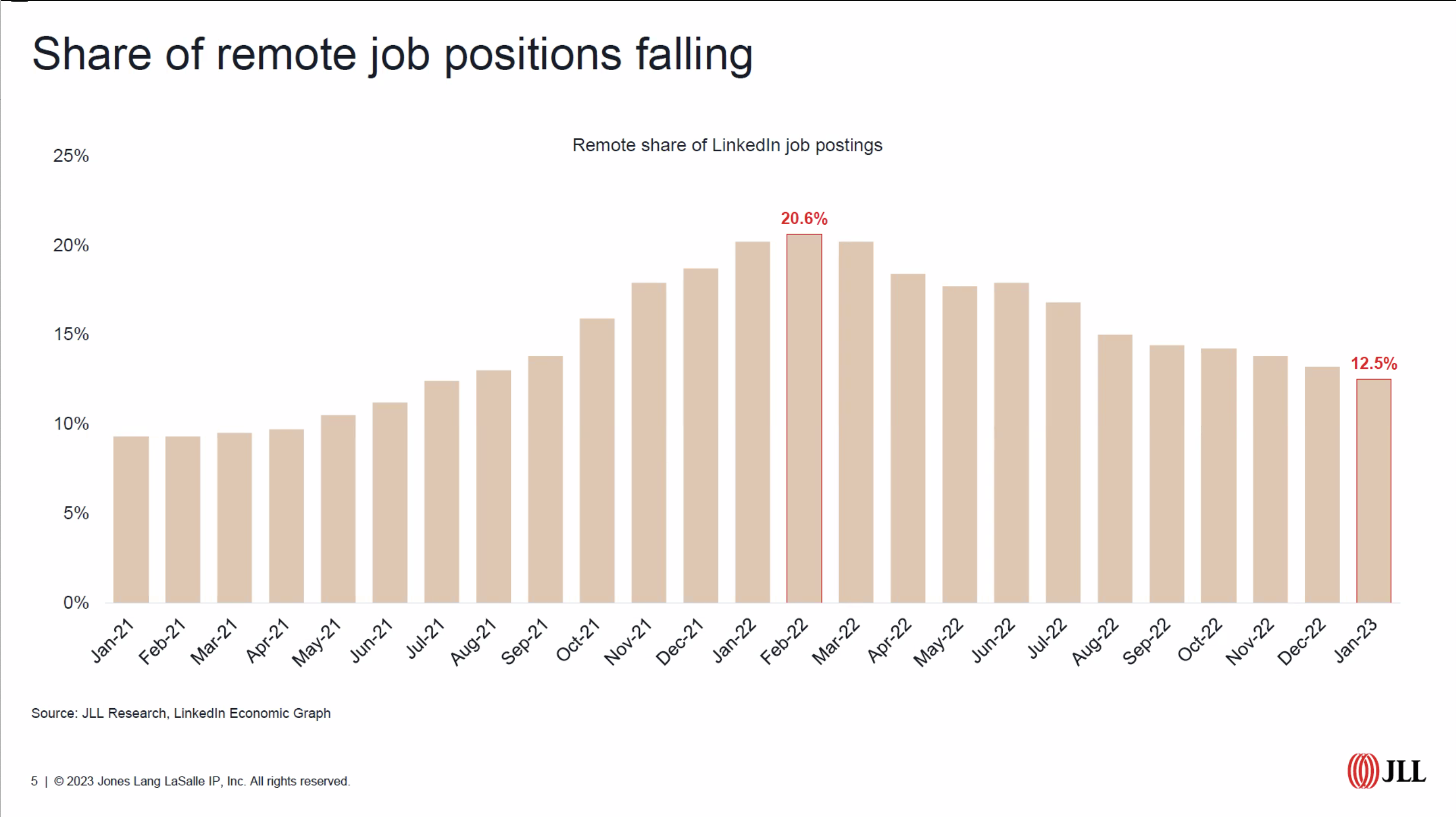

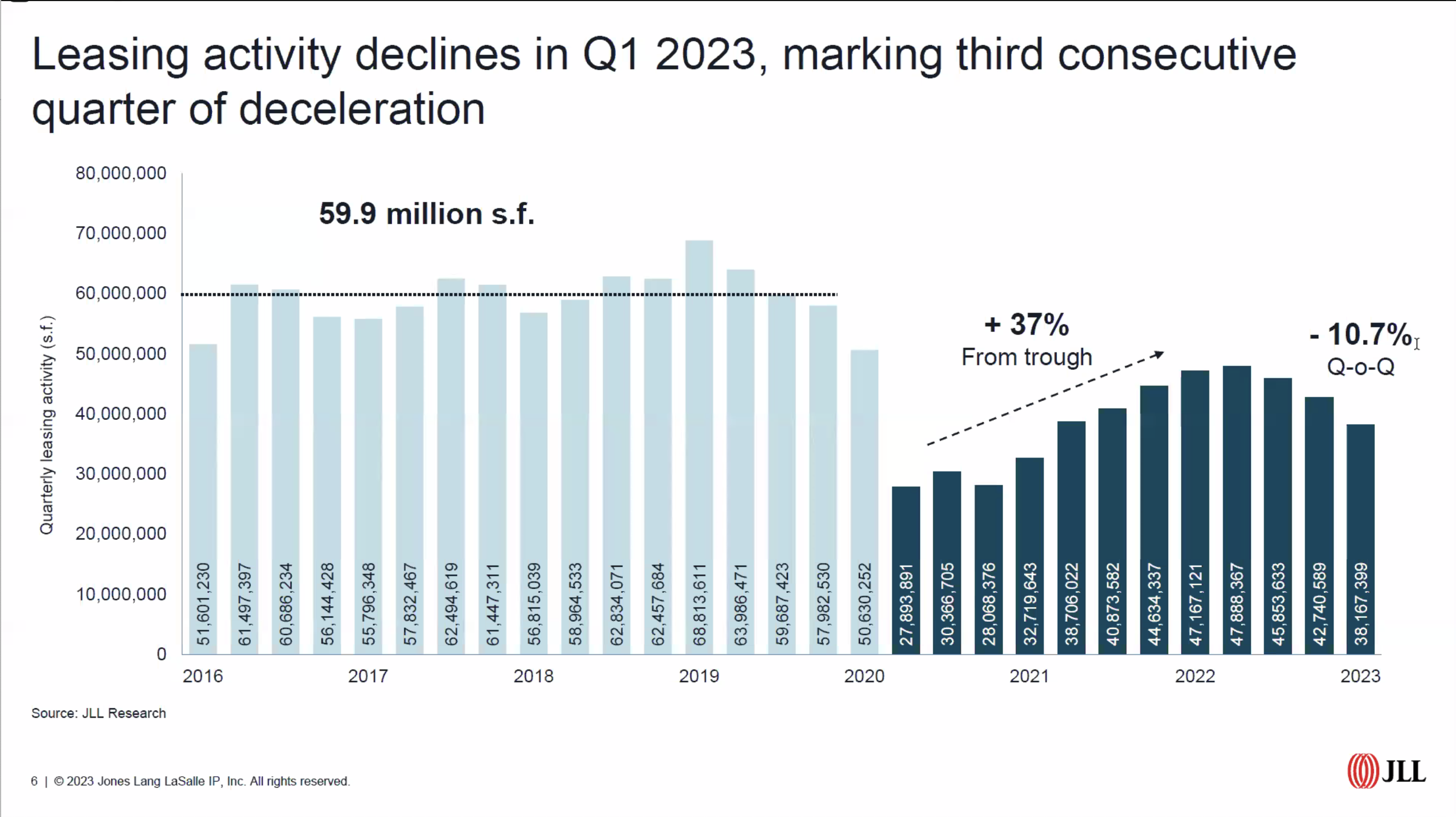

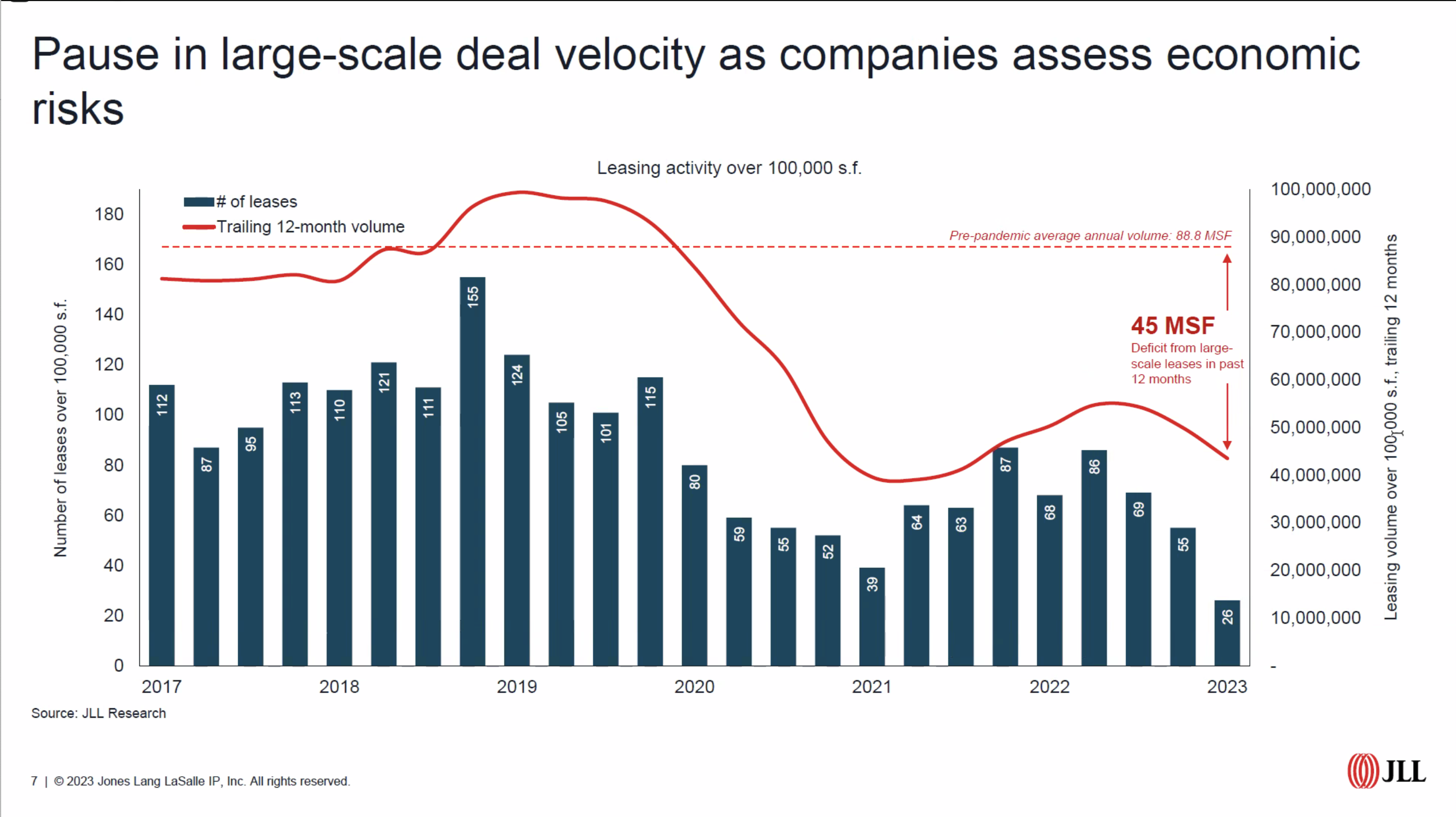

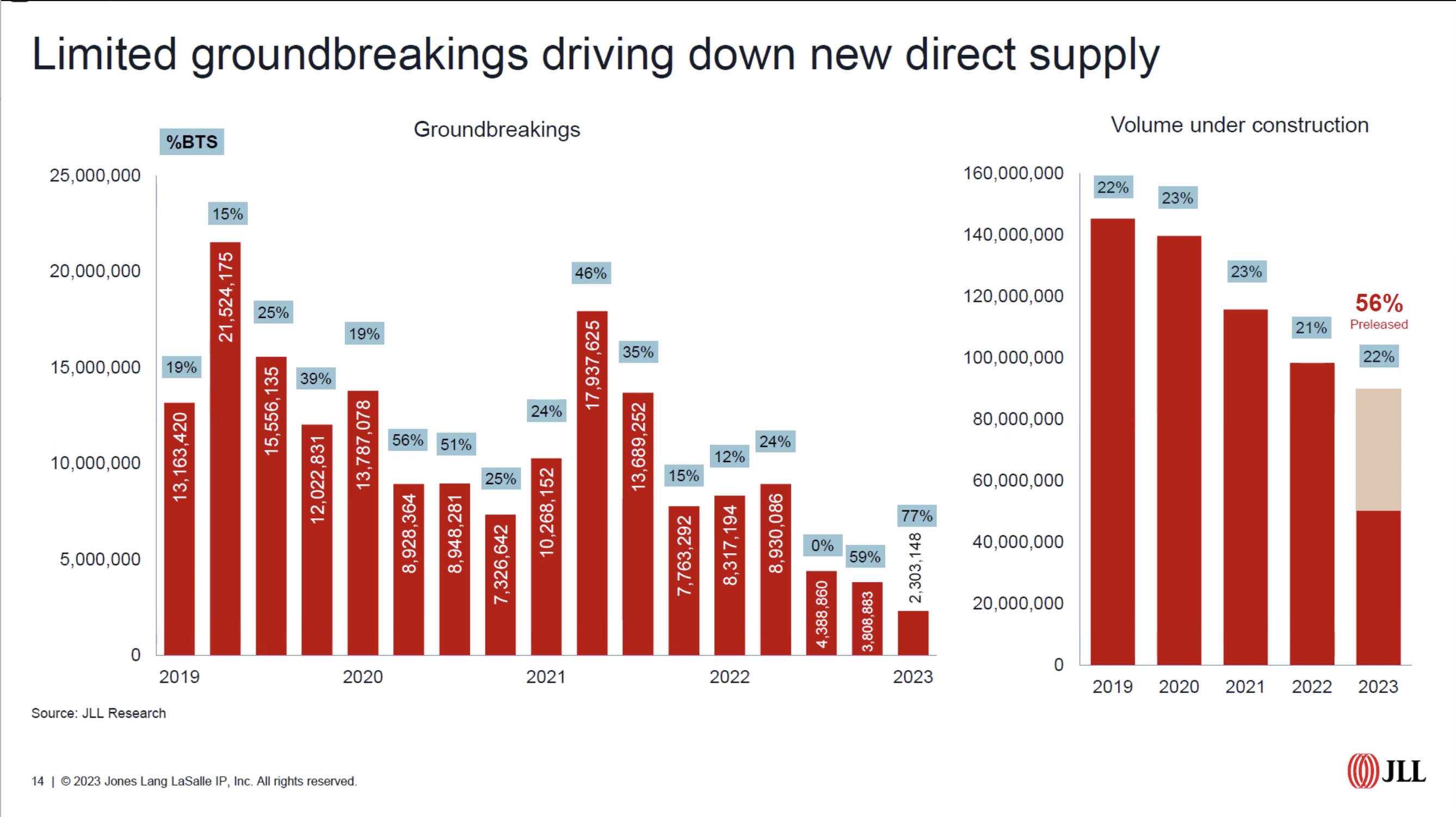

*Image from MUST REIT presentation slide

*Image from MUST REIT presentation slide

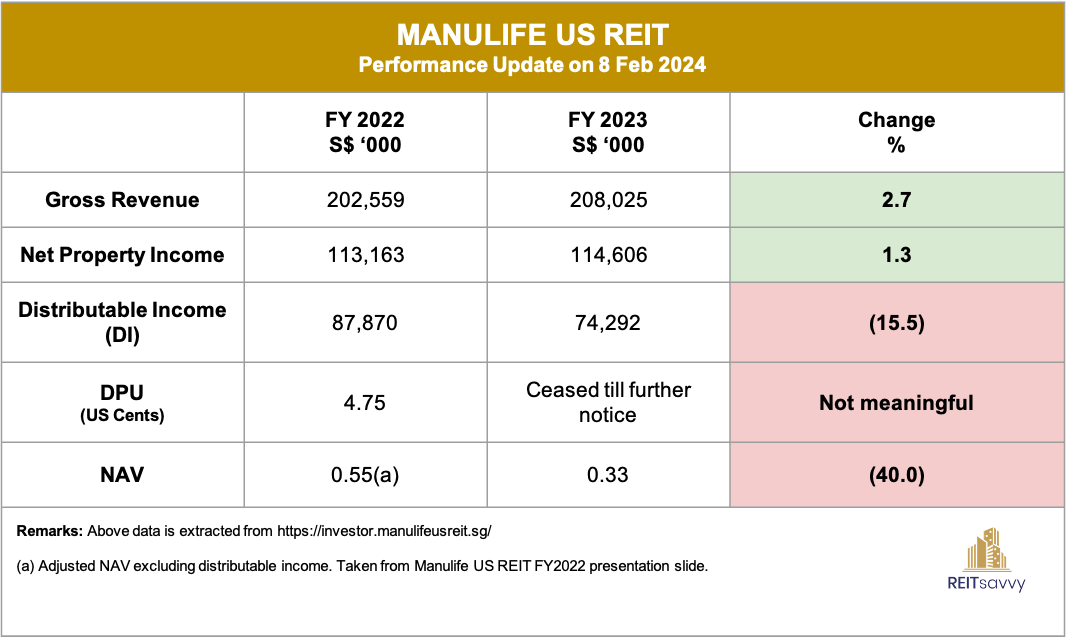

Quick Glance

In the fiscal year 2023, MANULIFE US REIT demonstrated growth with a 2.7% increase in gross revenue and a slight uptick of 1.3% in Net Property Income (NPI). It’s heartening to witness these improvements despite the REIT experiencing distress.

However, there was a notable decline of 15.5% in Distribution Income for MUST, attributable to several factors: Decreased rental and recoveries income due to higher vacancies and increased property expenses.

Elevated finance costs due to rising interest rates and loss of income from the divestment of Tanasbourne in April 2023 and Park Place in December 2023.

Nevertheless, there were some positive contributions from: Increased lease termination fees. Higher carpark income.

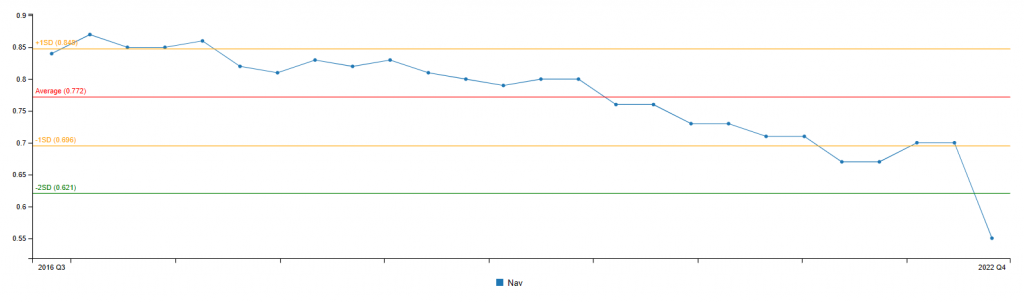

Comparing year-over-year Net Asset Value (NAV), there was a significant 40% drop, influenced by factors such as property revaluation and property divestment to name a few.

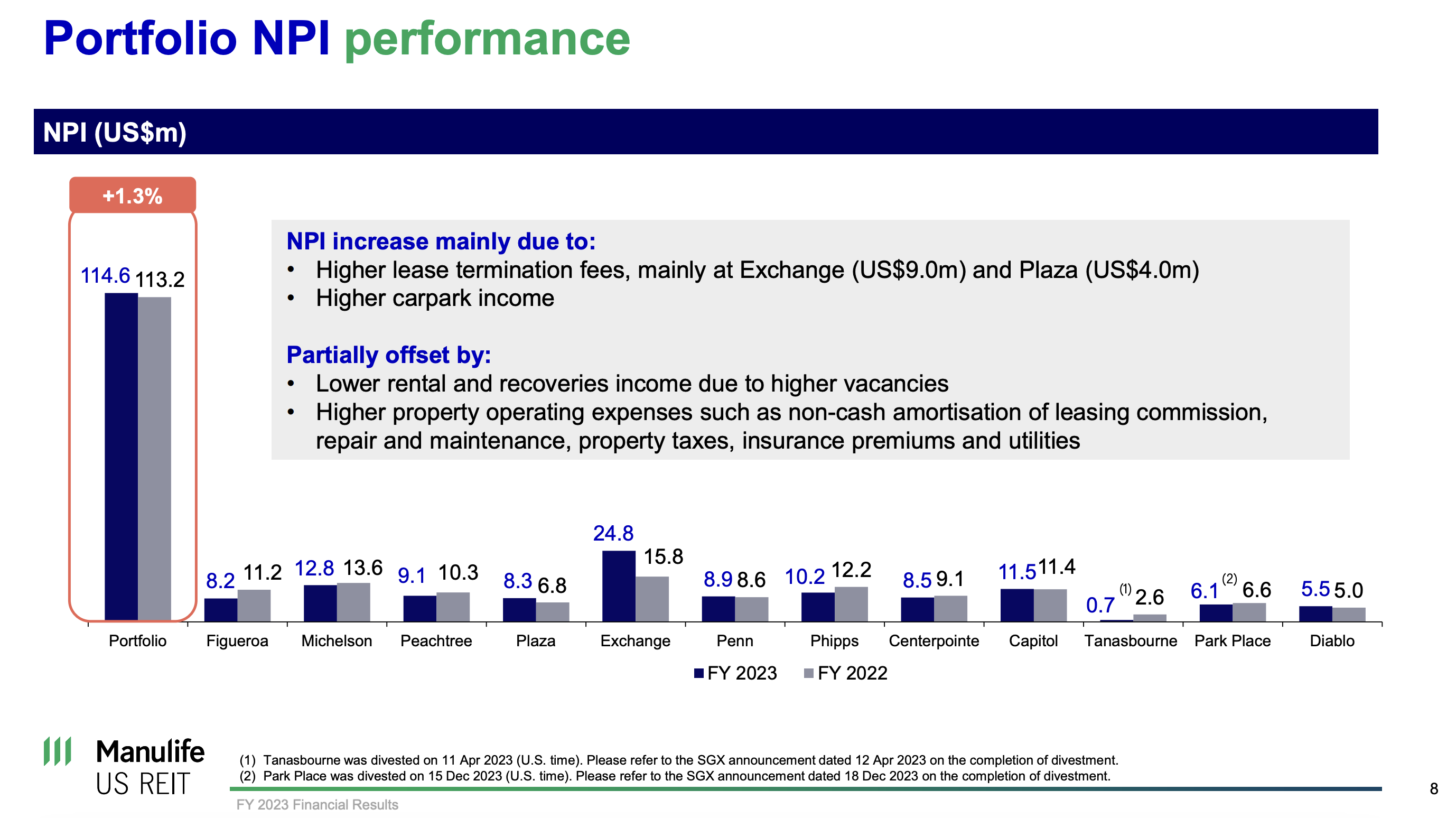

Highlight 1 – Higher NPI?

How can the Net Property Income (NPI) increase by 1.3% year-over-year despite higher operating expenses, increased interest costs, lower rental income, and higher vacancy rates?

The boost in NPI stems primarily from a one-time influx of termination fees, notably from Exchange contributing approximately US$9.0 million and Plaza with around US$4.0 million.

Without these additional termination fee inflows from the two properties, the overall NPI would have decreased to ~US$101 million, resulting in a negative growth of approximately ~10.78% instead.

*Image from MUST presentation slide

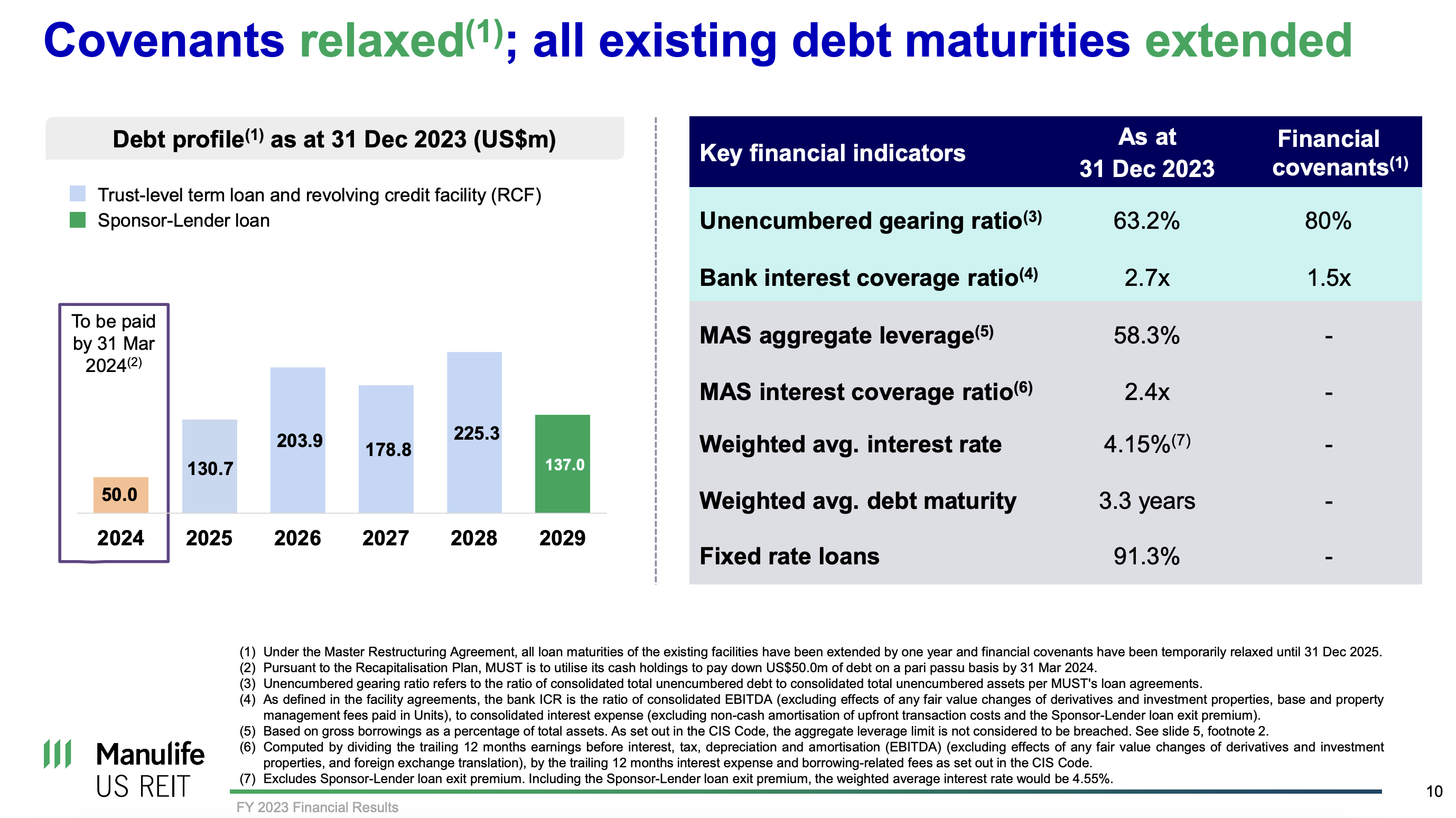

Highlight 2 – Debt Profile & MAS Leverage concern?

Debt Situation

Regarding its debt, there’s no need for refinancing in 2024. Additionally, MUST plans to utilize its cash reserves to pay off the US$50.0 million of debt by March 31, 2024, shown in the diagram.

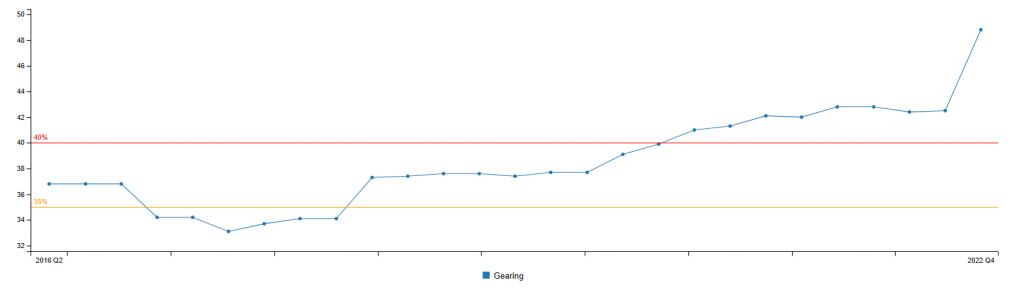

MAS Aggregate Leverage

At first glance, the aggregate leverage appears to exceed the limit imposed by MAS. However, MUST asserts that it’s not in violation but is restricted from taking on more debt.

MUST:

“According to the Monetary Authority of Singapore’s (MAS) Property Funds Appendix, the aggregate leverage limit is not considered to be breached if exceeding the limit is due to a decline in portfolio valuation, which is beyond the Manager’s control. However, the Manager will not be able to incur additional indebtedness and will have to fund capex, tenant improvement allowance and leasing costs with available cash, cash from operations and any disposition proceeds.”

As of now, everything appears to be in order.

*Image from MUST presentation slide

*Image from MUST presentation slide

Highlight 3 – Management

At present, MUST continues to face challenges and encounters several new obstacles that must be overcome. There remains a considerable amount of work ahead to ensure progress in the right direction.

Despite the demanding journey thus far and the challenges ahead, the management has maintained transparency in its progress and actively communicates with its stakeholders.

This proactive approach is crucial during times of crisis, as it demonstrates the commitment of the leadership and team to address issues head-on and provide updates on execution strategies. Such active engagement provides some confidence to investors in these times.

*Image from MUST IR

*Image from MUST IR

Conclusion

MUST is currently undergoing restructuring, a process that demands time and patience. Given the dynamic nature of the market, unforeseen challenges may arise beyond the REIT control.

However, what can be controlled is the transparency of the management team, actively overseeing the portfolio and finances to minimize or eliminate avoidable missteps.

In such circumstances, success isn’t about timing the market but rather about time in the market. With robust support from strong backers, there’s a greater likelihood of not only surviving but emerging stronger from the valuable lessons learned.

We are pleased to have had the opportunity to engage in a face-to-face discussion with Tripp Gantt, the CEO of MANULIFE US REIT and his team.

Courses: Financial Ratio Analysis and Technical Analysis for REITs with SGX Academy

Financial Ratio Analysis for Singapore REITS (2nd March 2024, 9am to 1pm)

- Learn how to assess the financial health of Singapore REITs by analyzing key ratios

- Identifying financial strengths and weaknesses, enabling them to make informed investment decisions

- Interpret ratios and understand what are the operation factors which can affect the ratio in future

- Learn how to use valuation ratios to determine the fair value of Singapore REITs and assess their sustainability.

- Identify undervalued or overvalued REITs, aiding them in making sound investment choices.

Cost: $467 –> $373 (20% discount if you use this link!)

Venue: SGX Academy Room. 2 Shenton way

SGX Centre 1. Level 2, S068804

Laptop is required. Please bring your own laptop for the training.

For more information, check out the link below to sign up for the course.

https://www.sgxacademy.com/event/financial-ratio-analysis-for-singapore-reits/

Technical Analysis for Singapore REITS (9th March 2024, 9am to 1pm)

- Learn how to effectively use chart patterns, identify support and resistance to analyze Singapore REITs’ price movements

- Identify trends and make informed investment decisions

- Gain insights into market psychology and sentiment analysis

- Gauge the overall market sentiment and make better predictions about future price movements of Singapore REITs

- Learn how to develop and implement trading strategies based on technical analysis

Cost: $467 –> $373 (20% discount if you use this link!)

Venue: SGX Academy Room. 2 Shenton way

SGX Centre 1. Level 2, S068804

Laptop is required. Please bring your own laptop for the training

For more information, check out the link below to sign up for the course.

https://www.sgxacademy.com/event/technical-analysis-for-singapore-reits/

REITsavvy: Your one-stop platform for REITs educational content and screener

Kenny Loh is a Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement