Base on TTM (Trailing Twelve Months):

- Current Price = $35.96

- PE = 25.32

- Dividend Yield = 2%

- Net Earning (TTM) = 6.74% (9.5% in 2008)

- ROA (TTM) = 1.34% (Not applicable to my criteria of ROA > 10% because Financial institution generally have very low ROA)

- ROE (TTM) = % 12.5% (23.6% in 2008)

- EPS (TTM) = $1.42 ($2.33 in 2008)

Intrinsic Value Calculation (DCF Model)

- Next 10 Year Average Projected Growth Rate = 10.3%

- Discount Rate = 10% (I use 10% to factor in the USD / SGD currency risk and economy risk in US)

- Number of Shares = 1,190 million

- 2008 Free Cash Flow = $7,689 million (Operating Cash Flow minus Capital Expenditure)

- Intrinsic Value = $65.59

Intrinsic Value Calculation (Discounted EPS Model)

- Growth Rate = 10.3%

- Discount Rate = 10%

- EPS (TTM) = $1.42

- Intrinsic Value = $14.41

Intrinsic Value Calculation (PE Model)

- Fair value PE = 15, intrinsic value= $21.30 (base on EPS $1.42)

- PEG = 2.45 (Current Price is Over value!)

Stock Background

- Historical High = $65.55

- 52 Weeks High = $36.44

- 52 Weeks Low = $10.26

So, which intrinsic value to use?

I will be using the Intrinsic Value ($21.30) derived from the PE Model. My reasons:

- Although the Intrinsic Value calculated from DCF Model is $65.59, however AXP may not be going up to this price base on historical high of $65.55.

- The intrinsic value ($14.41) derived from the Discounted EPS Model may be too conservative as the 52 weeks historical low is $10.26. Unless there is another big market crash due to financial crisis, it is unlikely AXP going back to this level again.

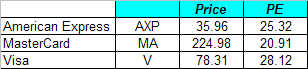

- By doing a comparison between American Express, MasterCard and Visa, the Intrinsic Value ($21.30) derived from the simple PE Model looks more realistic.

- The financial sector in generally in a very bad shape and it is safer to take a more conservative approach in valuing a financial institution. We don’t really know how many more banks are there goint to bankcrupt and how much inter-link toxic assets affecting each other. Furthermore, this is potential personal credit risks due to continous high unemployment rate in US. These credit card companies may have lot more undisclosed bad debts if the economy condition worsen.