Singapore REIT Fundamental Analysis Comparison Table – 1 June 2015

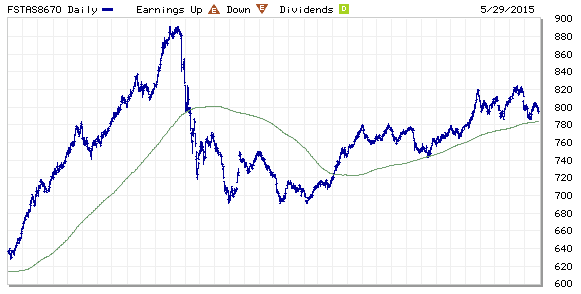

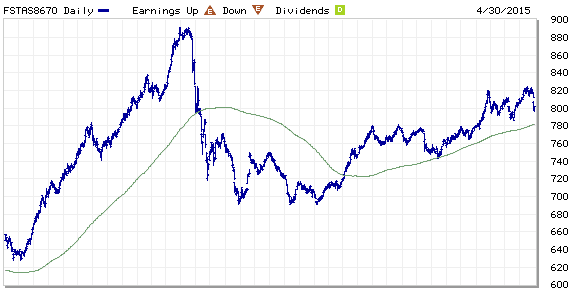

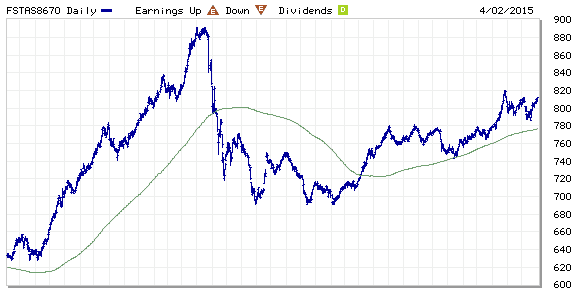

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreases from 802.45 to 795.76 compare to last post on Singapore REIT Fundamental Comparison Table on May 1, 2015. The index is continuing the uptrend and supported by the 200D SMA. However do take note that the index is trading below 20D and 50D SMA at the moment. Immediate resistance at about 800 and support at 780. Take extreme cautious that Head and Shoulder in formation with neckline at about 780. This is a trend reversal pattern.

Learn Stock Chart Pattern and Technical Analysis here.

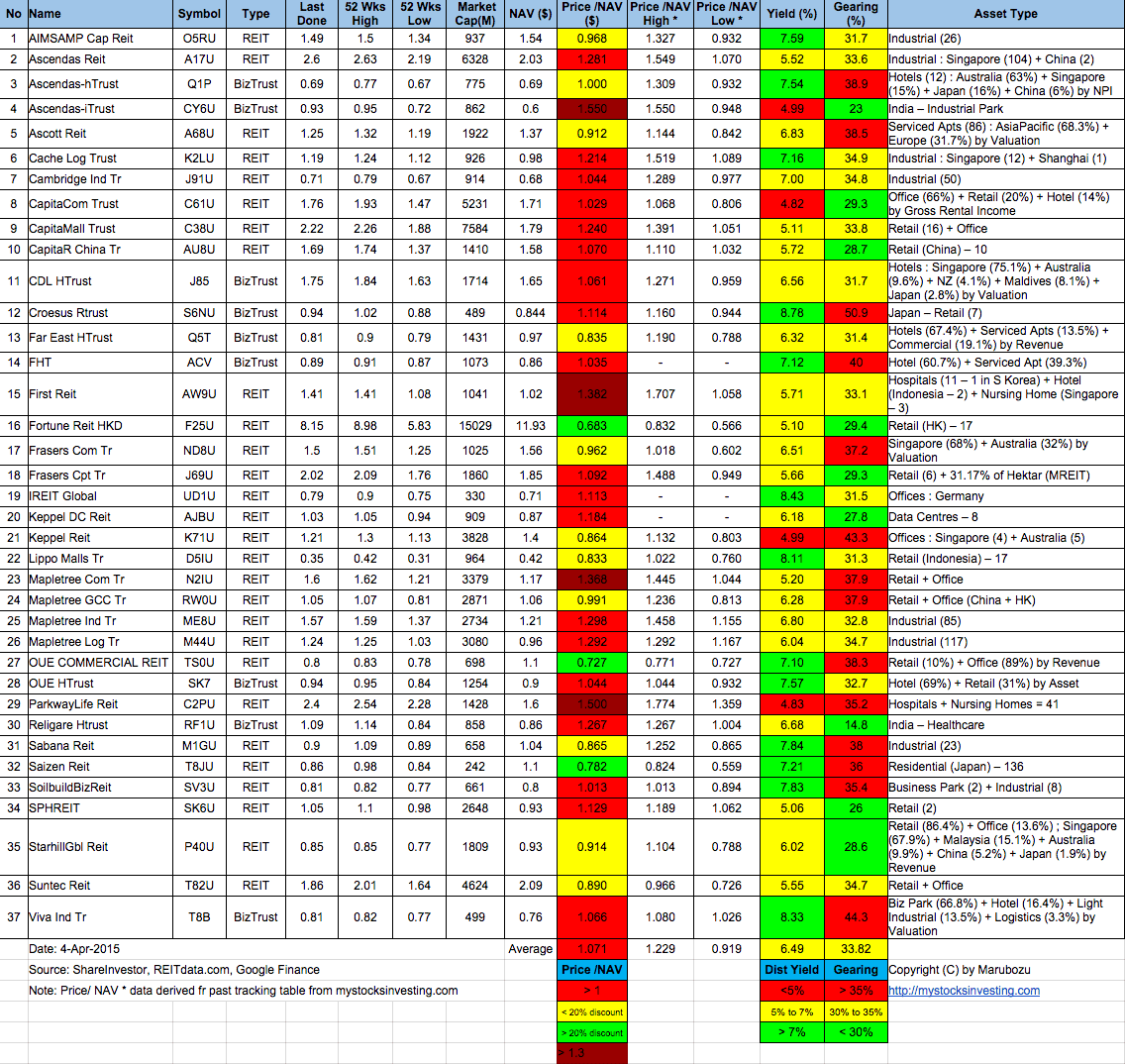

- Price/NAV decreases not much change at 1.05. (Singapore REIT in general slightly overvalue)

- Distribution Yield increases from 6.46% to 6.48%.

- Gearing Ratio increases from 33.71% to 34.08%

- Most overvalue REIT is FIRST REIT (Price/NAV = 1.44), followed by Parkway Life (Price/NAV = 1.40). Both Healthcare REIT, Defensive in nature.

- Most undervalue REIT is Fortune REIT (Price/NAV = 0.65), followed by OUE Commercial Trust (Price/NAV = 0.75).

- Higher Distribution Yield is VIVA Industrial Trust (9.13%) followed by Sabana REIT (8.4%). Note: High Distribution Yield does not mean it is safe REIT for investment. Don’t invest purely base on the Yield % because it is wrong thing to do without knowing the reasons.

- Highest Gearing Ratio is Croesus Retail Trust (50.4%) followed by VIVI Industrial Trust (43.4%)

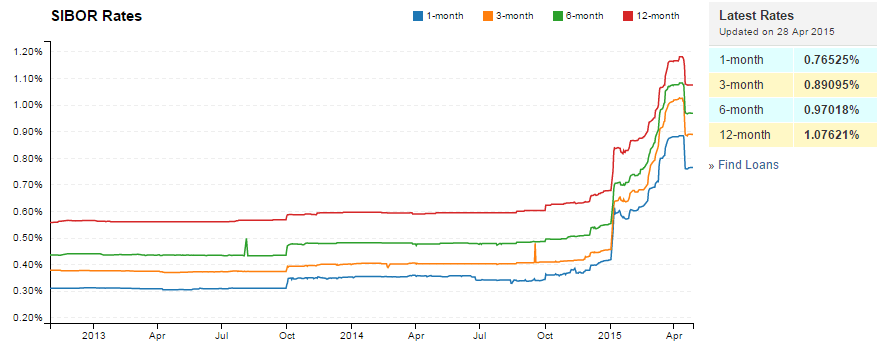

- Singapore Interest Rate reduces from 0.34% to 0.22%.

- 1 month decreases from 0.76525% to 0.70696%.

- 3 month decreases from 0.89095% to 0.82955%.

- 6 month decreases from 0.97018% to 0.88909%.

- 12 month decreases from 1.07621% to 1.01839%.

As we are entering into the month of June, all eyes are on US Federal Reserve whether they will raise the interest. The Fed will definitely increase the interest rate. The question is when? Interest hike will affect the borrowing cost, it is time for all the Investors to review your current investment portfolio and debt profile. Plan the next step before the day comes because it will affect your investment and loan monthly installment. Take initiative to evaluate your current mortgage loan and work on Refinance Plan before the mortgage loan interest shot up even further.

Fed’s Fischer sees short-term rate at 3.25%-4% in three to four years

Grab an insight of the REIT class here 3 Tips To Increasing Returns On REITs Investments

Check out the very pragmatic and educational public seminar here “Investing in Singapore REIT“.