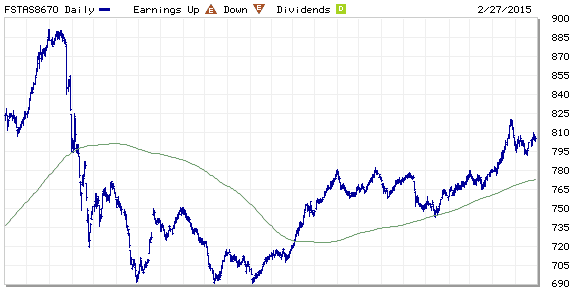

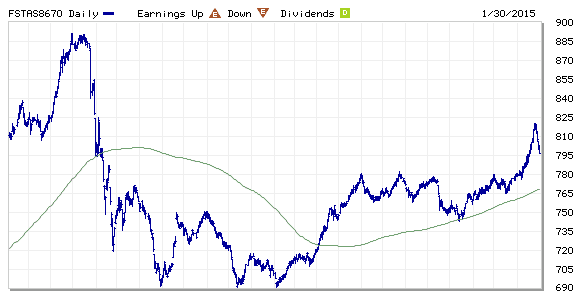

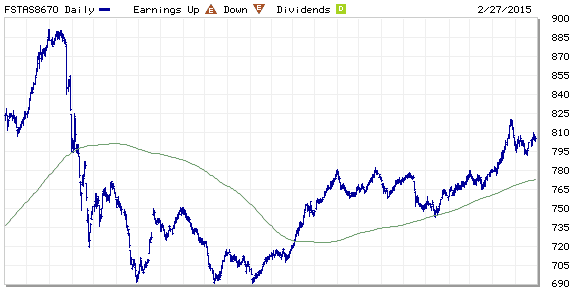

FTSE ST Real Estate Investment Trusts (FTSE ST REIT) Index increases from 796.8 to 805.26 compare to last post on Singapore REIT Fundamental Comparison Table on Feb 1, 2015. The index is continuing the uptrend after retraced to test 790-795 as support. Long term trend for Singapore REIT is bullish base on the chart pattern of this ST REIT index as the 200D SMA is trending up.

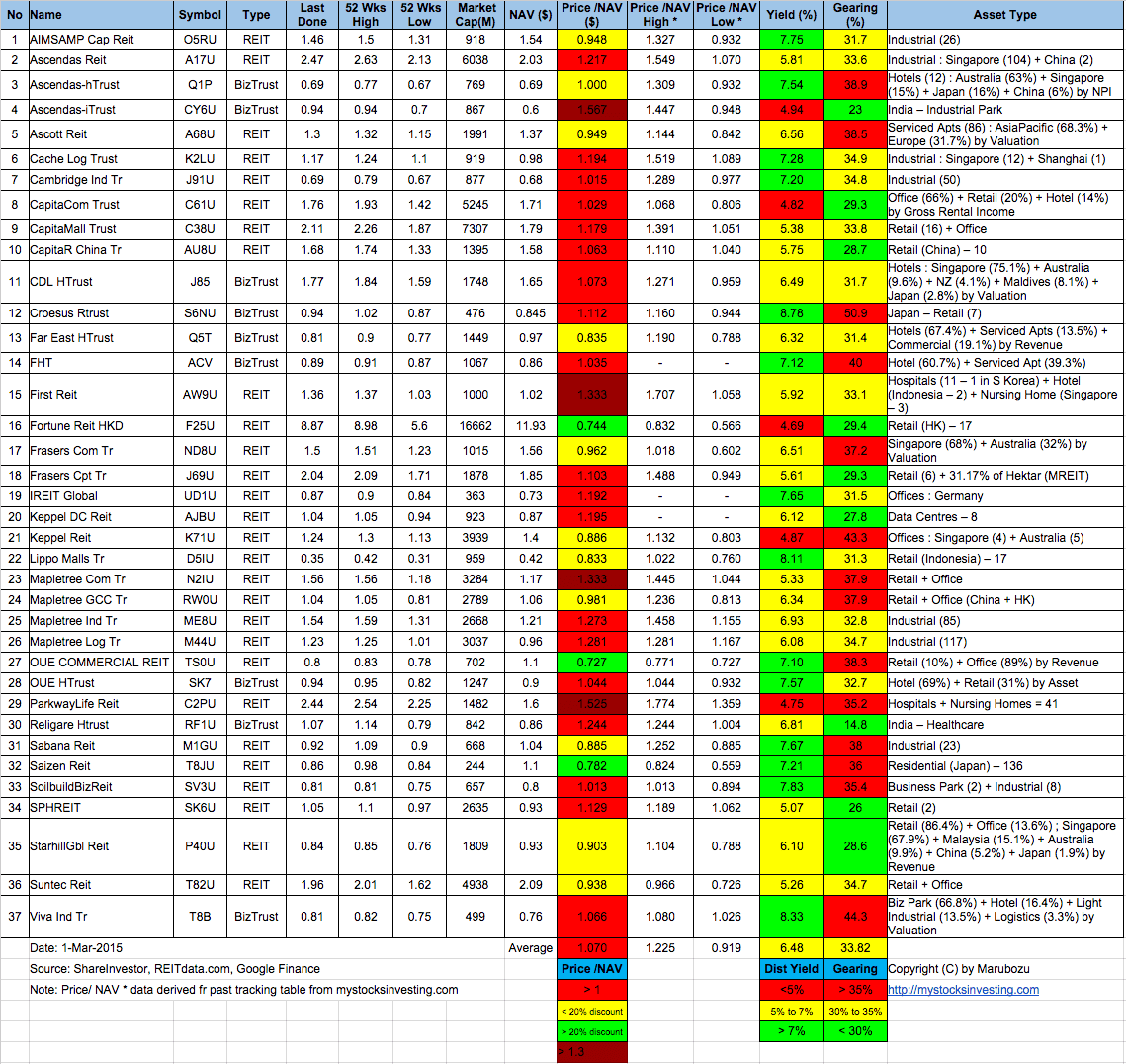

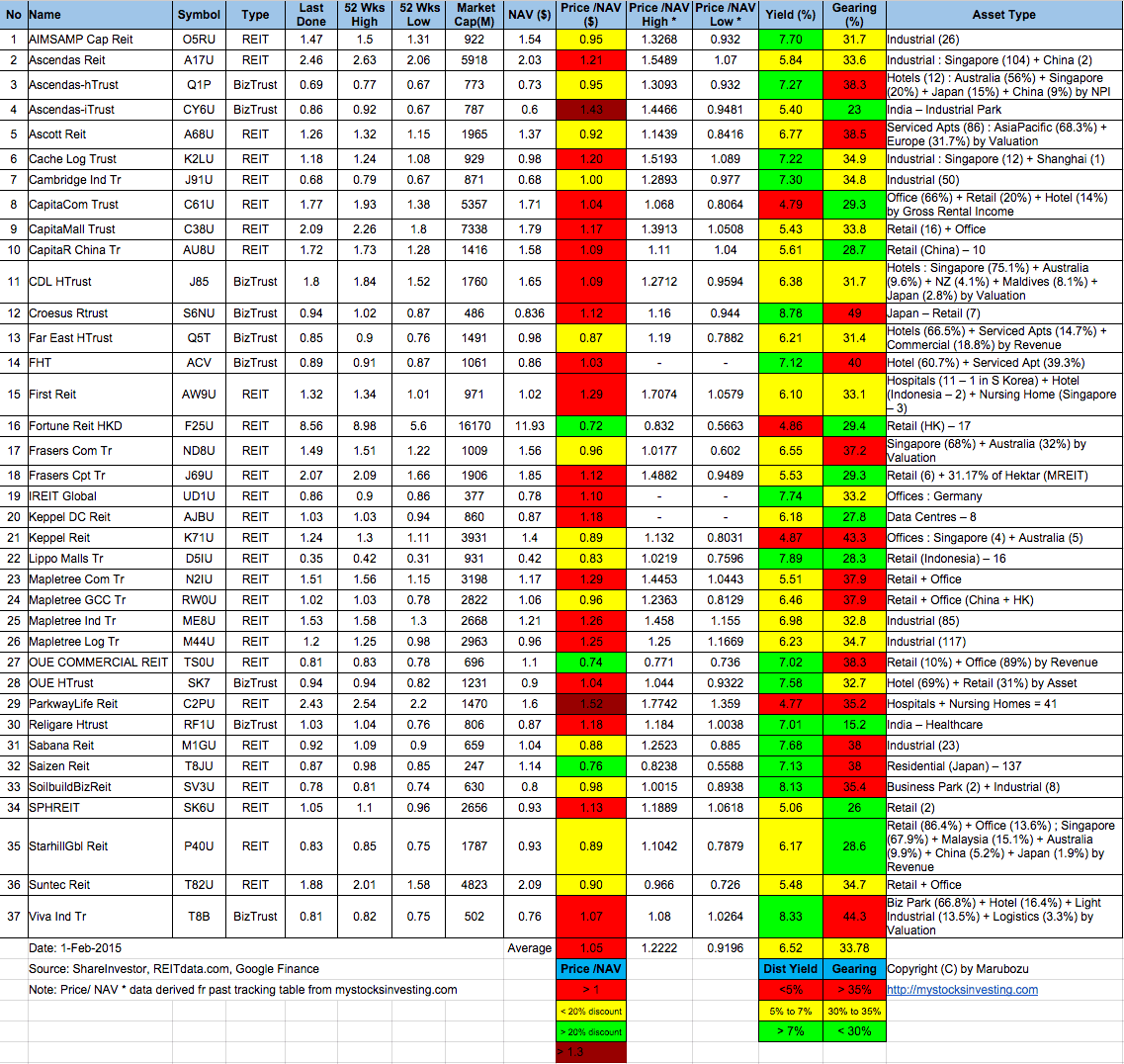

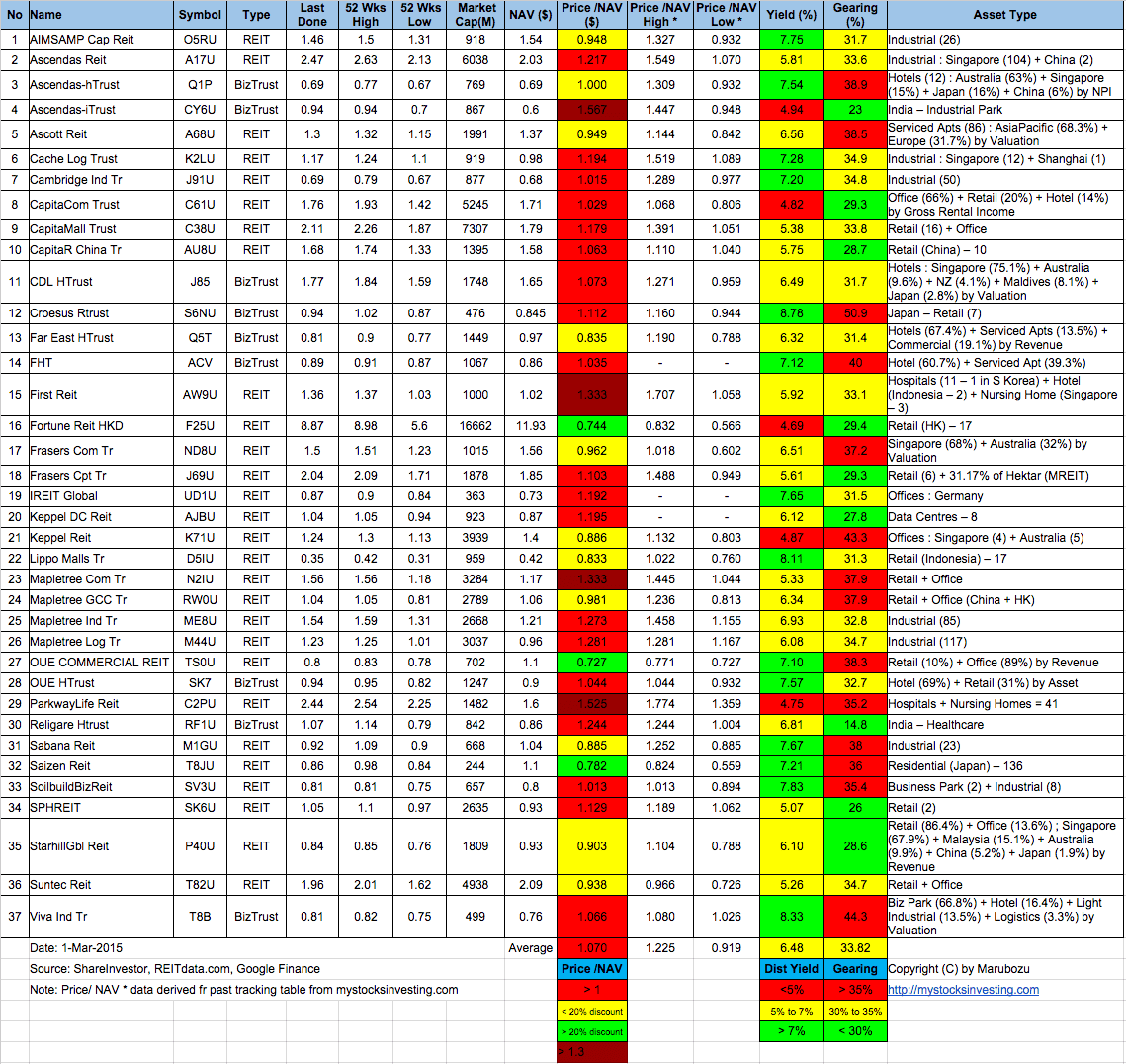

- Price/NAV slight change from 1.05 to 1.07 (slightly over value now)

- Distribution Yield decreases slightly from 6.52% to 6.48%.

- Gearing Ratio increases slightly from 33.78% to 33.82%.

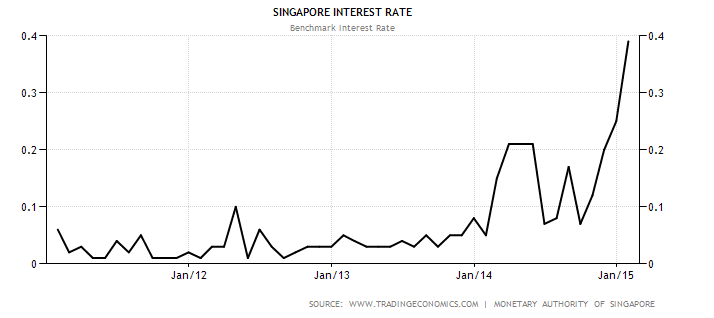

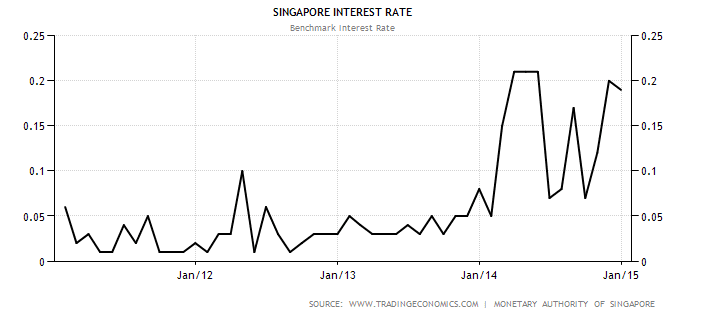

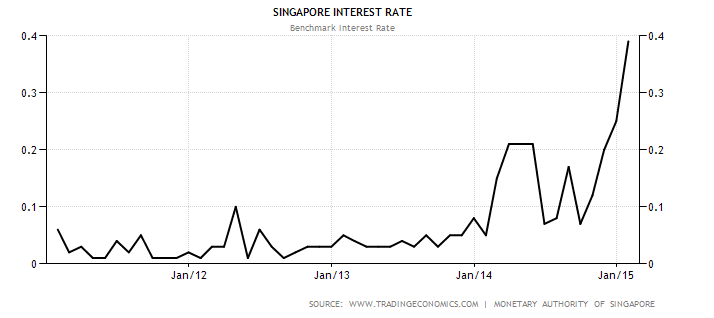

- Singapore Interest Rate spikes to 0.39% (doubled compares to last month)

- 1 month increases from 0.60302% to 0.61669%

- 3 month increases from 0.66763% to 0.68138%

- 6 month increases from 0.72915% to 0.74182%

- 12 month increases from 0.85705% to 0.87509%

Singapore Interest Rate and SIBOR continue to rise. Not a good sign for REIT which have high gearing ratio because there may be increase in borrowing cost depends on the debt expiry profile.

There are a lot of analysis on how the interest rate hike can affect the REIT performance but technically the FTSE ST REIT Index is telling a different story. So, should the investor Buy more REIT (because the chart is showing an uptrend with some REIT gives very high distribution yield) or Sell to take profit (because interest rate is going to go up)? Totally confused on what to do? I will share my analysis and my view how to invest safely in this “confusing market condition” in my coming REIT class. Check out the very pragmatic and educational public seminar here “Investing in Singapore REIT“.