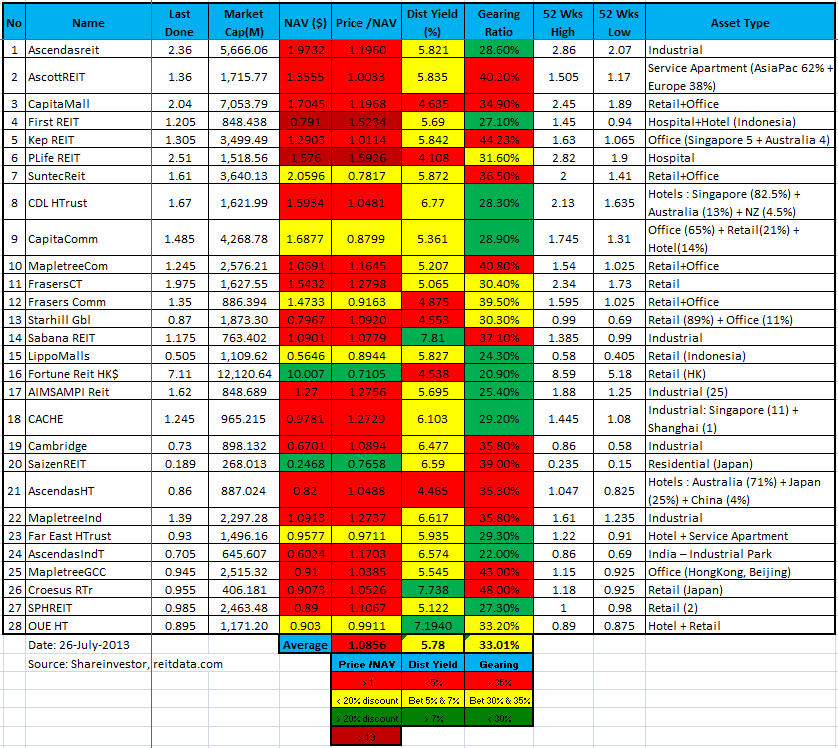

Singapore REIT Fundamental Analysis Comparison Table – 26 July 2013

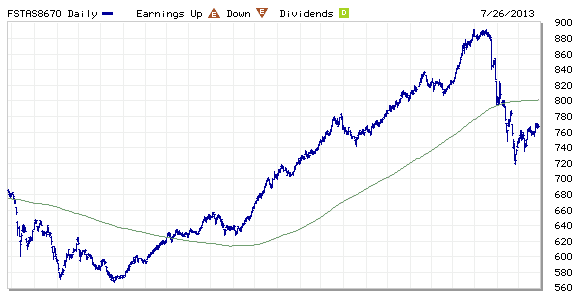

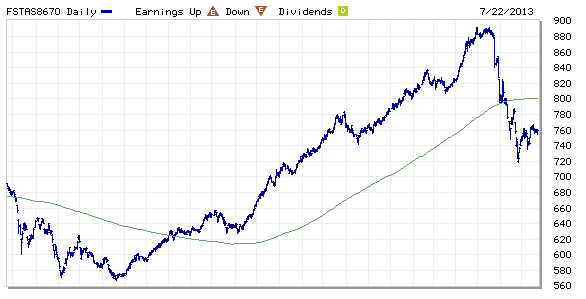

FTSE ST Real Estate Investment Trusts (FTSE ST REIT) Index rebounded to 767.53 on July 26, 2013. However the index is trading below 200D SMA and technically bearish. Resistance at about 800.

Compare to last month SREIT comparison table:

- Price/NAV decreases from 1.09 to 1.086.

- Dividend Yield decreases from 5.8% to 5.78%

- Gearing Ratio decrease from 33.27% to 33.01%.

Note: Added SPH REIT & OUE Hospitality Trust.

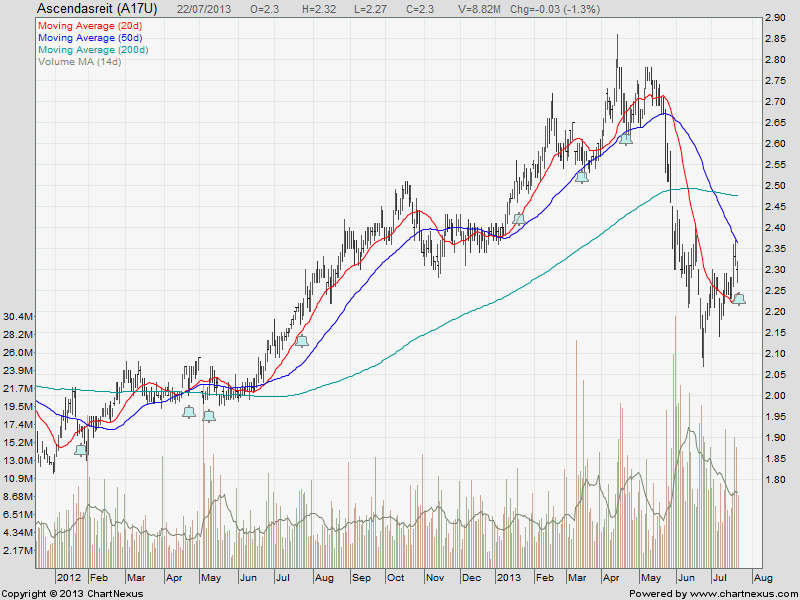

I prepare this Singapore REIT comparison one week earlier because I am preparing for the REIT class course material. If you are interested to learn how I do research on Singapore REIT and also time the entry / exit by learning the simple Trend Analysis, you may want to check out my next public tutorial “How to pick Singapore REIT for Dividend Investing” .