Singapore REIT (Hospitality Sector): Watch for turnaround play

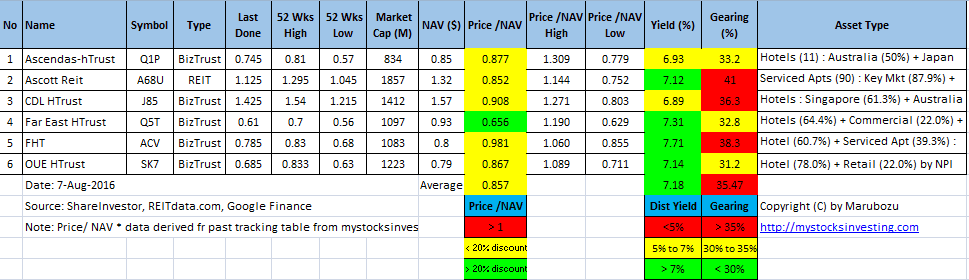

Singapore REIT (Hospitality Sector) is one of the under value sector base on Price/NAV.

The distribution yield for Far East H Trust, Ascott REIT, OUE HTrust, Frasers HT, CDL HT and Ascendas HT are all more than 6%.

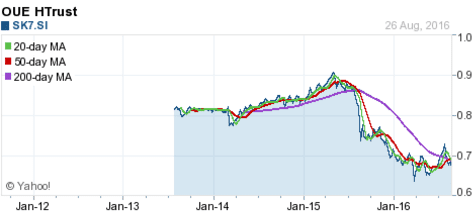

Look out for turnaround leading indicators when this sector is in rotation again which give a very good upside potential.

Bubble chart derived from April 8, 2017 Singapore REITs Fundamental Comparison Table.

Original Post from https://mystocksinvesting.com

Previous analysis on Singapore REIT Hospitality sector.

Information on “How to invest in Singapore REITs?” can be found here. https://mystocksinvesting.com/course/singapore-reits-investing/