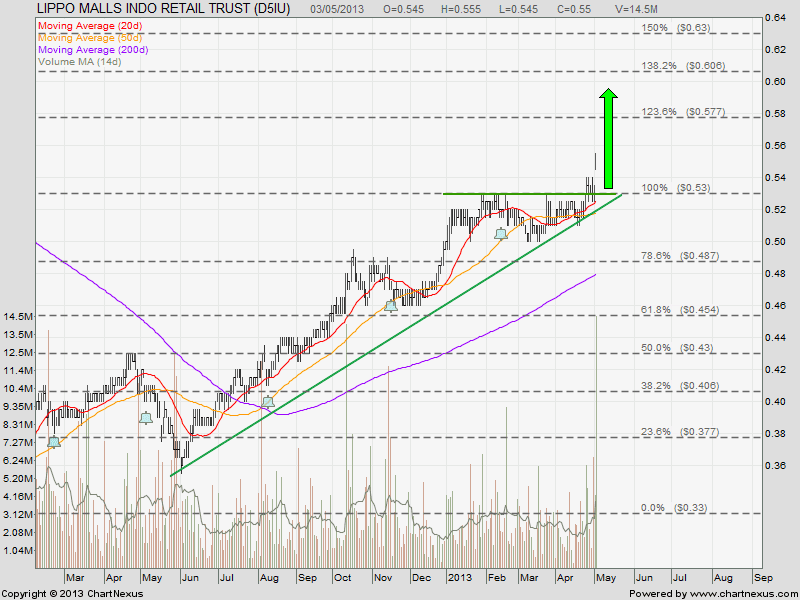

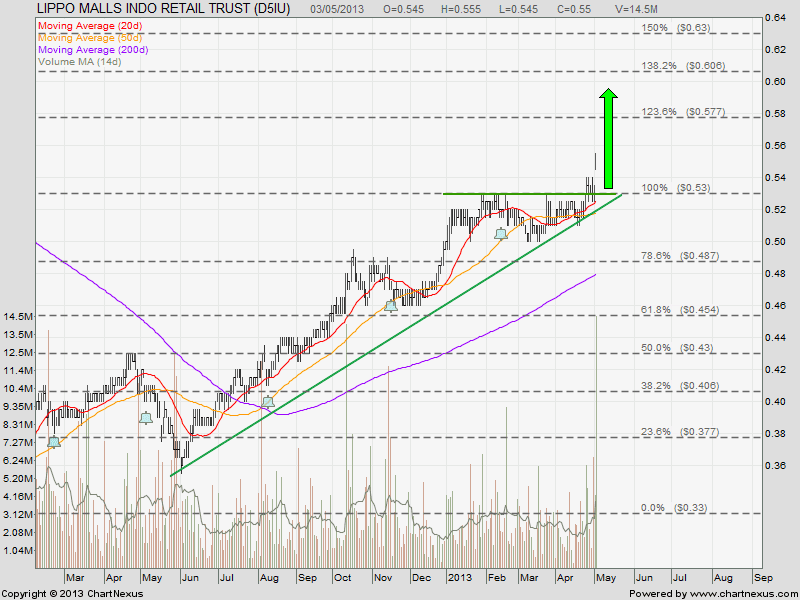

Lippo Malls Indo Retail Trust (LMIR) broke out from Ascending Triangle with huge volumn after reporting 30% increase in DPU compare to the same quarter in the previous year. The price target of this breakout is about $0.60. The stock is currently on clear uptrend and 5% undervalue to NAV of $0.57. Current price is $0.535.

Fundamental Data (From 1Q, 2013 Earning Result Presentation)

- NAV = $0.57

- DPU (1Q, 2012) = 0.63 cents

- DPU (1Q, 2013) = 0.89 cents (+30%)

- Distribution Yield (Annualised) = 6.9% (base on $0.515)

- Gearing Ratio = 24.3%

- Lease Expiry: More than 70% expire beyond 2015.

Fundamentally LMIR is undervalue and have very good prospect of further increase in DPU base on their growth strategy (S$4 Billion portfolio in 3-5 years) with low gearing ratio. Technically LMIR is on clear uptrend.

See comparison table of other Singapore REIT.

Past analysis on Lippo Mall Indonesia Retail Trust which posted one year ago.