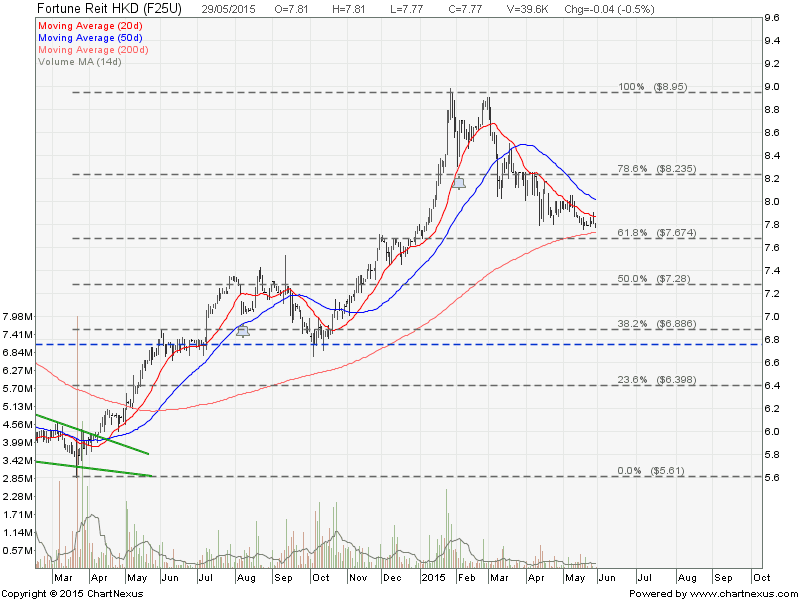

UOL Group: Long Term Trend is still Up. Good time to buy?

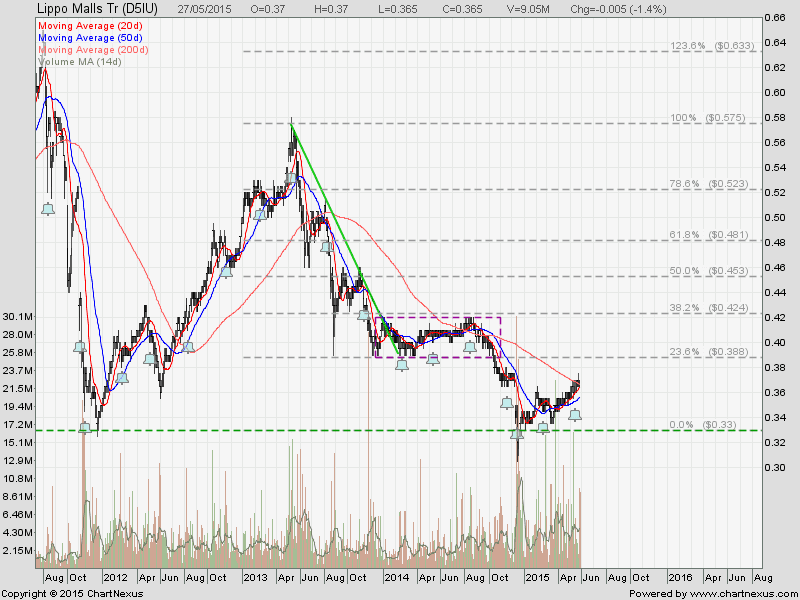

UOL Group has dropped more than 12% since the historical high and currently sitting on the 200D SMA support. Is it the Right time to buy?

Technically base on the chart pattern, UOL Group is still showing a long term up trend but currently short term downward pressure is pretty strong. It is important to watch whether UOL Group can find the good support and rebound from the long term up trend at about $6.80.

Original post by Marubozu My Stocks Investing Journey.

UOL Group Fundamental

- PE (TTM) = 8.79

- PE (5 Years High) = 7.92

- PE (5 Years Low) = 4.51

- Price to Book (MRQ) = 0.72

- Dividend Yield = 2.1%

- Current Ratio = 1.46

- Debt to Equity (MRQ) = 37.05

UOL Group Limited (UOL) is engaged in investing in properties, subsidiaries, associated companies, and listed and unlisted securities. The Company operates in four segments: property development and property investment, concentrated in Singapore, Malaysia and China; hotel operations, concentrated in Singapore, Australia, Vietnam, Malaysia, China and Myanmar and key asset and profit contributions are from the hotels in Singapore and Australia; investments, which relates to the investments in equity shares in Singapore, and management services to companies and hotels in Singapore and overseas. The Company’s diversified portfolio consists of residential apartments, offices, retail malls, hotels, spas and restaurants. Together with hotel subsidiary, Pan Pacific Hotels Group Limited (PPHG), UOL owns and/or manages over 30 hotels, resorts and serviced suites in Asia, Oceania and North America under two brands, Pan Pacific and PARKROYAL.