Author: Luis Aureliano

In 2015, it was reported that Singapore investors spent a record $26.3B on buying overseas properties – an indication that Singapore has a wide pool of investment-conscious individuals with deep pockets. However, the number for Singaporean dollars making their ways to foreign investment opportunities is only a minute fraction of the money that Singaporeans spend on local investments.

Interestingly, the amount of Singaporean dollars that flows into foreign lands pales in comparison to the amount of direct foreign investments in Singapore. A large number of overseas investors have found an incredible opportunity in Singapore. This article seeks to provide the discerning investor with an objective outlook on what foreign investors can expect from the Singaporean economy.

An overview of Singapore’s stock market

Singapore boasts one of the most attractive financial and trade sectors in the global community. The country’s financial market is called Singapore Exchange Limited with a market cap of more than SGD902.425 billion ($8.19B). Credit Lyonnais Securities Asia (CLSA) has forecasted that Singapore is on track to supplant the Swiss banking industry as a destination financial center by 2025. Singapore financial market enjoys the benefits of a strategic location that makes it an ideal hub for more than 4 billion people who can jet in within a 7- hour flight radius.

Singapore’s financial markets have also enjoyed a reputation for transparency and accountability because the government has zero tolerance for corruption. In fact, there are reports that more than 7,000 multinational firms from the U.S. and E.U. and Japan have set up shop in Singapore. More so, about 3,000 firms China and India have a presence in Singapore. Hence, if you want to invest in Singapore’s stock market, you can be sure that you’ll encounter the stocks and ETFs of familiar companies.

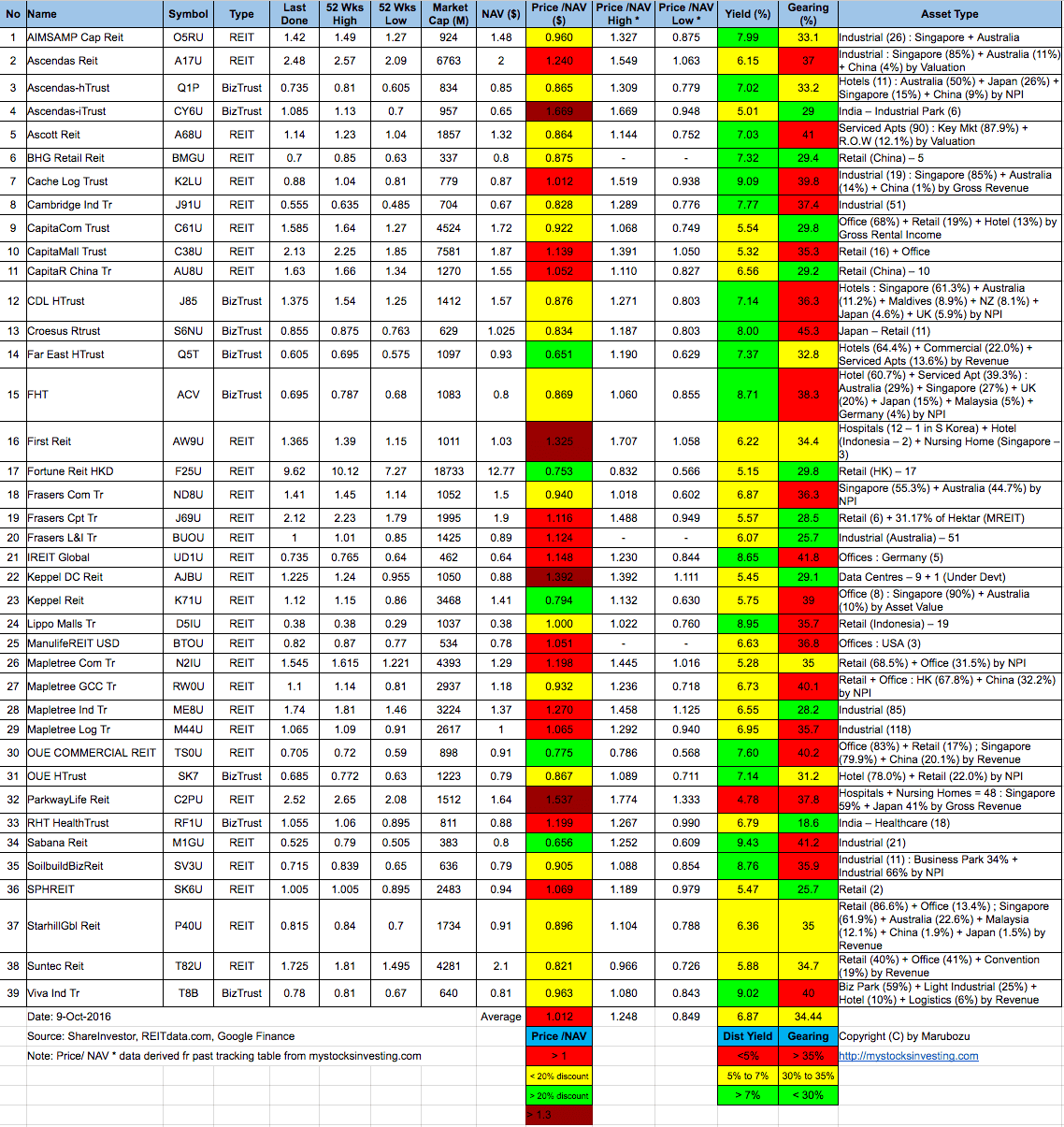

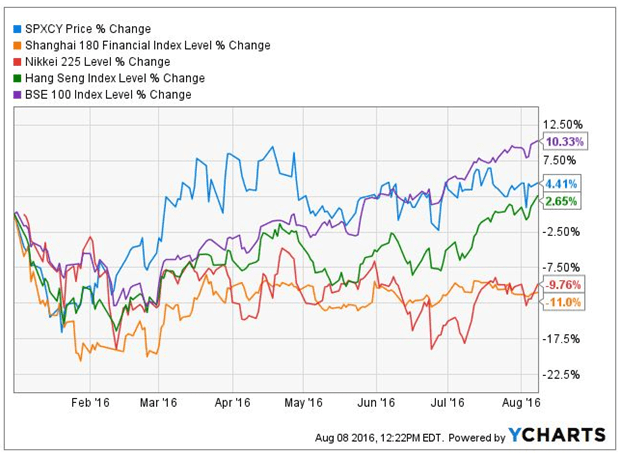

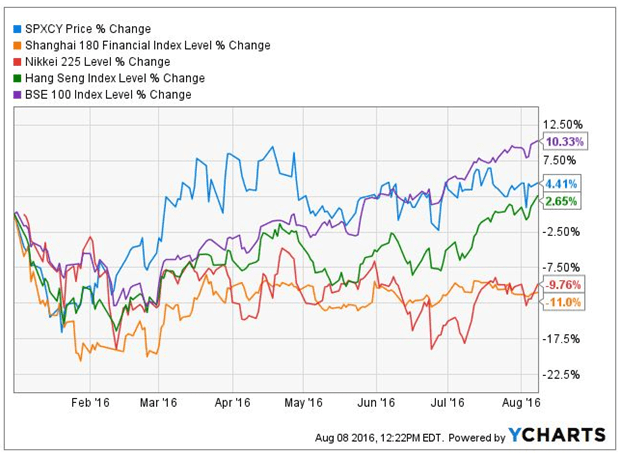

Singapore Exchange has outperformed other Asian markets in the year-to-date period as shown on the chart above. However, Singapore Exchange has largely underperformed the U.S. and EU markets as shown the chart below.

An overview of Singapore’s real estate market

Singapore has a developed real estate market built by one of the world’s richest populations. It is no longer news that Singapore has the third highest per capita income in the world; hence, many Singaporeans have much easier access to financing for real estate investments.

More so, Singapore has one of the lowest employment rates in the world and it has the largest concentration of millionaires in any one country. In addition, the country offers a low property tax rate and an advanced infrastructure that makes it easy to do business with individuals, corporate bodies, or the government.

Nevertheless, Singapore’s real estate market has suffered a massive downturn in recent years. Many reasons have been advanced for the weakness in Singapore’s housing market and the country’s Urban Redevelopment Authority (URA) has provided data on the weakness in the housing market.

The URA observes that private residential property index fell by 0.6% in Q2 2016 to mark the ninth straight quarter of declines. More so, the URA noted that the prices of residential properties fell by 0.4% during the quarter and price of high-end, non-landed homes fell slightly by 1.4% quarter over quarter in Q1 2016.

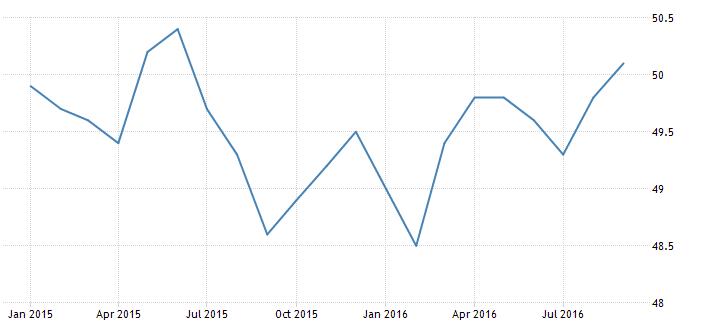

The currently depressed nature of the Singaporean real estate market might provide investors with a remarkable opportunity to buy prime properties in great locations at a discount. For instance, buyers are snapping up well-positioned projects and foreign developers are buying up new sites aggressively. The URA reported a sharp increase in the number of private housing units that developers launched and sold in the second quarter as shown in the chart below.

However, it is important that you conduct your due diligence and not buy a piece of Singapore’s real estate with misplaced expectations. You should be ready to buy Singapore real estate with a medium to long-term view in mind.

Is this a good time to invest in Singapore?

Foreign investors should be pleased to know that this is a good time to invest in Singapore’s market because of the latent opportunities in Singapore’s economy. However, foreign investors might want to make a strategic entry because Singapore Dollar has strong bullish trend in relation to other currencies. Investors who want to move investment funds to a bank account in Singapore need to understand that Singapore Dollar tends to soar when bad news hits the west.

When the news of the Brexit in which the United Kingdom voted to leave the EU broke, the Singapore dollar found strength against other major global currencies. For instance, the Singapore Dollar made sharp gains against 11 out of 16 major peers – in fact, the Singapore Dollar advanced 14% against the Pound (GBP) after the Brexit vote was cast.

The chart above shows how the Singapore Dollar has traded in relation to United States Dollar in the last one month. The forex gains were strong and impressive and the Monetary Authority of Singapore had to adopt a monetary easing policy. Nonetheless, the Singapore Dollar is still waxing strong and it rose to a one-month high against the dollar in August. On August 1, the Singapore dollar rose to more than a 1-month high of 1.3372 against the USD from an early low of 1.3430. At July 31 close, the Singapore dollar was trading at 1.3387 against the dollar.

Given the strong bullish trends in the Singapore Dollar, foreign investors might want to wait until the currency has a pullback before they move their funds into Singapore. However, you should not forget that Singapore’s economy is healthy and its currency soars when there is bad news in the west; hence, a sustained gloomy outlook in the economy of the west might keep the bullish flames of the Singapore dollar alive.

Nonetheless, foreign investors should note that Singapore’s economy is closely linked to the Chinese economy; hence, economic weakness in China might trigger weakness in Singapore. Smart investors will do well to use economic indicators coming out of the U.S., EU, and China as pointers on the timing for investing in Singapore’s financial or real estate market.