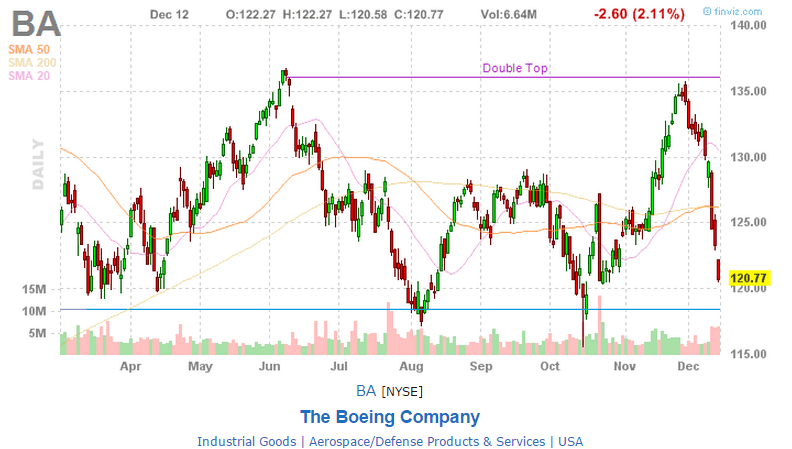

IBM: Breakdown from Rectangle

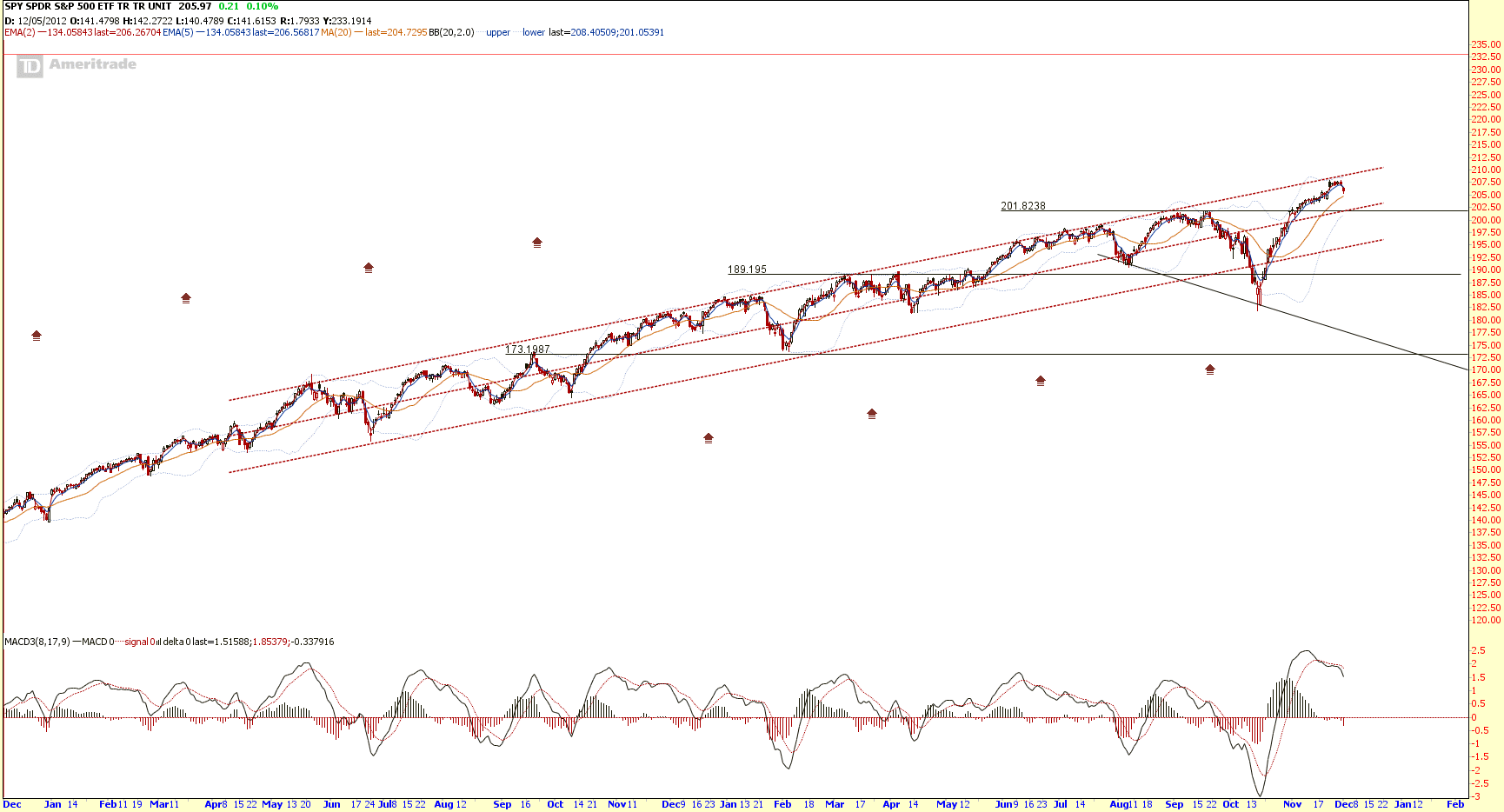

Trade Opportunity for IBM after break down from Rectangle which has been in consolidation mode for 2 months! IBM is on confirmed down trend as the stock is trading below 20D, 50D, 200D SMA. MACD Bearish Convergence. 2/5 EMA starts bearish trend.

Technical Analysis for IBM

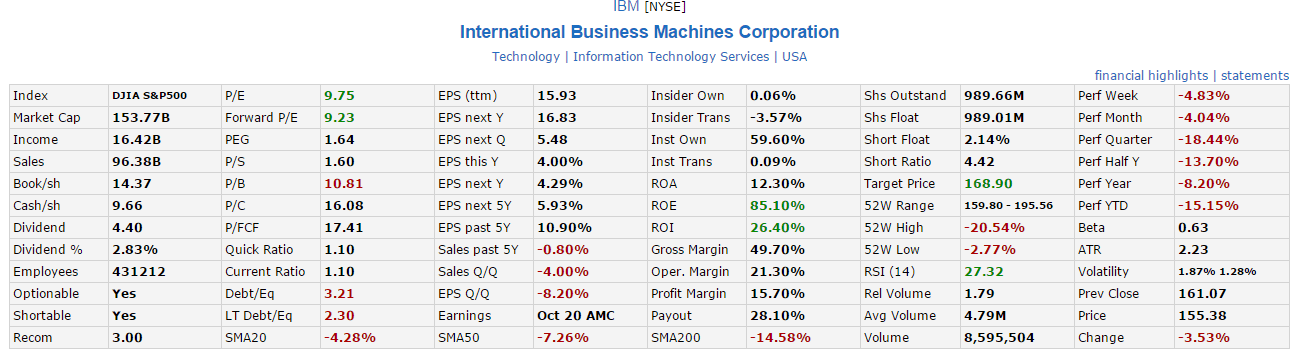

Fundamental Analysis for IBM

Base on current chart pattern, IBM is suitable for trading. You will be DEAD if you use Value Investing method to invest in IBM now!

Original post by Marubozu from My Stocks Investing Journey.