In InvestFair 2021, topics such as Cyber Security, Digital Investment, Investments in China, Millenial-driven trends etc were touched on as potential avenues to invest in. Other investment-related topics such as Environmental, Social and Governance (ESG) were also touched on.

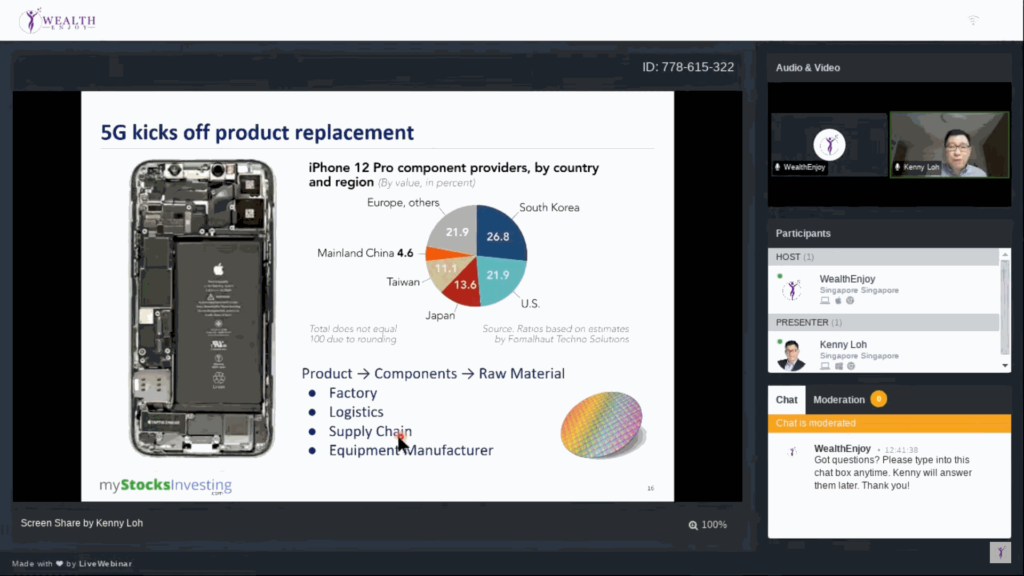

In addition to these, there are also sectors that Kenny thinks are worth considering, such as the rise of 5G mobile networks, Alternative Investments (such as cryptocurrency) etc. In this webinar, Kenny Loh, a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor, covers his investment strategy in 2021. For example, 5G and Internet of Things (IoT) can affect many industrial sectors. (Timestamp 34:37)

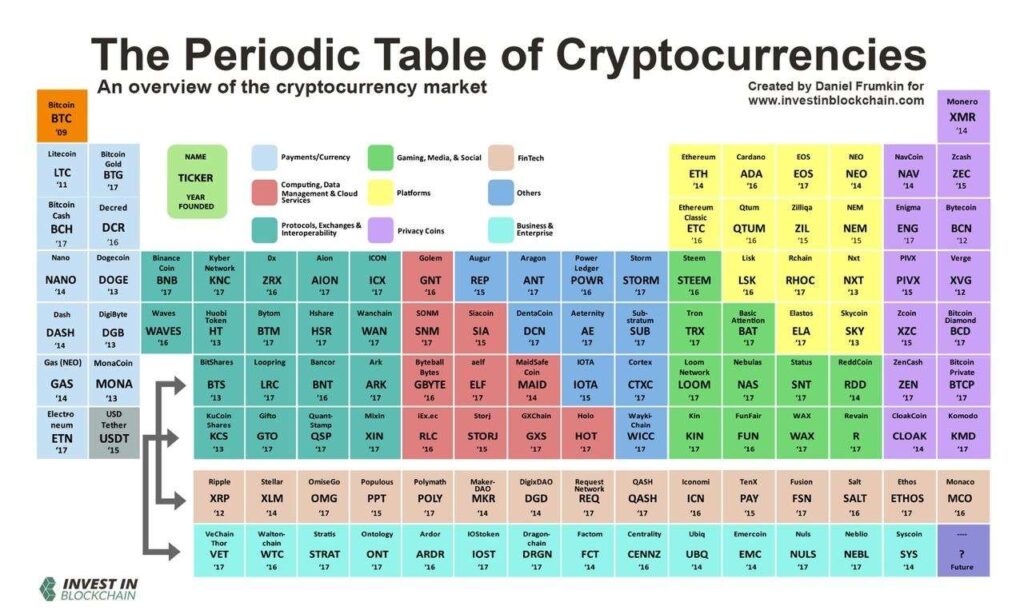

Kenny Loh also touched on Alternative Investments, specifically Cryptocurrency as a form of investment. Do you know that there are many different types of Cryptocurrency, with different uses such as a form of payment/currency (e.g Dogecoin, Electroneum), Fintech (e.g Ripple, Stellar ), smart contracts (Ethereum), and more? (timestamp: 51:46)

In addition to these, he covers events that will affect markets worldwide, including the impact that 5G will have on current markets, the COVID-19 pandemic, China growth, Emerging Market growth, Artificial Intelligence etc. He will also cover the many different types of Investments in 2021, from alternative investments such as Cryptocurrency and Gold, to Investment Properties such as REITs and Unit Trusts, and how to start building your very own portfolio.

Complementary Consultation session by an Independent Financial Advisor

Want to start building your own investment portfolio, or don’t know how to start investing? Book a consultation now!

Timestamps:

11:55 Start of Webinar

12:32 About Kenny Loh

13:52 Introduction: things to take note of

15:01 Investment Strategy

19:23 Summary of the Current Macro Environment

22:30 Thematic Portfolio 2021 (& explanation of Investment Portfolio)

26:01 Thematic Investing 2021 (Core Portfolio and Satellite Portfolio)

27:35 China’s Growth Story

29:43 China Equity

31:07 Technological Disruption

32:42 Artificial Intelligence

34:37 5G Networks

39:33 Internet of Things (IoT)

40:27 Effects of 5G

42:50 APAC ex Japan Equity

43:30 Financial Sector

44:45 Emerging Markets

47:41 Private Equity

49:01 Singapore REITs

50:22 Gold

51:46 Cryptocurrency

54:28 Uses for cryptocurrency

1:00:25 Digital Currency Funds

1:02:17 Thematic Portfolio 2021 (Past Year Performance)

1:03:29 Thematic Portfolio Example (Kenny’s own portfolio)

1:04:29 Why and who should build a diversified portfolio?

1:06:15 How to build a diversified portfolio? (and ways to do it)

1:09:03 How to start investing now?

1:11:23 End of Webinar

1:12:49 Advisory and managed account services

Start of Q&A

1:14:39 Why is there a rotation from big cap industrial REITs to other stocks?

1:17:06 Will you manage accounts for your clients?

1:18:59 Mapletree REITs got beaten down this year. Is it a good time to buy?

1:20:31 Which REITs sectors do you think will be bullish in the near term?

1:22:15 What would be the minimum amount required for your advisory service and/or managed account service?

1:25:08 Are you looking only into Unit Trusts and not Stocks/ETFs?

1:27:39 Right now, is the market focused on recovery or inflation?

1:29:25 What is your personal view on the spike of yield spread and how to take advantage of it?

1:31:25 If I already have an investment portfolio, will you help to advise on my portfolio as part of your advisory service?

1:33:01 Gold prices have dropped substantially recently. Do you see a rebound on the gold price soon?

1:34:20 What are the fees for the advisory/managed account services?

1:35:05 Do you have any cryptocurrency assets in your portfolio and what percentage?

1:37:45 I noticed that you did not include US in your asset allocation. Is that true?

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Sympsosium and Invest Fair.

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement