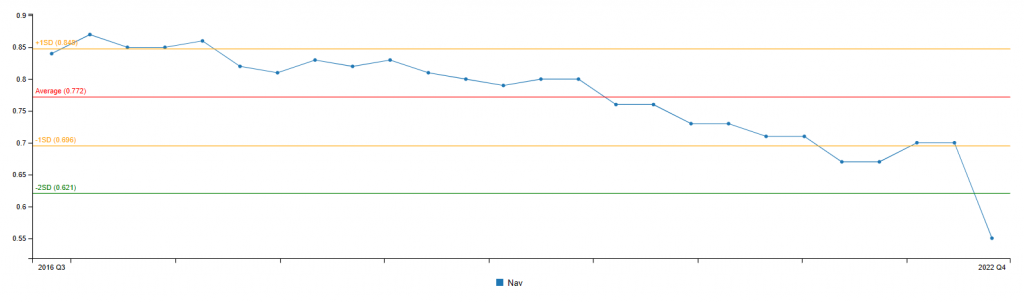

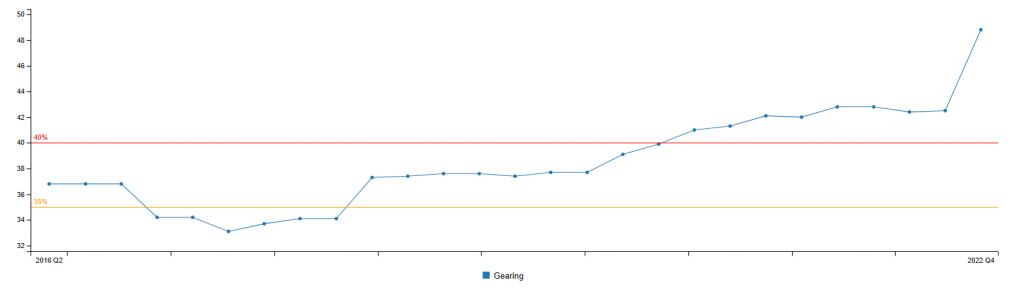

One year ago, I covered Manulife US REIT’s declining property valuation. However, MUST’s portfolio valuation has continued to decline. The recent earnings results have documented a -10.9% portfolio valuation decline y-o-y as of 31st December 2022, increasing its gearing ratio to ~49%. This is close to the gearing ratio limit of 50% for REITs. I have therefore asked the following questions, on how MUST can reduce its gearing ratio as well as stem the constant portfolio valuation declines.

MUST’s NAV trend since Q3 2016.

MUST’s Gearing Ratio trend since Q3 2016.

- What is the probable gearing ratio at the end of the year if: (1) a more reasonable cap rate used; and (2) if MUST is able to find new tenants to replace old ones who have decided to exit?

- The current valuation may be too conservative and planned for the worst-case scenario. Will MUST revalue its properties again in mid-year if there are significant changes in the assumption?

“We will be working to reduce our gearing through various options such as asset dispositions, distribution reinvestment plan, capital injection, discussions with capital partners and so on. We aim to bring our gearing below 45%. The strategic review is also ongoing, with healthy interest from a broad range of counterparties, including local and international developers, REITs and private equity. We expect to provide further updates on the strategic review in 2Q 2023. Meanwhile, the weighted average cap rate of MUST’s portfolio has increased slightly from 6.0% as at Dec 2021 to 6.3% as at Dec 2022. With more clarity on rate hikes and banks easing their lending, we should see some impact on cap rates. It is still early days. As for TCW, the tenant vacating from Figueroa by the end of the year, we have a couple of prospects who have toured the space a few times and we continue to engage them. For valuations, we will continue with yearly valuations in line with MAS regulations and our SREIT peers.” – a MUST spokesperson

MUST’s ESG ratings and transparency is commendable

Despite the poor performance in terms of portfolio valuation and gearing ratio, MUST’s strengths are in the areas of ESG. In the GRESB Real Estate Assessment, it has attained 5 stars, as well as the highest “Negligible” risk rating by Sustainalytics.

Kenny Loh is an Associate Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair.