With wider adoption of e-commerce, Artificial Intelligence and Cloud Computing, this technology disruption will change the way how we work, how we spend and how business do business in future. The adoption of 5G will accelerate the rise of digital economy and the consumption of data. Thus, we are going to see the huge growth in Data Centers in the REIT space moving forward.

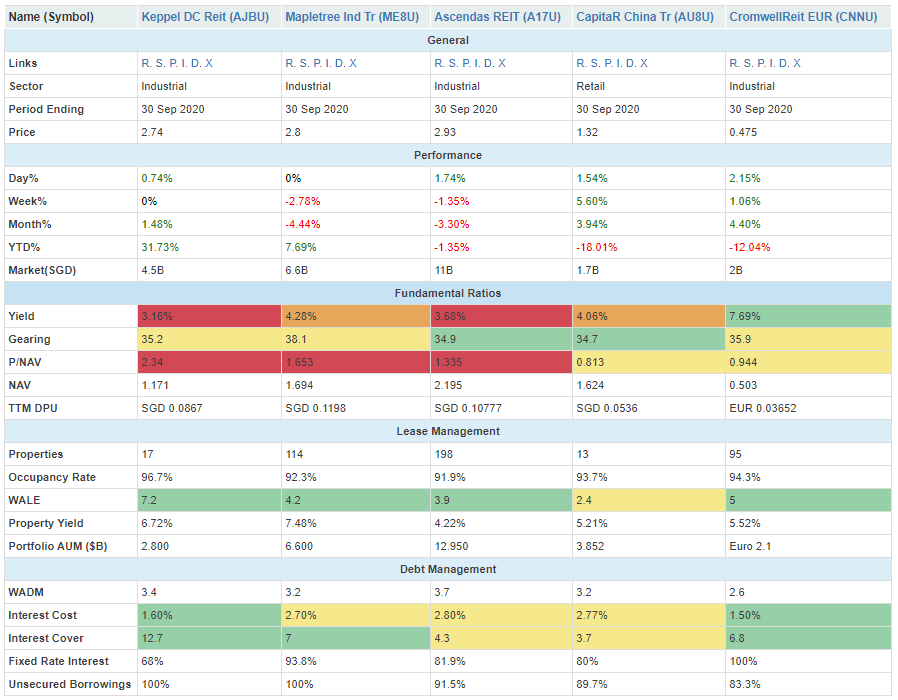

The REITs who have the data centers in the current / future portfolio:

(1) Keppel DC REIT (AJBU.SI) – 100% (AUM$2.9B) . 18 Assets across 8 countries.

(2) Mapletree Industrial Trust (ME8U.SI) – 38.7%. 28 Assets (mainly in US)

(3) Ascendas REIT (A17U.SI) = 5.2%.

(4) Capitaland Retail China Trust (AU8U.SI) – Expanded Mandates to include Data Centers in China.

(5) Cromwell European REIT (CNNU.SI) – Have announced an acquisition of Data Centers in Europe in 2021.

.

The following table is extracted from https://stocks.cafe/kenny/comprehensive

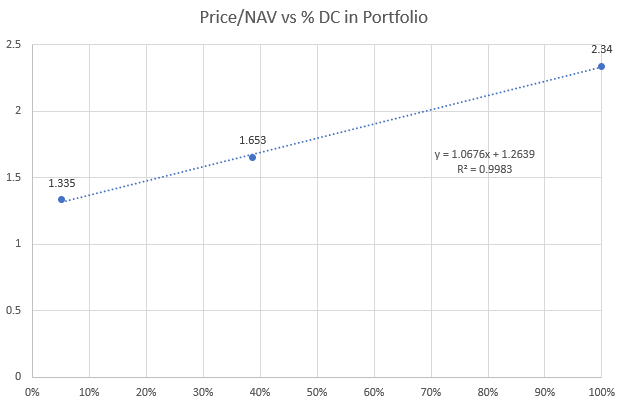

As we can see from the above comparison table, there is a high correlation between the Price/NAV valuation vs Percentage of Data Centers in the portfolio. This is a strong evidence that Data Centers are trading at a premium to other property classes. Below regression analysis (unfortunately there are only 3 data points) proves a very strong correlation with R-Square of 0.9983!

My Reasons of doing this analysis

(1) To Spot Investing Opportunities in S-REIT (which REIT to buy and the entry level)

(2) To Identify the Valuation Gap (Price/NAV) of REITs with and without Data Centers

(3) To Identify the upside potential (capital gain) if any REITs to acquire Data Centers

(4) To model the “Should Price/NAV” with the % Data Center in the portfolio (Price/NAV = 1.0676 * %DC + 1.2639)

Let’s see whether my modelling works after Capitaland Retail China Trust and Cromwell European REIT acquire the data centers into the portfolio.

.

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Sympsosium and Invest Fair.