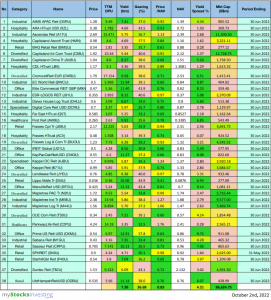

On the 3rd November 2020, Capitaland Mall Trust began trading as Capitaland Integrated Commercial Trust (CICT), following the merger of Capitaland Mall Trust and Capitaland Commercial Trust. Following the merger, Capitaland Integrated Commercial Trust now has 24 Retail/Office/Integrated Development properties in Singapore.

Following this merger, out of the top 10 REITs in terms of market capitalisation, there are now 3 REITs in Singapore with both Retail, Office and Integrated Development properties, including Mapletree Commercial Trust and Suntec REIT. In this article, we will be comparing how these REITs stack up, using portfolio information, financial ratios, etc.

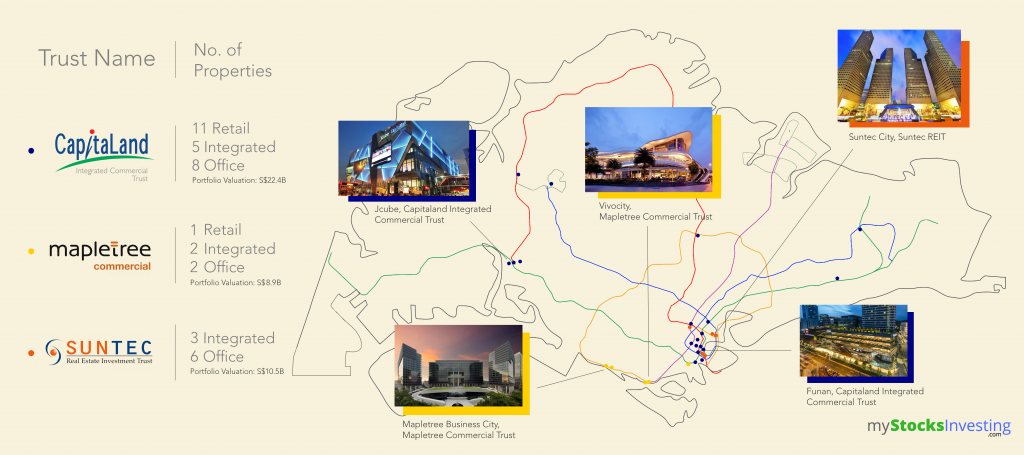

REIT Portfolio Overview

Capitaland Mall Trust recently merged with Capitaland Commercial Trust, to form Capitaland Integrated Commercial Trust. With a total of 24 properties, which include office towers in the CBD area and retail malls distributed around Singapore, CICT is the largest market capitalisation trust in Singapore, with a total portfolio valuation of S$22.4 billion.

Having a portfolio which includes VivoCity, Singapore’s largest shopping mall, and Mapletree Business City, one of the largest Integrated Developments in Singapore, Mapletree Commercial Trust is the 4th largest REIT in terms of market capitalisation as of 4th January 2021. With 5 properties located in the south of Singapore, it has a portfolio valuation of S$8.9 Billion.

With 5 properties in Australia and 4 in Singapore, Suntec REIT has a portfolio valuation of S$10.5 Billion. Properties owned by Suntec REIT include Suntec City, one of Singapore’s largest commercial developments, encompassing 5 office towers, a shopping mall and a convention centre.

Portfolio Distribution

The above diagram shows the geographical distribution of each of the REIT’s portfolio locations. Some of the observations that can be drawn out include:

- Capitaland Integrated Commercial Trust properties can be found throughout Singapore, even in heartland areas. For example, Junction 8 Shopping Centre in Bishan.

- 4 of Mapletree Commercial Trust properties are in the Harbourfront/Alexandra precinct, close to Singapore’s downtown area, with one in the CBD area.

- Out of these 3 REITs, Suntec REIT is the only REIT which owns overseas properties in Australia. In Singapore, all their properties are located in the CBD area.

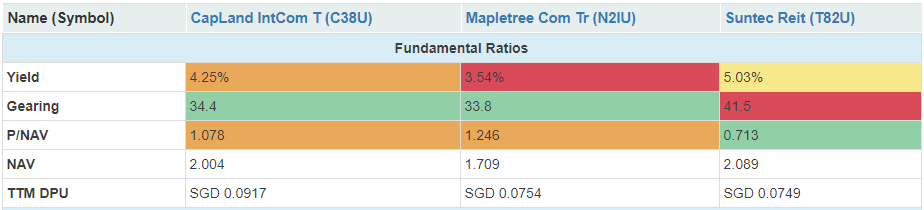

Fundamental Ratios

Need a comprehensive S-REITs screener, complete with comparison features? Want to compare Financial Ratios of 37 other S-REITs?

Do subscribe to the StocksCafe REIT screener now! You can opt for a monthly subscription, or a yearly subscription for 10% off! For a limited time only.

The above table shows the corresponding fundamental ratios of the 3 REITs. Some observations that can be made are shown below:

- Yield (ttm): At current prices, Mapletree Commercial Trust has the lowest yield of 3.54%. However, yield (ttm) is not a meaningful unit of measurement at the moment, due to recent dividend cuts due to the pandemic, and the switching of dividend payouts of some REITs to a semi-annual payout schedule (e.g Starhill Global REIT).

- Gearing: Capitaland Integrated Commercial Trust and Mapletree Commercial Trust have a gearing ratio of about 34%, while Suntec REIT has a high gearing ratio of 41.5%.

- Capitaland Integrated Commercial Trust is currently slightly overvalued, at Price/NAV of 1.078. Mapletree Commercial Trust is relatively overvalued while Suntec REIT is relatively undervalued.

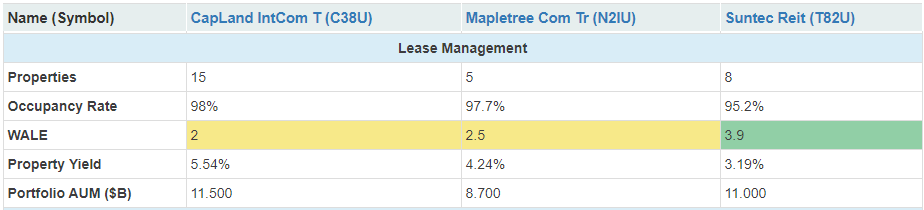

Lease Management

The above table shows the corresponding lease management values of the 3 REITs. Note that for CICT, values for the former Capitaland Mall Trust are shown above instead. Some observations that can be made are shown below:

- Number of Properties: Capitaland Integrated Commercial Trust owns the most properties, with 24 properties after the merger. Suntec REIT is the only REIT here with overseas properties, namely in Australia.

- Occupancy Rate: All 3 REITs have strong occupancy rates of above 95%, with the lowest being Suntec REIT at 95.2%.

- Weighted Average Lease Expiry (WALE): Suntec REIT has the highest WALE value at 3.5 years.

- Property Yield: Capitaland Integrated Commercial Trust has the highest Property Yield value of 5.54%, followed by Mapletree Commercial Trust and Suntec REIT. .

- Property Portfolio Value: The former Capitaland Mall Trust has the highest AUM value by a considerable margin even before the merger, at $11.5B.

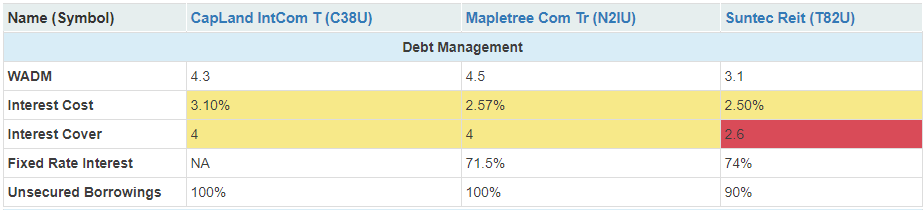

Debt Management

The above table shows the corresponding lease management values of the 3 REITs. Note that for CICT, values for the former Capitaland Mall Trust are shown instead. Some observations that can be made are shown below:

- Weighted Average Debt Maturity (WADM): Capitaland Integrated Commercial Trust and Mapletree Commercial Trust has higher WADM values, at 4.3 and 4.5 years respectively.

- Interest Cost: All 3 REITs have Cost of Debt values ranging between 2.5% to 3.1%

- Interest Coverage Ratio: Suntec REIT has a lower Interest Coverage Ratio compared to the other REITs, at 2.6x.

- Unsecured Borrowings: Almost all the borrowings made by the 3 REITs are unsecured.

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also an invited speaker of REITs Symposium and Invest Fair. Kenny Loh also offers REIT Portfolio Advisory for a fee. Do contact him at kennyloh@fapl.sg