Retail REITs in Singapore have rebounded since Phase 2 in Singapore began. In this article, we will be covering 5 predominantly retail REITs in Singapore, namely Capitaland Integrated Commercial Trust, Frasers Centrepoint Trust, SPH Reit, Starhill Global REIT and Lendlease Global Commercial REIT, comparing their portfolio information, financial ratios, etc.

REIT Portfolio Overview

Capitaland Mall Trust recently merged with Capitaland Commercial Trust, to form Capitaland Integrated Commercial Trust. Owning 5 Retail/Office, 8 Office and 11 Retail Developments, wholly in Singapore, CICT is the largest market capitalisation trust in Singapore.

Frasers Centrepoint Trust owns 7 Retail Malls in Singapore, including the newly-renovated Northpoint City. Mostly located away from the downtown, these malls seek to serve housing estates.

SPH Reit owns 5 properties, all of which are Retail Malls. 3 of the malls, The Rail Mall, Clementi Mall and Paragon are situated in Singapore, while Figtree Grove Shopping Centre and Westfield Marion Shopping Centre are located in Australia.

Starhill Global REIT owns properties in China, Japan, Malaysia, Australia and Singapore. In Singapore, Starhill Global REIT owns 2 properties, namely Ngee Ann City and Wisma Atria, which make up 70.1% of its total asset value.

Lendlease Global Commercial REIT owns 2 properties, 313 Somerset in Singapore and Sky Complex, a freehold office complex in Milan, Italy, with 313 Somerset having 71.5% of the IPO Portfolio. Lendlease Global Commercial REIT has also recently acquired a 5% stake in Jem, a shopping mall in Jurong East, Singapore.

Portfolio Distribution

The above diagram shows the geographical distribution of each REIT’s retail properties. Some observations that can be drawn out include:

- Capitaland Integrated Commercial Trust-owned retail malls (formerly Capitaland Mall Trust before the merger) can be found throughout Singapore, in both housing estates (e.g Junction 8) and downtown areas (e.g Plaza Singapura).

- Frasers Centrepoint Trust-owned retail malls are mostly found in housing estates away from the downtown areas.

- Both Starhill Global REIT and Lendlease Global Commercial REIT’s Singapore portfolio own retail malls in Orchard Road.

- SPH Reit owns 3 retail malls in Singapore, 2 in housing estates in the west, and Paragon at Orchard Road.

Fundamental Ratios

The above table shows the corresponding fundamental ratios of the 5 REITs. Some observations that can be made are shown below:

- Yield (ttm): At current prices, all 5 REITs except Starhill Global REIT have relatively low yields of below 5%. However, yield (ttm) is not a meaningful unit of measurement at the moment, due to recent dividend cuts due to the pandemic, and the switching of dividend payouts of some REITs to a semi-annual payout schedule (e.g Starhill Global REIT).

- Gearing: Other than SPHReit (with a low gearing ratio of 30.5%) and Starhill Global REIT (with a higher than average gearing ratio of 39.7%), the other 3 REITs have gearing ratios around 35%.

- Starhill Global REIT and Lendlease Global Commercial REIT are currently relatively undervalued with Price/NAV values of 0.527 and 0.753 respectively. compared to the other 3 REITs.

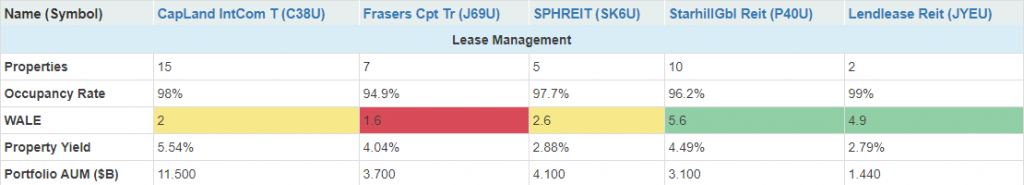

Lease Management

The above table shows the corresponding lease management values of the 5 REITs. Note that for CICT, values for the former Capitaland Mall Trust are shown instead. Some observations that can be made are shown below:

- No. of Properties: Capitaland Integrated Commercial Trust owns the most properties, with 16 being Integrated Developments/Retail Properties. Both Frasers Cpt Trust and SPHReit are wholly Retail REITs, while the rest include offices in their portfolios.

- Occupancy Rate: All 5 REITs have strong occupancy rates of above 94%, with the lowest being Frasers Cpt Trust at 94.9%.

- Weighted Average Lease Expiry (WALE): Starhill Global REIT and Lendlease Global Commercial REIT have the highest WALE values, at around 5 years. The remaining 3 REITs have lower WALE values, ranging between 1.6 years to 2.6 years.

- Property Yield: Capitaland Integrated Commercial Trust, Frasers Cpt Trust and Starhill Global REIT have Property Yield values of between 4-6%, while the remaining 2 REITS have values of about 2.8%.

- Property Portfolio Value: The former Capitaland Mall Trust has the highest AUM value by a considerable margin even before the merger, at $11.5B.

Debt Management

The above table shows the corresponding lease management values of the 5 REITs. Note that for CICT, values for the former Capitaland Mall Trust are shown instead. Some observations that can be made are shown below:

- Weighted Average Debt Maturity (WADM): Capitaland Integrated Commercial Trust has the highest WADM value, at 4.3 years.

- Interest Cost: Lendlease Global Commercial REIT has the lowest Interest Cost, at 0.86%. The other REITs have higher Cost of Debt values, ranging between 2.4% to 3.23%

- Interest Coverage Ratio: Lendlease Global Commercial REIT has a considerably higher Interest Coverage Ratio compared to the other REITs, at 9.2x.

- Unsecured Borrowings: SPHReit is the only REIT in this comparison that has 100% secured borrowings.

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also an invited speaker of REITs Symposium and Invest Fair. Kenny Loh also offers REIT Portfolio Advisory for a fee. Do contact him at kennyloh@fapl.sg