FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increases from 802.25 to 810.27 (+1.00%) ( compare to last post on Singapore REIT Fundamental Comparison Table on Aug 7, 2017. The index rebounded from the uptrend channel support and 50D SMA, and continue its bullish uptrend. See key level of support and resistances of FTSE REIT Index here.

Fundamental Analysis

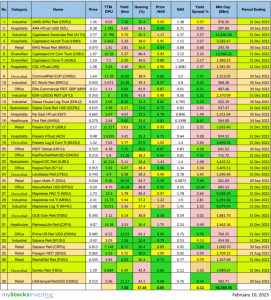

- Price/NAV stays at 1.05 (Singapore Overall REIT sector is slightly over value now).

- Distribution Yield increases from 6.48% to 6.51% (take note that this is lagging number). About one third number of Singapore REITs (12 out of 37) have Distribution Yield > 7%. This is a significant drop in numbers compare to a few months ago. This indicates there are lesser Singapore REITs with attractive yield to pick now.

- Gearing Ratio reduced from 34.8% to 34.7%. 20 out of 37 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy.

- Most overvalue REIT is Parkway Life (Price/NAV = 1.60), followed by Keppel DC REIT (Price/NAV = 1.38), First REIT (Price/NAV = 1.32), Mapletree Industrial Trust (Price/NAV = 1.33) and Ascendas REIT (Price/NAV = 1.30)

- Most undervalue (base on NAV) is Fortune REIT (Price/NAV = 0.69), followed by Far East HTrust (Price/NAV = 0.74) and Keppel REIT (Price/NAV = 0.83) and OUE Com REIT (Price/NAV = 0.83).

- Highest Distribution Yield (TTM) is Cache Logistic Trust (8.34%), followed by SoilBuild BizREIT (8.12%), Lippo Mall Indonesia Retail Trust (8.09%) and iREIT Global REIT (7.9%).

- Highest Gearing Ratio is Cache Logistic Trust (43.4%), iREIT Global (41.3%).

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

Economy Analysis – Singapore

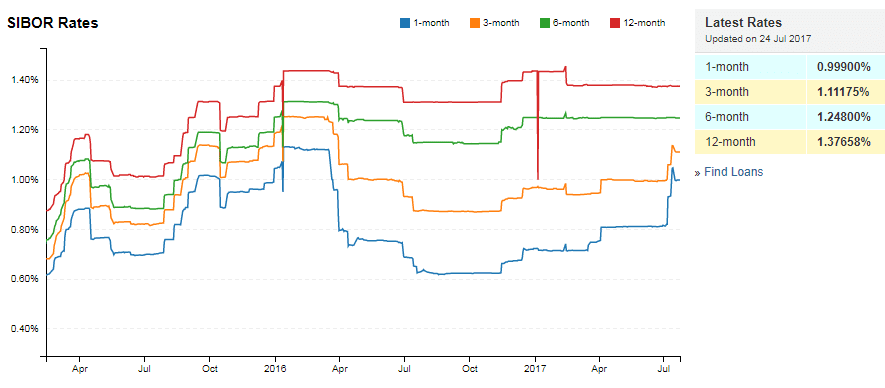

- 1 month at 0.99900%

- 3 month at 1.11175%

- 6 month at 1.24800%

- 12 month at 1.37658%

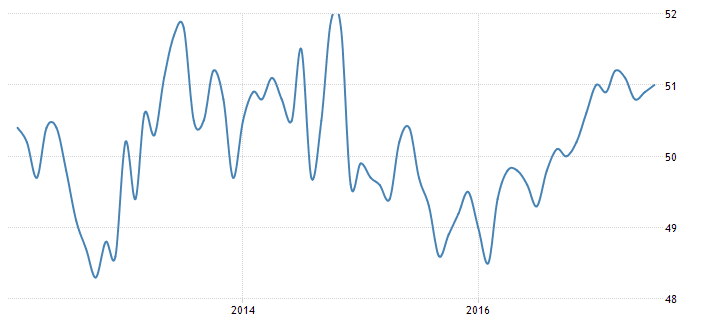

The Singapore Manufacturing PMI rose to 51 in July 2017 from 50.9 in the previous month. The reading pointed to the strongest pace of expansion in the manufacturing sector since April, boosted by growth in new orders, new exports and output. Also, the PMI for the electronics sector increased to 52.2 from 52.1 in June. Manufacturing PMI in Singapore averaged 50.14 from 2012 until 2017, reaching an all time high of 51.90 in October of 2014 and a record low of 48.30 in October of 2012.

The Gross Domestic Product (GDP) in Singapore expanded 2.20 percent in the second quarter of 2017 over the previous quarter. GDP Growth Rate in Singapore averaged 6.78 percent from 1975 until 2017, reaching an all time high of 37.20 percent in the first quarter of 2010 and a record low of -13.50 percent in the fourth quarter of 2008.

Summary

Fundamentally the whole Singapore REITs is slightly over value. Office and Hospitality sectors are still undervalue but have not seen any clear turnaround signs yet. Technically Singapore REITs is still on bullish up trend but facing the resistance of 820.

There are not many REITs left to pick at the present moment. If you have missed the boat to invest in REITs but have fear of selecting the wrong REITs. you may want to check out this Investing in Singapore REIT course here.

If you do not have time to do all the analysis and monitor the stock market, there is a solution for you … REITs Portfolio Advisory. I will help you to build a Diversified REITs portfolio for you. I will do all the work by selecting fundamental strong REIT, time the entry, monitor the quarterly earning performance, sell the weak REITs, etc. https://mystocksinvesting.com/course/private-portfolio-review/

See all other relevant Singapore REITs blog posts here.

Check out coming seminars at https://mystocksinvesting.com/events