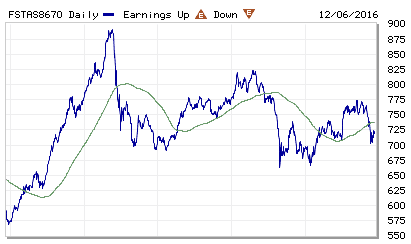

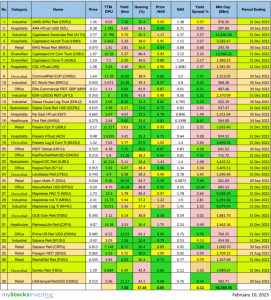

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreases from 730.39 to 722.05 (-1.14%) compare to last post on Singapore REIT Fundamental Comparison Table on Nov 5, 2016. The index is trading below the 200D SMA. Take note that the 200D SMA is no longer sloping up and is currently flat. If the index continues to trade below 200D SMA and the 200D starts to slope down, the Singapore REIT sector will reverse to a confirmed down trend. SGX S-REIT (REIT.SI) Index decreases from 1125.83 to 1111.15 (-1.30%).

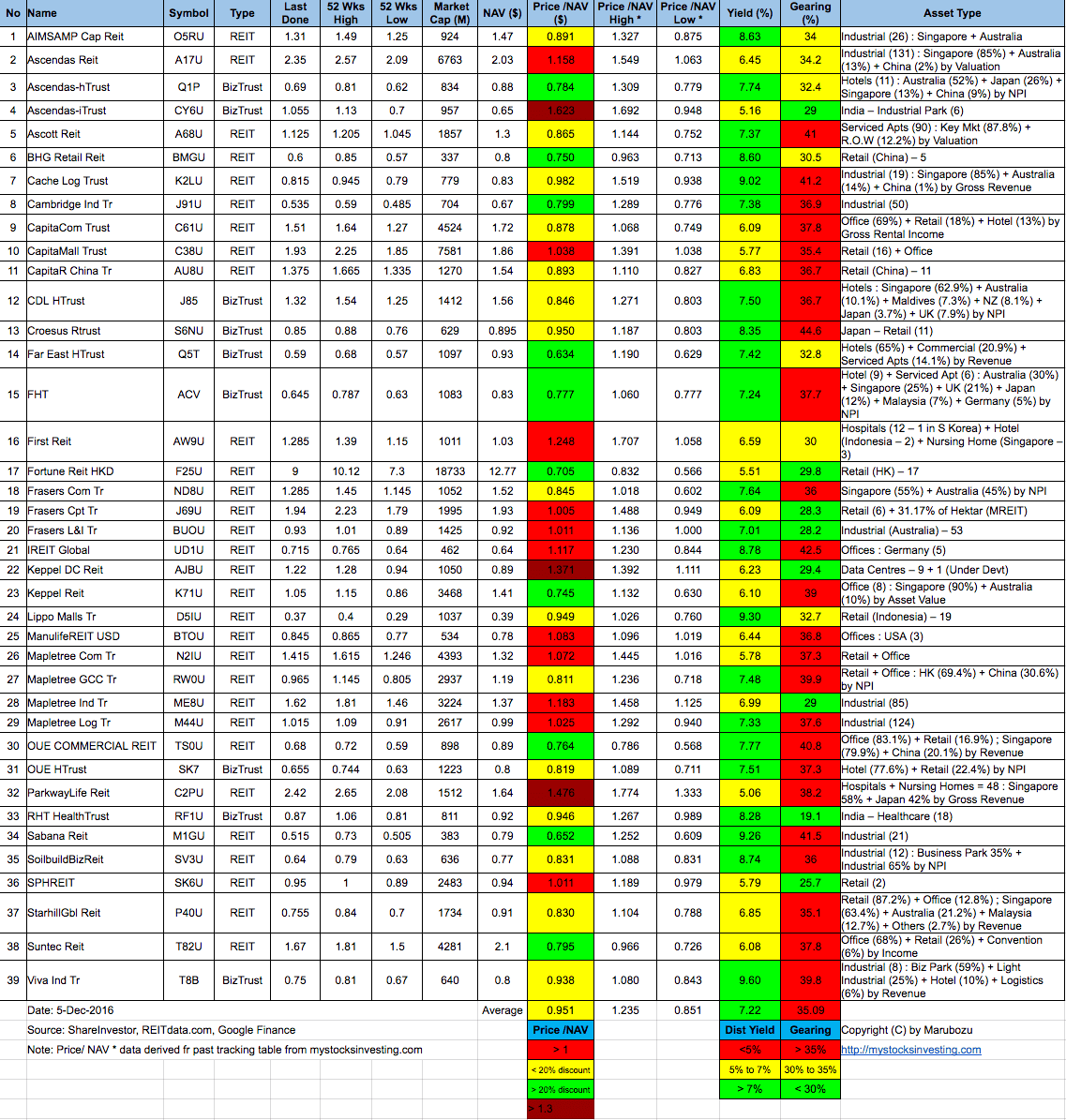

- Price/NAV decreases from 0.969 to 0.951 (Singapore Overall REIT sector is under value now) after recent sell off.

- Distribution Yield increases from 7.07% to 7.22% (take note that this is lagging number). More than half of Singapore REITs (20 out of 39) have Distribution Yield > 7%. High yield REITs mainly from Hospitality Trust and small cap Industrial REIT. Selection of Singapore REITs have become much more important now because not all the high yield REITs has strong fundamental.

- Gearing Ratio decreases from 35.15% to 35.09%. 24 out of 39 have Gearing Ratio more than 35%.

- Most overvalue is Ascendas iTrust (Price/NAV = 1.623), followed by Parkway Life (Price/NAV = 1.476) and Keppel DC REIT (Price/NAV = 1.371)

- Most undervalue (base on NAV) is Far East HTrust (Price/NAV = 0.634), followed by Sabana REIT (Price/NAV = 0.652) and Keppel REIT (Price/NAV = 0.745).

- Highest Distribution Yield is Viva Industrial Trust (9.60%), Lippo Malls Indonesia Retail Trust (9.30%) followed by Sabana REIT (9.26%).

- Highest Gearing Ratio is Croesus Retail Trust (44.6%), iREIT Global (42.5%), Sabana REIT (41.5%), Cache Logistic Trust (41.2%), Ascott REIT (41.0%) and OUE Commercial REIT (40.8%)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

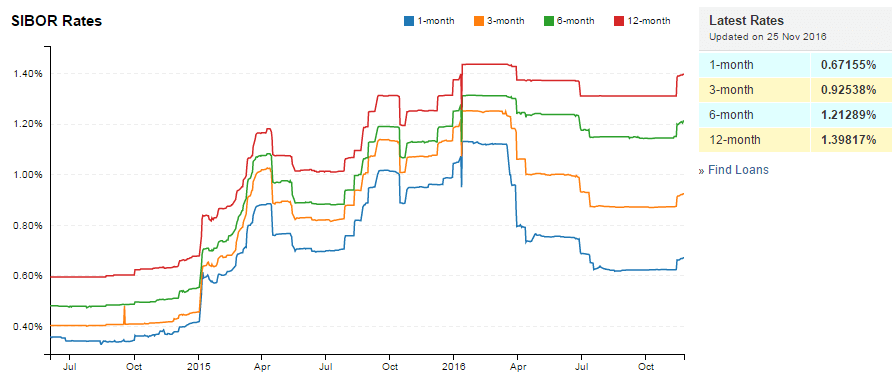

- Singapore Interest Rate decreases from 0.12% to 0.07%

- 1 month increases from 0.62417% to 0.67155%

- 3 month increases from 0.87242% to 0.92538%

- 6 month increases from 1.14530% to 1.21289%

- 12 month increases from 1.31225% to 1.39817%

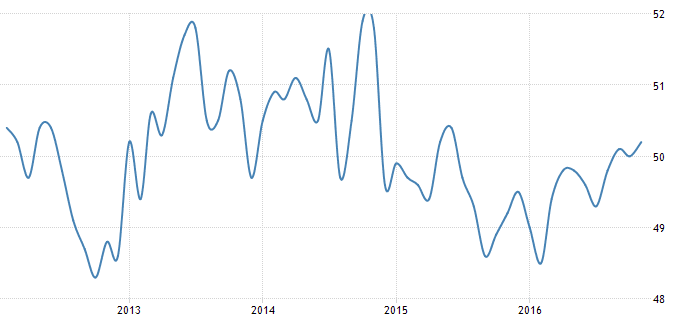

Manufacturing PMI in Singapore increased to 50.20 in November from 50 in October of 2016. Manufacturing PMI in Singapore averaged 50.03 from 2012 until 2016, reaching an all time high of 51.90 in October of 2014 and a record low of 48.30 in October of 2012.

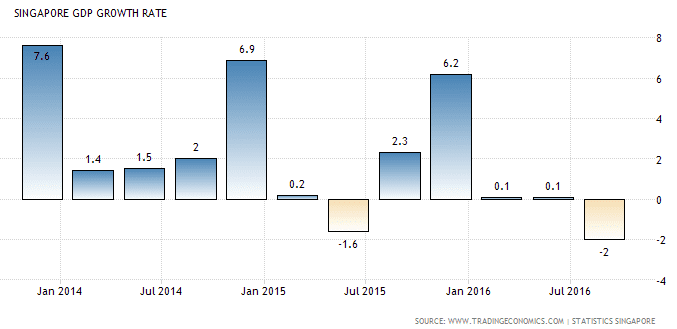

The Singaporean economy contracted a seasonally-adjusted annualized 2 percent on quarter in the three months to September of 2016, compared to a 4.1 percent decline in preliminary estimates. Markets were expecting a 2.5 percent contraction. GDP Growth Rate in Singapore averaged 6.82 percent from 1975 until 2016, reaching an all time high of 37.20 percent in the first quarter of 2010 and a record low of -13.50 percent in the fourth quarter of 2008.

Singapore REITs in general is under value due the recent sell off after Donald Trump won the the US Presidential Election, and the market is anticipate a 80% probability of rate hike in Dec 2016. Distribution yield for some Singapore REITs with bigger market capitalization has become a little bit more attractive again. Should there be any knee jerk reaction if Janet Yellen announces the rate hike next week, it is a good opportunities to pick up some fundamental strong REIT.

Technically Singapore REITs sector is in bearish territory after breaking down the 200D SMA support. We need to wait for the Singapore REIT Index to find the support after FOMC meeting next week to plan the entry. Happy hunting but don’t hunt the wrong one!

Original post from https://mystocksinvesting.com

Check out coming seminars at https://mystocksinvesting.com/events