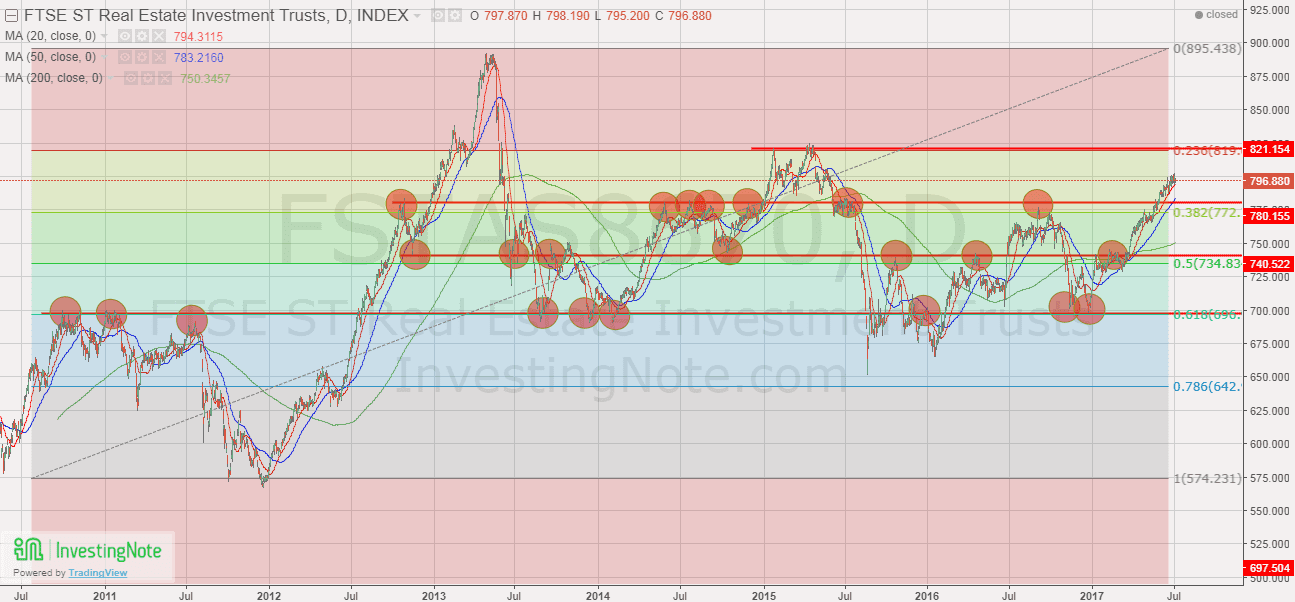

Technical Analysis

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increases from 788.29 to 796.88 (+1.09%) ( compare to last post on Singapore REIT Fundamental Comparison Table on June 4, 2017. The next strong resistance is at about 820. Singapore REITs as a whole is still on a bullish up trend.

See previous Singapore REITs Index Chart and Technical Analysis here.

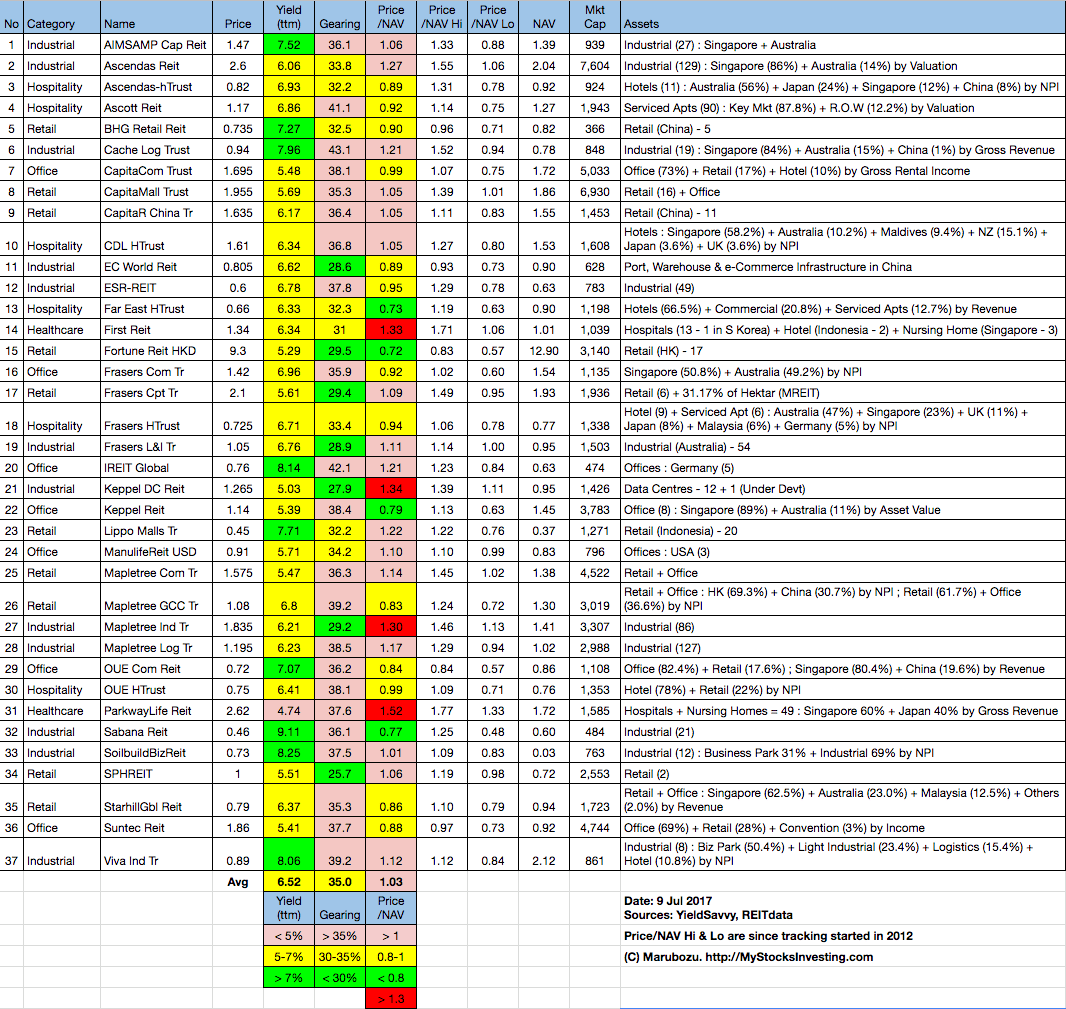

Fundamental Analysis

- Price/NAV increases from 1.02 to 1.03 (Singapore Overall REIT sector is slightly over value now).

- Distribution Yield decreases from 6.67% to 6.52% (take note that this is lagging number). About one quarter number of Singapore REITs (9 out of 37) have Distribution Yield > 7%. This is a significant drop in numbers compare to a few months ago. This indicates there are lesser Singapore REITs with attractive yield to pick now.

- Gearing Ratio maintains at 35.0%. 22 out of 37 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy.

- Most overvalue REIT is Parkway Life (Price/NAV = 1.52), followed by FIRST REIT (Price/NAV = 1.33) and Keppel DC REIT (Price/NAV = 1.34).

- Most undervalue (base on NAV) is Fortune REIT (Price/NAV = 0.72), followed by Far East HTrust (Price/NAV = 0.73), Sabana REIT (Price/NAV = 0.77),and Keppel REIT (Price/NAV = 0.79).

- Highest Distribution Yield (TTM) is Sabana REIT (9.11%), followed by SoilBuild BizREIT (8.25%), Viva Industrial Trust (8.06%) and iREIT Global REIT (8.14%).

- Highest Gearing Ratio is Cache Logistic Trust (43.1%), iREIT Global (42.1%) and Ascott REIT (41.1%)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

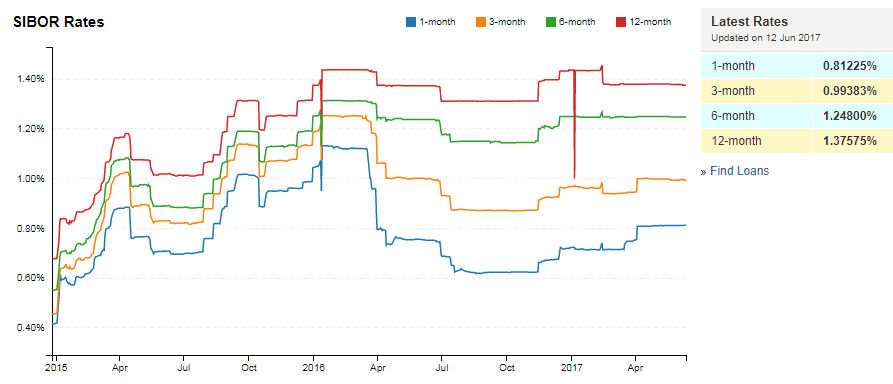

Economy Analysis – Singapore

- 1 month increases from 0.80850% to 0.81225%

- 3 month decreases from 0.99925% to 0.99383%

- 6 month decreases from 1.25000% to 1.24800%

- 12 month decreases from 1.38125% to 1.37575%

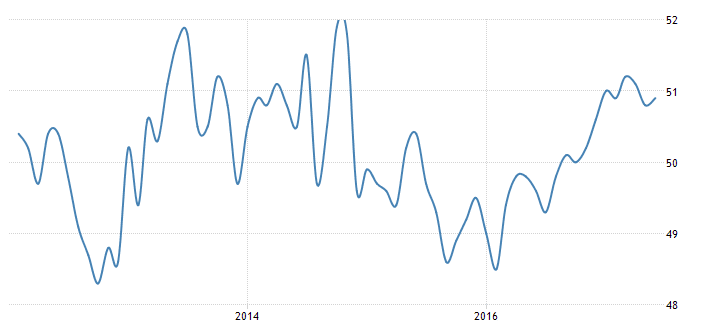

The Singapore Manufacturing PMI increased to 50.9 in June of 2017 from 50.8 in the previous month. The reading pointed to the 10th straight month expansion in the factory activity, as new orders, new exports orders, inventory, output rose at a faster pace. In contrast, employment contracted further. Meanwhile, the PMI for electronics sector decreased to 52.1 from 52.4 in May. Manufacturing PMI in Singapore averaged 50.03 from 2012 until 2016, reaching an all time high of 51.90 in October of 2014 and a record low of 48.30 in October of 2012.

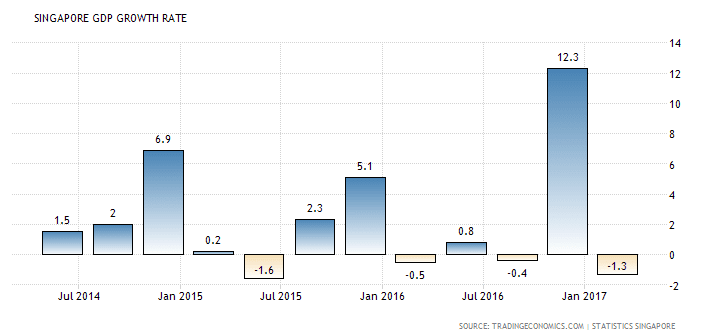

The Gross Domestic Product (GDP) in Singapore contracted 1.30 percent in the first quarter of 2017 over the previous quarter. GDP Growth Rate in Singapore averaged 6.81 percent from 1975 until 2017, reaching an all time high of 37.20 percent in the first quarter of 2010 and a record low of -13.50 percent in the fourth quarter of 2008.

Summary

Fundamentally the whole Singapore REITs is slightly over value. Big cap REITs do not move much last month while small cap REITs play the catch up. Price has moved a lot for most of the REITs and thus there is a significant drop in the distribution yield. Some of the big cap REITs are no longer cheap base on the valuation and yield.

Technically Singapore REITs is still on bullish up trend with the next resistance of 820. The future direction of Singapore REIT sector is very much dependent on the quarterly earning release in the next few weeks. The bullish momentum is expected to continue if most REITs meet or beat the distribution expectation.

There are not many REITs left to pick at the present moment. If you have missed the boat to invest in REITs but have fear of selecting the wrong REITs. you may want to check out this Investing in Singapore REIT course here.

See all other relevant Singapore REITs blog posts here.

Original post from https://mystocksinvesting.com

Check out coming seminars at https://mystocksinvesting.com/events

Hello,

May I know the ratio Price/NAV hi. Does it mean the historic low of the ratio “Price/NAV” since 2012? Or the ‘current price’ / ‘historic low of the NAV’?

Thank you.

To Tim.

Historic low of the ratio “Price/NAV” since 2012

Hi Mr Loh

Thanks for the table. May I know how often should we compute this table since price changes every day?

Suz

Suz, you don’t need to compute everyday because REITs is meant for passive income investing, not for trading. Furthermore, REIT has much lower volatility and the price does not fluctuate very much.