Technical Analysis of FTSE ST REIT Index (FSTAS8670)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) broke out from the consolidation and hit historical high at 973.21. The REIT index has changed from 941.99 to 941.89 (-0.01%). The REIT index has a flash sold off due to COVID-19 fear but immediately rebounded strongly from the support at 884.292. Currently the REIT index goes above the 50D and 200D SMA. Based on the current trend and chart pattern, the REIT index is still trading on an bullish uptrend. Immediate support at 940 (Previous Resistance turned support) followed by 920 (200 SMA). Probable direction for REIT index: Up. Previous chart on FTSE ST REIT index can be found in the last post Singapore REIT Fundamental Comparison Table on 02-02, 2020.

Fundamental Analysis of 40 Singapore REITs

The following is the compilation of 40 REITs in Singapore with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis. DPU Yield for Eagle Hospitality Trust, Prime US REIT and Lendlease Global Commercial REIT are projection based on the IPO prospectus. Elite Commercial REIT is not included as newly IPOed.

Note: The Financial Ratio are based on past data and there are lagging indicators.

- Price/NAV decreases from 1.10 to 1.07 (Singapore Overall REIT sector is over value now).

- Distribution Yield increases from 6.24% to 6.64% (take note that this is lagging number). About 30% of Singapore REITs (12 out of 40) have Distribution Yield > 7%.

- Gearing Ratio stays at 35.4%. 25 out of 40 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy. Note: The current limit of gearing ratio for REITs listed in Singapore Stock Exchange is 45% but there is a consultation paper by SGX to review the potential increase to 50-55% limit.

- The most overvalue REIT is Keppel DC REIT (Price/NAV = 2.18), followed by Parkway Life (Price/NAV = 1.88), Ascendas REIT (Price/NAV = 1.59), Mapletree Industrial Trust (Price/NAV = 1.89), Mapletree Logistic Trust (Price/NAV = 1.69), Frasers Logistic & Industrial Trust (Price/NAV = 1.35), Frasers Centerpoint Trust (Price/NAV = 1.34) and Mapletree Commercial Trust (Price/NAV = 1.30).

- The most undervalue (base on NAV) is Eagle Hospitality Trust (Price/NAV =0.37), followed by Lippo Malls Indonesia Retail Trust (Price/NAV = 0.71) and Far East Hospitality Trust (Price/NAV = 0.70)

- The Highest Distribution Yield (TTM) is Eagle Hospitality Trust (19.38%) followed by SoilBuild BizREIT (8.79%), Lippo Mall Indonesia Retail Trust (11.21%), Sasseur REIT (8.6%), EC World REIT (8.46%), First REIT (8.78%) and Cache Logistic Trust (8.00%).

- The Highest Gearing Ratio are ESR REIT (41.5%), OUE Comm REIT (40.3%), Far East HTrust (39.2%), Cache Logistic Trust (40.1%) and EC World REIT (38.7%).

- Top 5 REITs with biggest market capitalisation are Ascendas REIT ($12.23B), CapitaMall Trust ($9.15B), Capitaland Commercial Trust ($7.75B), Mapletree Commercial Trust ($7.54B) and Mapletree Logistic Trust ($7.56B)

- The bottom 3 REITs with smallest market capitalisation are BHG Retail REIT ($316M), Sabana REIT ($474M) and iREIT Global REIT ($507M)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Workshop here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

Interest Rate Watch

The US Fed just announced a 50 bps emergency rate cut to combat the COVID-19 on Mar 3, 2020.

https://edition.cnn.com/2020/03/03/economy/federal-reserve-rate-cut/index.html

- 1 month decreases from 1.68717% to 1.46701%

- 3 month decreases from 1.73862% to 1.47101%

- 6 month decreases from 1.82363% to 1.60431%

- 12 month decreases from 1.96338% to 1.93600%

Based on the latest forecast, there is another 50 bps rate cut on Mar 18!

This is crazy! another 50 bps rate cut in 2 weeks time? The economic impact must be huge due to COVID-19 outbreak in US to trigger 100 bps rate cut in 1 month!

SGX Fund Flow

Top institution sell banks and switch to industrial REITs. Huge out flow of Singapore banks in Feb 2020 and this trend should continue in anticipate of another 50 bps interest rate cut.

Summary

Fundamentally the whole Singapore REITs is over value now based on simple average on the Price/NAV. The big cap REITs rebounded quickly after the recent sell off. Valuation remains very rich for big cap REITs due to its defensive nature. Most of the DPU yield for big cap REIT are below 5% now such as CapitaCom Trust, CapitaMall Trust, Fraser Centerpoint Trust, Keppel DC REIT, Keppel REIT, Parkway Life REIT, Mapletree Com Trust, Mapletree Logistics Trust and Mapletree Industrial Trust. The distribution yield of ParkwayLife REIT (3.66%) and Keppel DC REIT (3.1%) have dropped below 4%. However, the yield remains attractive for most Singapore REITs compared to other fixed income asset classes like corporate bonds and government bonds. The yield spread between big cap and small cap REIT has widen due to the recent sell off as small & mid cap REITs have not rebounded as strong as big cap REITs.

Yield spread (reference to 10 year Singapore government bond of 1.22%) has widened from 4.636% to 5.42% The risk premium for small cap REIT is very attractive as compared to big cap REITs. This indicates value picks only in small and medium cap REITs.

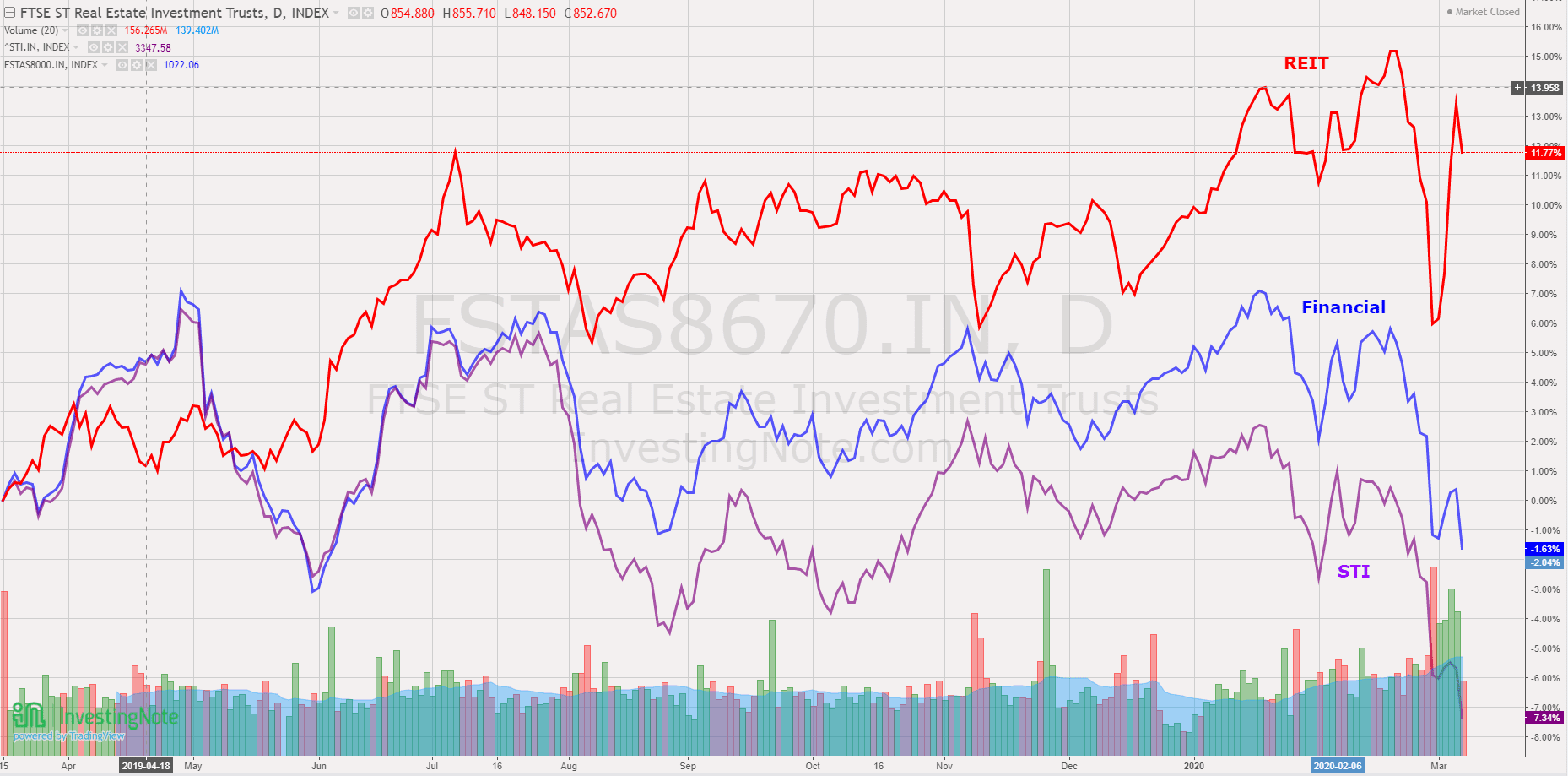

Below chart is the One Year comparison between FTSE ST REIT Index, FTSE ST Financial Index and Straits Time Index (STI). STI and Financial Sectors suffered huge losses due to the fear of COVID-19 outbreak. However, Singapore REIT index is holding very well and still trading in positive gain (1 year performance) due to its defensiveness.

Singapore REITs may continue to do well in 2020 due to ultra low interest rate environment, high yield and its defensiveness during the volatile period. Some of the rental income will probably be affected due to COVID-19 for 3-9 months like hospitality sector and retail mall. Investors may consider to use this opportunity to accumulate under value REITs caused by the panic sell off, wait patiently for the share price recovery and DPU recovery while collecting regular dividend. Time in the market is better than time the market.

STAY CALM, DO HOME WORK, SHOP CHEAP REITs and WAIT PATIENTLY.

If you want a “Sleep Well” Dividend Paying Portfolio to make your money works harder for you, Singapore REIT is one of the asset classes you must have in your investment portfolio. Of course, you have to learn more about the fundamental of REITs, the behaviors of the REITs, and pro/cons of the REITs.

My next Singapore REIT investing course is planned on April 18, 2020. You can register here. https://mystocksinvesting.com/course/singapore-reits-investing/

If you do not have time to learn all the basic, or you want to kick start your REIT portfolio within 1 month, I can help you to construct a REIT portfolio with a fee. You can just sit back, relax and wait for the dividend to come it as I will be doing all the job in managing your REIT portfolio. For REIT Portfolio Consultation, please drop me an email marubozu@mystocksinvesting.com

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement

Hi, thanks for the analysis and information.

I read an article here, https://dollarsandsense.sg/s-reit-report-card-heres-how-singapore-reits-performed-in-fourth-quarter-2019/

it said the best performing reits in 1st q. 2020 is “keppel reits” referring to SGX.

But i can’t find the reason why keppel is the best.

Can you explain that? (Since in your article that isn’t mentioned)

Thanks